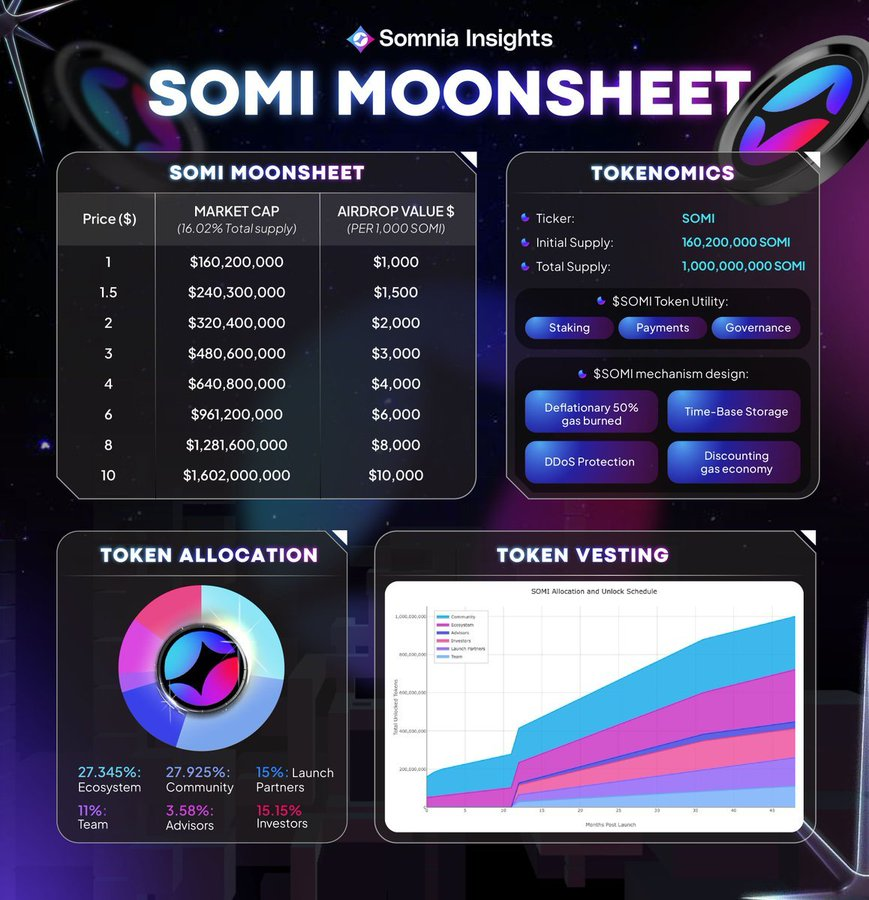

When looking at comparable launches like Avalanche and Ronin, @Somnia_Network launch metrics fit squarely in the proven “sweet spot” for early price discovery. At $1 per token, SOMI’s circulating market cap sits around $160M, which is nearly identical to Avalanche’s ~$180M and Ronin’s ~$140M at launch. Both of those ecosystems went on to achieve explosive multiples from this base. In terms of FDV, SOMI also lines up competitively, Avalanche started around $1.1B and Ronin around $750M, while SOMI at $1 equals a $1B FDV. This balance between mid-100M circulating cap and ~$1B FDV is exactly where investors have historically shown strong appetite. Where SOMI can stand out is in the narrative layer. Ronin’s success was tied almost entirely to Axie Infinity, exposing it to single-game concentration risk. Avalanche rode the DeFi scaling wave but faced heavy competition against Ethereum and other L1s. SOMI, however, combines gaming, AI, and metaverse infrastructure, with a unique...

8.26K

18

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.