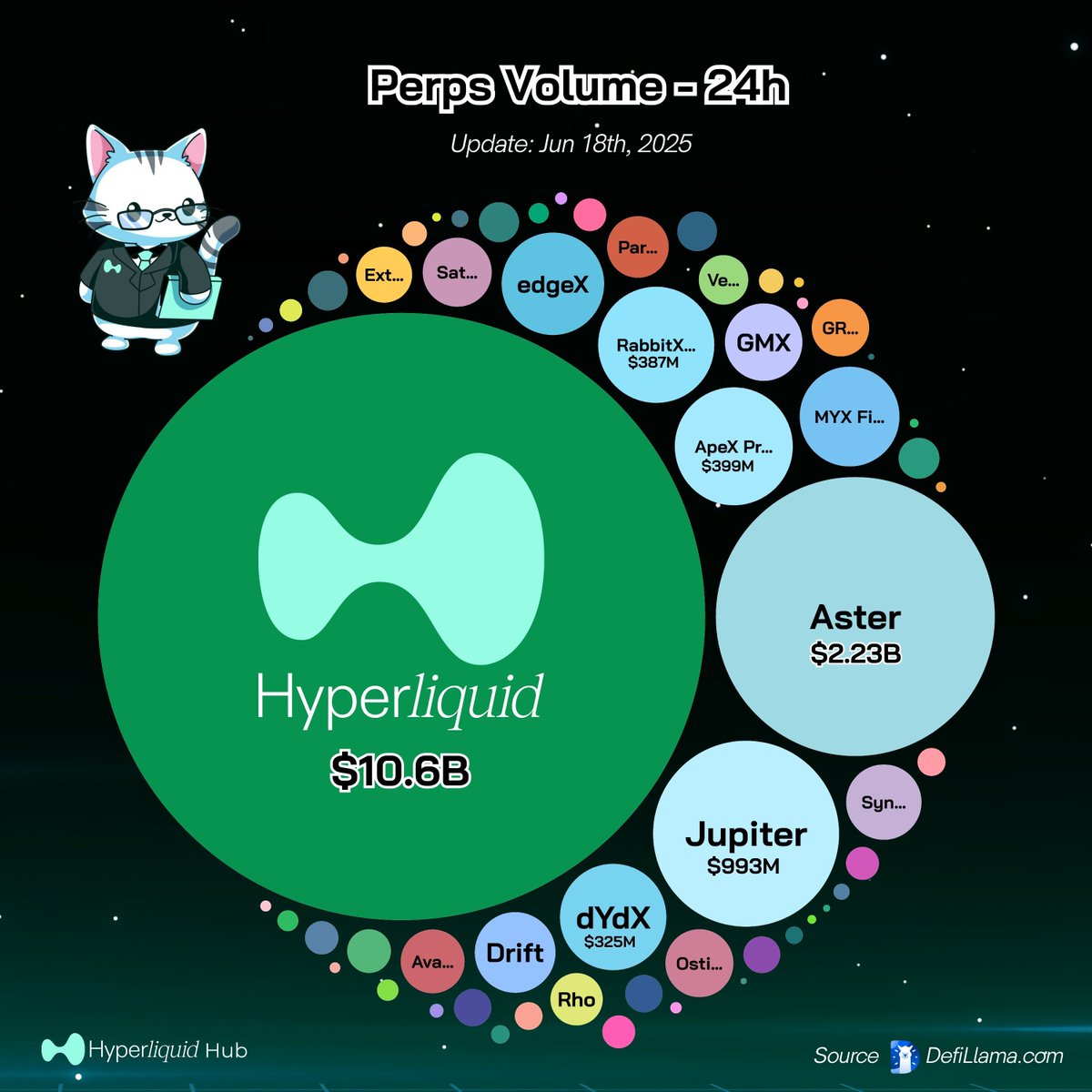

【Growth Strategy|@HyperliquidX How to Become the Strongest On-Chain DEX?】

In the past year, Hyperliquid has risen with almost overwhelming speed, quickly dominating the on-chain derivatives market and becoming the most talked-about and controversial DEX.

You may have experienced its high-leverage trading, used its no KYC platform, and witnessed the public uproar caused by James Wynn opening a $500 million position on-chain.

But what truly makes Hyperliquid the "strongest DEX" on-chain is not just one or two breakthroughs, but its extreme advancements across multiple dimensions.

1️⃣ Four Dimensions of "Extremity" Strategy

① Extremely Low Barriers

Hyperliquid replicates the user experience of CEX but requires no KYC at all.

Up to 50x leverage;

Smooth UI / Fast matching;

Instant use, no identity verification;

For users, this is a DEX that is infinitely close to CEX, with almost zero barriers.

② Extremely Deflationary Model

It has no VC, no private placements, but returns nearly 100% of the platform's revenue to the community, truly building a closed-loop deflationary model.

46% of transaction fees rewarded to HLP;

54% flows into the Assistance Fund for repurchasing and burning $HYPE;

This is a rare "pure endogenous growth" model, returning almost all platform revenue to users, directly driving the spiral rise of $HYPE. The result was that the day before yesterday, $HYPE broke its historical high, reaching $45.

③ The Largest Airdrop in History

In November 2024, Hyperliquid airdropped $HYPE, accounting for 31% of the total supply and worth over $1.2 billion, to early users, activating trading and viral growth.

After the $HYPE airdrop, it rose from an initial $3.9 to $34.96, this visible "wealth effect" instantly attracted countless eyes.

④ The Strongest Attention Economy

One of Hyperliquid's major features is: trading = content.

On-chain positions are fully public, and whale trades become a source of traffic:

James Wynn's $568 million BTC long position attracted countless FOMO followers;

Andrew Tate's 76 high-leverage trades ignited social media discussions;

Position → Emotion → Liquidity, this attention economy flywheel has no equal on-chain.

2️⃣ The Cost Behind Extremity

When everything is pushed to the extreme, costs come along. Behind Hyperliquid's "high-performance narrative," some structural risks have begun to emerge:

Whale arbitrage incidents: High leverage + unlimited positions led to the HLP treasury losing millions of dollars within 24 hours.

Governance intervention in the market: Community governance adjusted oracle prices to force liquidations, raising questions about "decentralization."

Lack of transparency in strategies: The code has not been fully open-sourced, and key trading and liquidation logic is controlled by an off-chain team, lacking public verifiability.

These issues have prompted the industry to reflect on "black-box DeFi," with Sky (former MakerDAO) co-founder @RuneKek stating plans to create an "open-source version of Hyperliquid" to replace the existing model.

Summary: From Extreme Rise to Mechanism Test

Hyperliquid's success is not because it is perfect, but because it dares to push experience, deflation, and traffic to the extreme.

Its "strengths" have allowed it to reach the top, but whether it can traverse cycles depends on whether its "weaknesses" can be addressed.

Of course, its weaknesses are not just its own issues, but structural problems that the entire industry must solve before on-chain finance can become mainstream.

Show original

15

8.58K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.