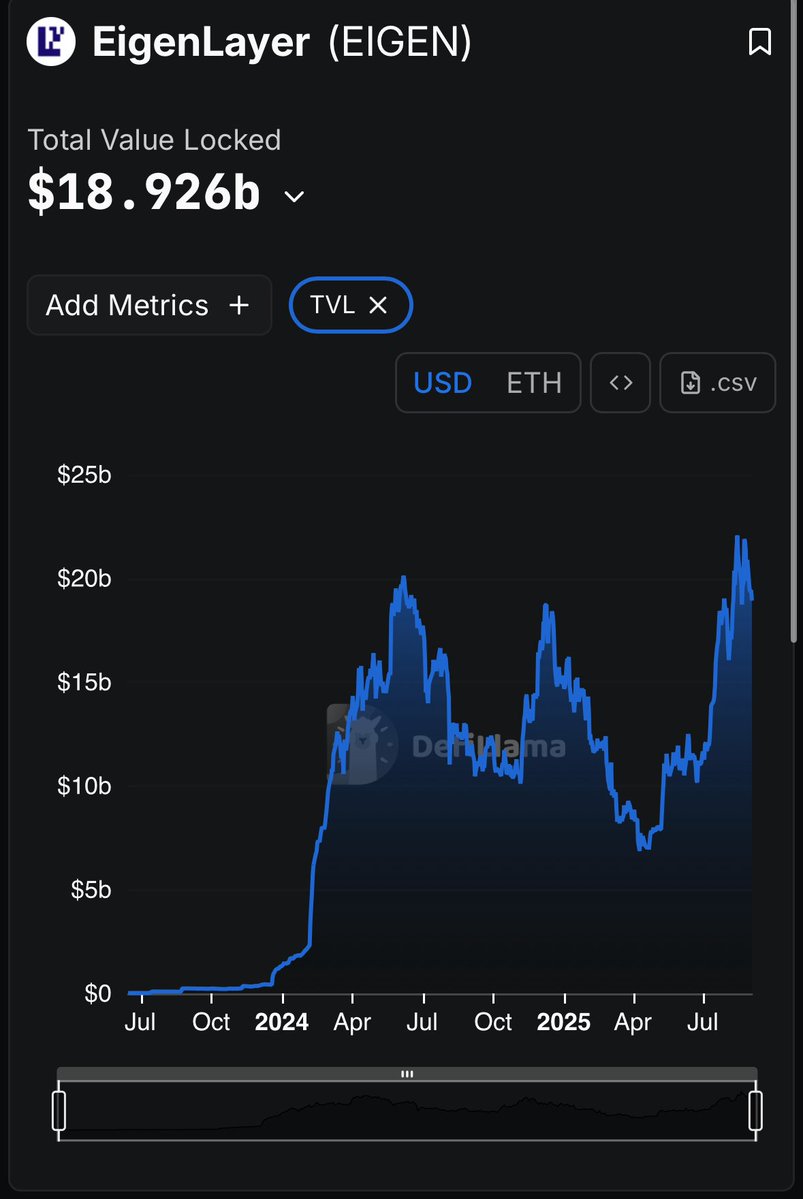

Why I’m Bullish on Eigen EigenLayer stands out as a premier opportunity in the Ethereum ecosystem, pioneering restaking to secure AVSs and expand verifiable compute for DeFi, AI agents, and RWAs, particularly as ETH surges with ETF inflows topping $50 billion since 2024. Despite $EIGEN trading down ~80% from its $5.65 ATH, the protocol’s fundamentals shine with $18B+ TVL and growing across 200+ AVSs, backed by a16z’s $170M investment and ongoing innovations like slashing mechanisms and Pectra compatibility, positioning it for narrative rerating in maturing markets. 🔷ETH macro tailwind: ETH’s momentum amplifies Eigen’s restaking utility, enhancing AVS security as adoption grows, though this synergy remains underappreciated. 🔷Restaking dominance: Commands ~70% market share with ATH TVL of $15B+, far outpacing competitors like Symbiotic ($1.4B) and Karak ($270M), creating strong network effects. 🔷Value disconnect: Protocol health at peaks (TVL $15B) contrasts with price lows and...

13.63K

28

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.