Looping yield-bearing assets is now extremely prevalent in DeFi, with Pendle PTs accounting for $5.8b in money market collateral.

But what is it about PTs that make them so attractive?

Today your boy looks at the ability of PTs to create structurally superior yield-bearing stablecoins and how it drives protocol growth.

I. Leveraged Looping

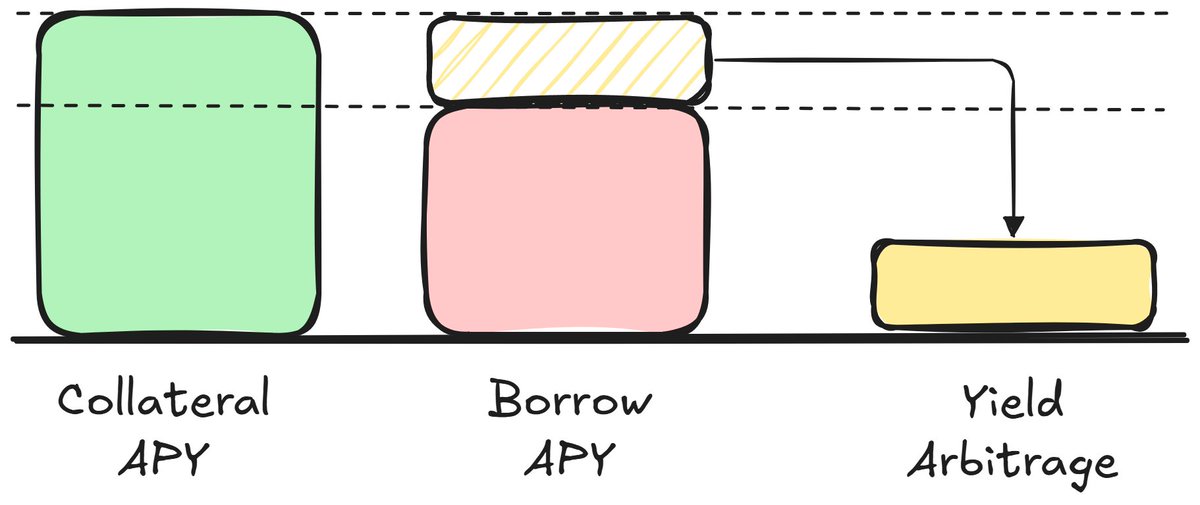

Leveraged looping works on a very simple principle: leveraging the spread between a collateral's underlying yield and its cost to borrow. A reasonable user would be willing to loop until (or close to) the point where Collateral APY ~= Borrow APY since it's essentially risk-free yield.

Looping is beneficial to users AND protocols alike:

- Users get amplified yields

- Protocols source liquidity from debt

II. Collateral Yield

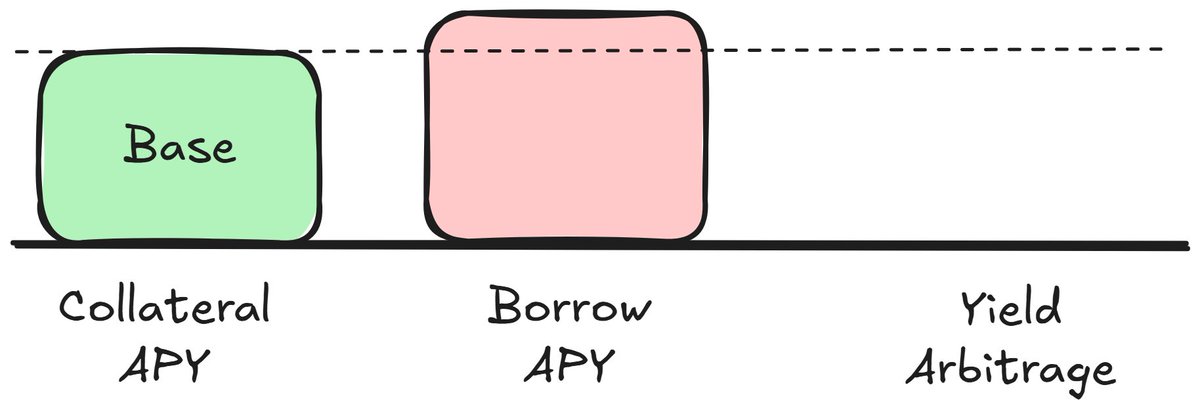

Not every stablecoin has the same capacity to generate yield - for example, @OpenEden_X's cUSDO earns ~4% APY while @FalconStable's sUSDf earns ~8% APY.

With the market pricing USDC debt at 5-10% APY, cUSDO is effectively locked out of looping.

