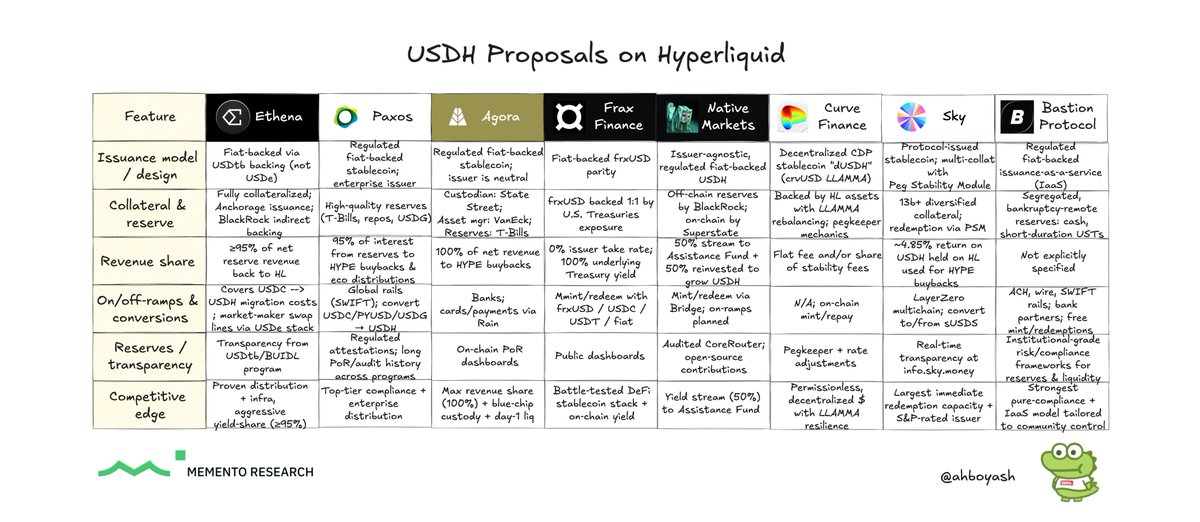

So @HyperliquidX just opened a request for proposal (RFP) to assign the $USDH ticker to a 3rd party stablecoin issuer (stakers and validators vote on the proposal of their choice). Why Hyperliquid wants this This would greatly reduce the reliance on USDC/Coinbase, and most importantly keep reserve yield + liq incentives inside the HL ecosystem --> why let value leak to external parties? Projects involved • @ethena_labs: Fiat-backed USDH via USDtb; ≥95% of net reserve yield routed back to HL + migration paths from USDC • @Paxos: Enterprise rails and audits; returns 95% of interest to $HYPE buybacks and eco • @withAUSD: State Street custody + @vaneck_us asset manager; 100% of net revenue to HL; $10m+ day-1 liq on HL • @fraxfinance: USDH at frxUSD parity; 0% take rate, on-chain T-bill yield to HL; mint/redeem across frxUSD/USDC/USDT/fiat • @fiege_max (Native Markets): Issuer-agnostic via Bridge; 50% yield stream to the Hyperliquid Assistance Fund, 50% to growth; programmatic...

31.66K

321

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.