Big Brother B@BTCBruce1 said@pumpdotfun was banned because he was sued by the group? I don't think that's the reason. If you look briefly at the information about Pump's lawsuit, you will find that the two class action class action lawsuits actually took place in January of this year, not recently. And in fact, according to the claim basis of these two lawsuits and the current SEC regulatory attitude towards memecoin, the probability of Pump winning the case is very high, as long as the court does not make a mistake and does not refer to the SEC's clarification regulatory statement on memecoin issued on February 27, Pump can be said to win this case nine times out of ten. This is also why the lawsuit against Pump has not made much splash so far, and it has not affected its activity and TGE plan.

Let's take a look at the matter of Pump being a class action lawsuit from a legal perspective, and the possibility of both sides winning the lawsuit, whether it will eventually be as circulated on the Internet will be a large sum of money and then beaten to death by the SEC.

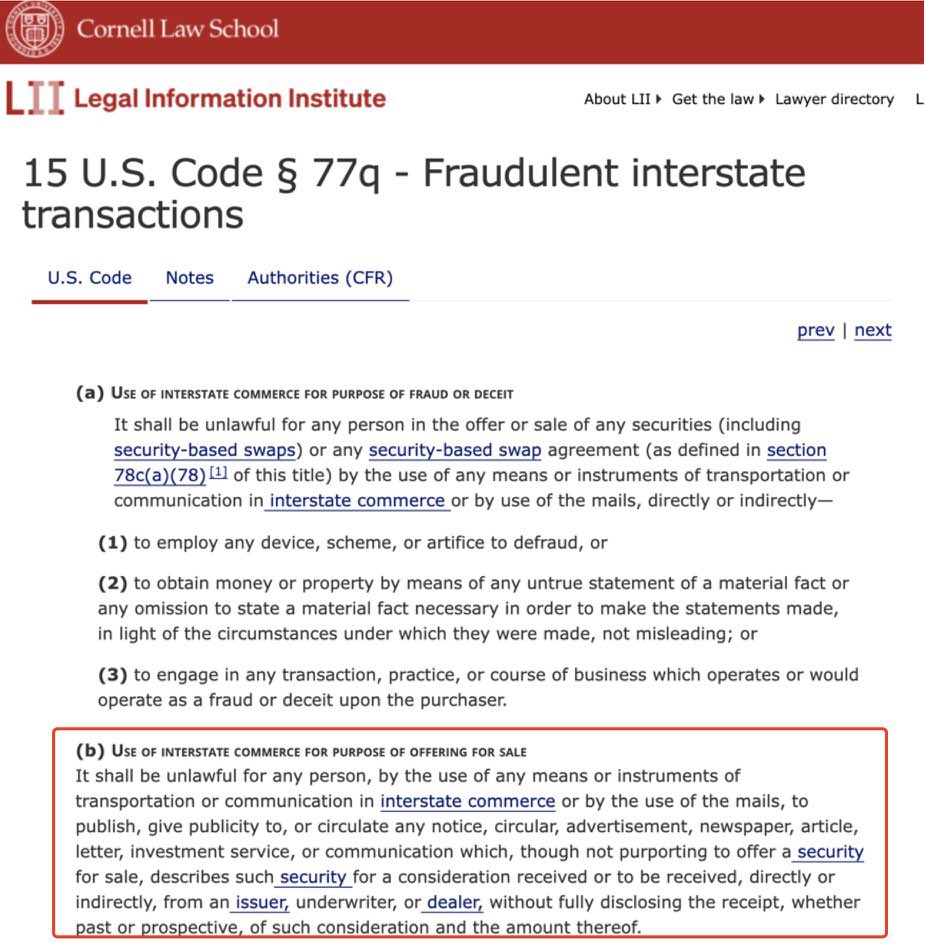

The two main class actions are Carnahan v. Baton Corporation Ltd d/b/a et al., No. 1:25-cv-00490 on January 16 and Aguilar v. Baton Corporation Ltd d/b/a et al., No. 1:25-cv-00880 on January 30. The primary claim in both cases and of action is 15 U.S.C. § 77 Securities Fraud. In fact, it is an accusation that Pump violated clause (b) in the figure below (Figure 1), but the claim is based on the assumption that Memecoin is defined as a security, then Pump's market behaviour includes the sale of unregistered securities.

Is Memecoin a security? This is the most important legal issue in these class actions, and the answer is no, based on the current SEC attitude. The reasons are as follows: (1) it is not a "securities" under the Securities Act 1933 and (2) it is not an investment contract as determined in SEC v WJ Howey Co

First, according to the SEC's statement on memecoin regulation on February 27, memecoin does not constitute any of the common financial instruments specified in the definition of "security" because it does not generate revenue, does not transfer rights to future revenues, profits, or assets of a business, and memecoin itself is not a security per security. For those who are able to read, please refer to the original SEC article "Section 2(a)(1) of the Securities Act and Section 3(a)(10) of the Securities Exchange Act of 1934, each defines the term "security" by providing a list of various financial instruments, including "stock," "note," and "bond." A meme coin does not constitute any of the common financial instruments specifically enumerated in the definition of "security" because, among other things, it does not generate a yield or convey rights to future income, profits, or assets of a business. In other words, a meme coin is not itself a security. (Dig a pit here and give a gambling protocol/mining tick/or option purpose to memecoin, which may be defined as a security)

Second, according to the analysis requirements of economic realities in the Howey test, memecoin does not belong to the category of investment contract. The Howey test mainly considers "whether there is an investment in the enterprise that can be obtained from the entrepreneurial or managerial efforts of others based on reasonable expected profits", and requires that the "efforts of others" of the howey test are satisfied when "the efforts made by others other than the investors are undeniably important efforts and are key management efforts that affect the success or failure of the enterprise". The sale and sale of Memecoin does not involve investment in the enterprise, nor does it have the purpose of reasonably expecting that someone else's entrepreneurship or management will bring profits.