This is a set-back for cUSDO scalability as it isn't able to take advantage of leveraged liquidity.

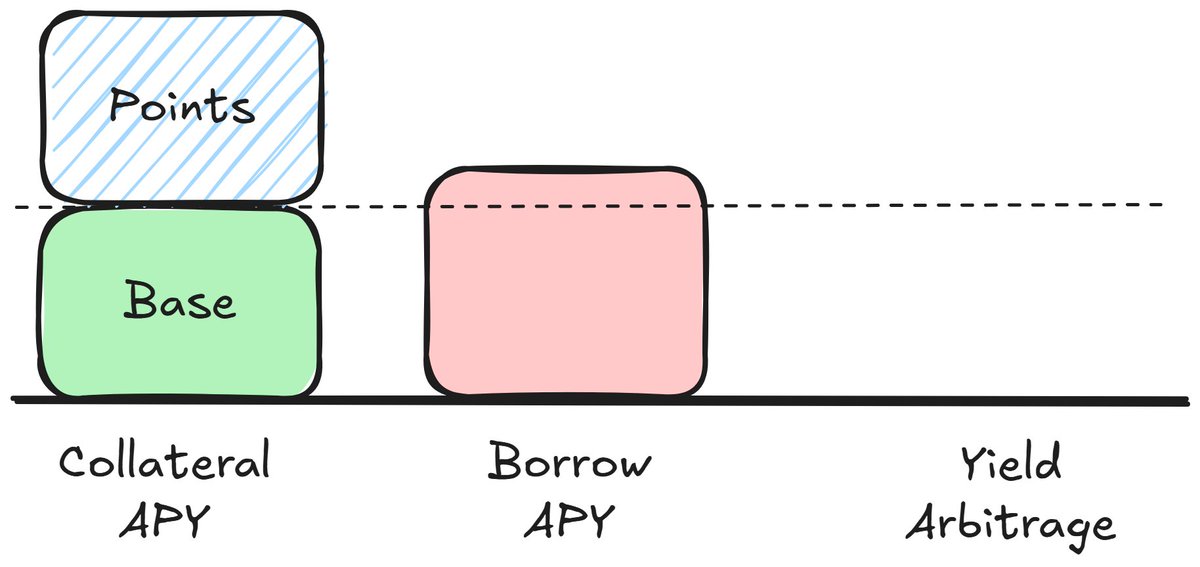

III. Intangible Yield

What cUSDO's 4% APY does not reflect, however, is Open Eden's ongoing point program. This is essentially an APY injection on top of cUSDO's base yield.

The challenge here, however, is this point APY is impossible to price.

This ultimately means that cUSDO remains an unlikely choice for looping since its yield composition is intangible.

IV. Pendle

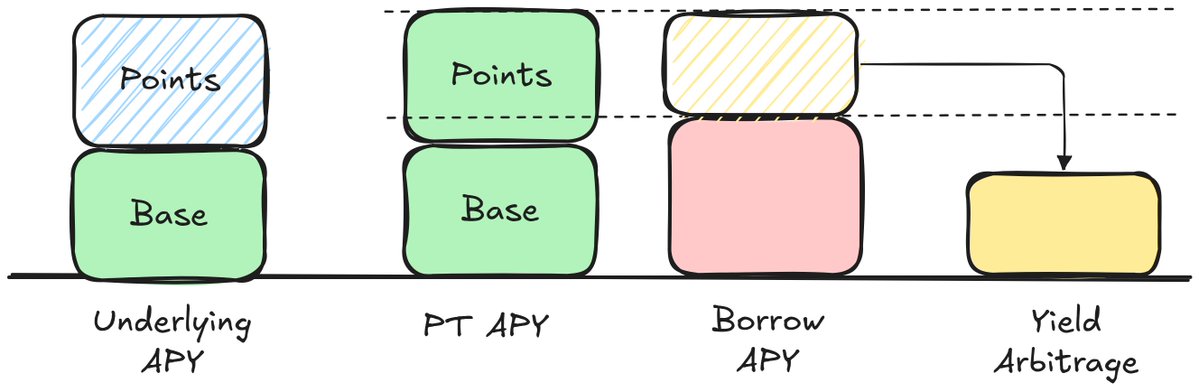

Pendle's yield-stripping layer lets the market 'price-in' the value of points into the fixed yield of PT-cUSDO. Instead of cUSDO points being worth an arbitrary amount, the market can price it directly by trading its Implied Yield.

The outcome is PT-cUSDO has ~10.5% APY vs. the 4% APY of its underlying.

This makes it an EXTREMELY attractive yield-bearing stablecoin that is very much able to be looped with every loop driving additional TVL to Open Eden!

Pendle

10.7K

101

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.