First of all, the purchaser of Memecoin is not investing in a business. That is, their funds will not be pooled for promoters or other third parties to use to develop Memecoin or related ventures. Second, any expectation of profit by Memecoin purchasers is not the result of the efforts of others. That is, the value of Memecoin stems from speculative trading and the collective sentiment of the market, just like collectables. Therefore, it does not meet the conditions for the formation of an investment contract. (Note here that those projects that use the memecoin title are actually raising funds to develop or set up a business, and the shell of memecoin cannot keep you safe)

According to the SEC's statement of memecoin, which is later than these two class actions, it actually overturns the main cause of action of the above two class actions, that is, memecoin is a security and pumpfun is trading unregistered securities. Therefore, as long as the court does not refute the SEC's memecoin statement, pumpfun's victory can be said to be nine out of ten. The only risk is that the court does not refer to the current SEC statement and regulatory attitude towards memecoin.

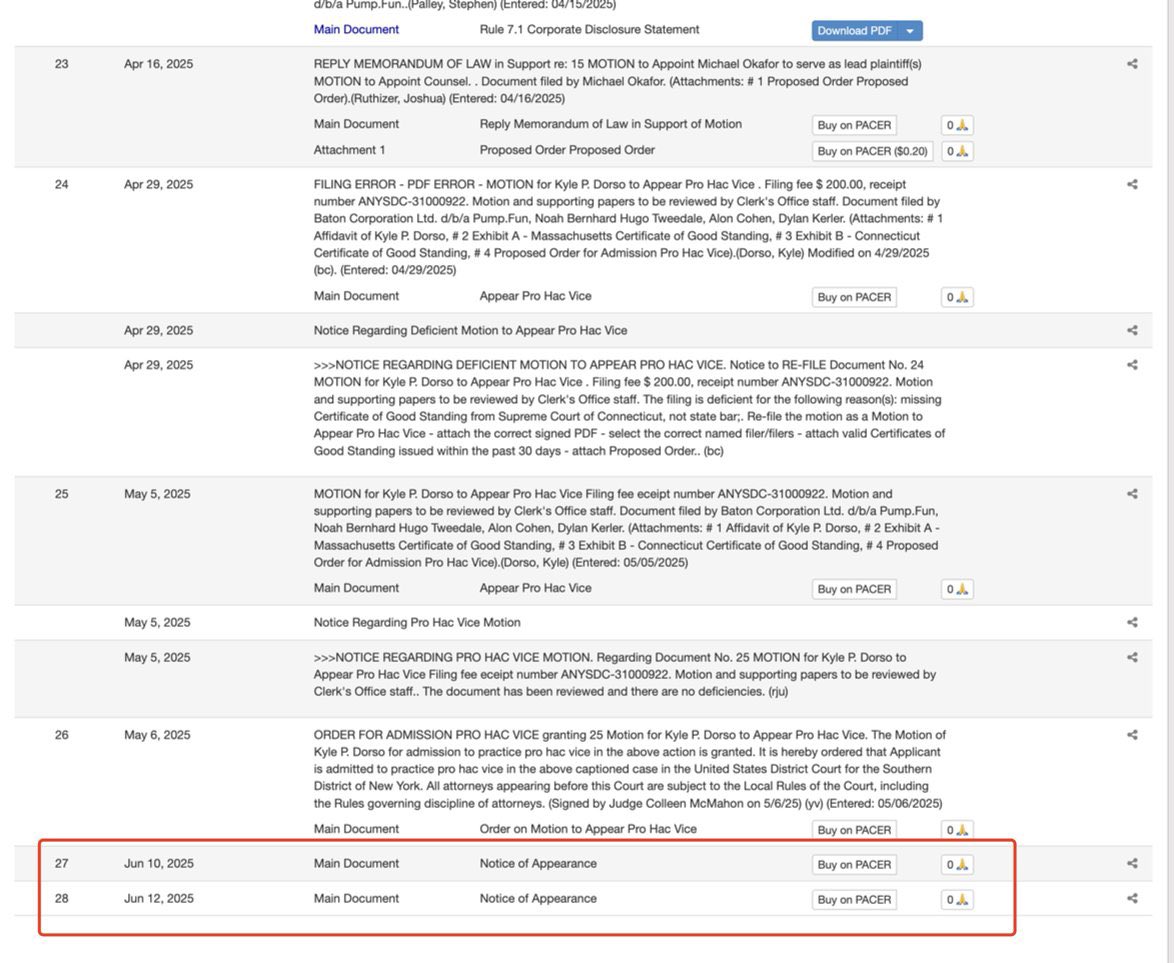

In addition, the case is still pending, and there was indeed a movement on June 12, but it was only the issuance of a notice of the summoning of witnesses (Figure 2), which was not an important and decisive step. So in general, it can be said that this time the pump was banned because of the SEC's hammer, which can be said to be nonsense. If you have this time to eat melons and worry about it, it is better to check the information and learn the law.

Show original

54

12.54K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.