How Resolv uses the three-coin model to obtain real on-chain returns

As a new generation of DeFi stablecoin protocol, Resolv's core product is USR (Crypto Native, Delta Neutral Stablecoin), which is pegged to the US dollar through ETH/BTC spot and perpetual contract hedging. The project adopts the three-currency model of "USR stablecoin + RLP risk layer + RESOLV governance token", and has become a representative of the "second generation" stablecoin in the DeFi field with high capital efficiency, native returns, decentralised risk management and other mechanisms

At the heart of Resolv is its Delta neutral strategy, a complex financial project designed to maintain a 1:1 peg of the USR stablecoin to the U.S. dollar without relying on traditional fiat collateral

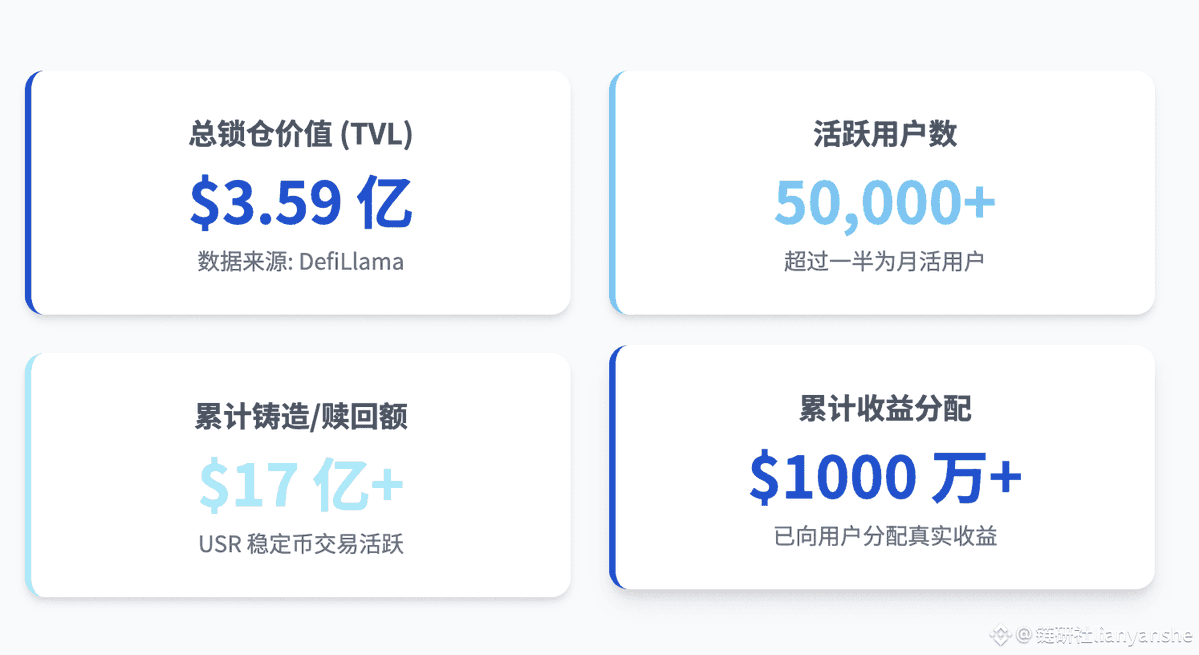

The following RESOLV is the key data for the project

➤ Tokens and tokens and economic models in detail

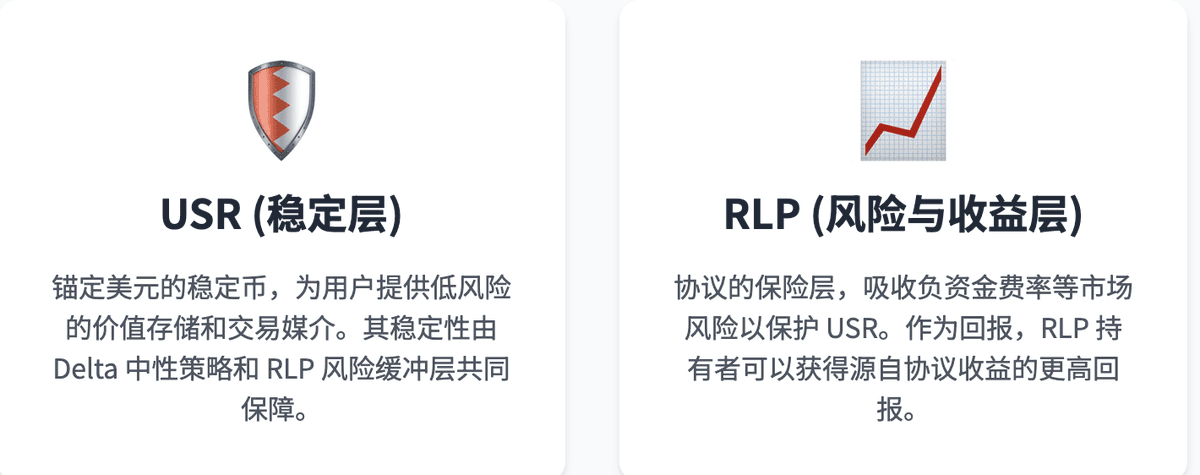

Three-coin model of USR stablecoin + RLP risk layer + RESOLV governance token

1. USR stablecoin

🔸 With ETH and BTC as the main collateral, users can mint or redeem USR (ERC-20 standard) 1:1.

🔸 Adopt the Delta neutral strategy: the protocol holds a spot long position while shorting the equivalent perpetual contract on the CEX/DEX to achieve the immunity of the overall asset to small fluctuations in the US dollar price

🔸USR supports stUSR (interest-bearing version), which can obtain protocol-native income (such as ETH staking, funding rate)

2. RLP (Resolv Liquidity Pool)

🔸 As a buffer for the risk of the protocol and the enhancement layer of returns, it absorbs systemic risks such as negative funding rates, liquidation differences, and counterparty defaults

🔸RLP holders take on the risk and receive a floating return higher than the USR (dynamic APY, market driven)

🔸The RLP price fluctuates with the overall collateralization ratio and profitability of the protocol.

3. RESOLV Governance Token

🔸 Governance and utility core, holders can participate in decision-making on protocol parameters, upgrades, treasury allocation, and more

🔸 A time-weighted staking reward mechanism with a maximum of 2x multiplier is used to incentivise long-term holding

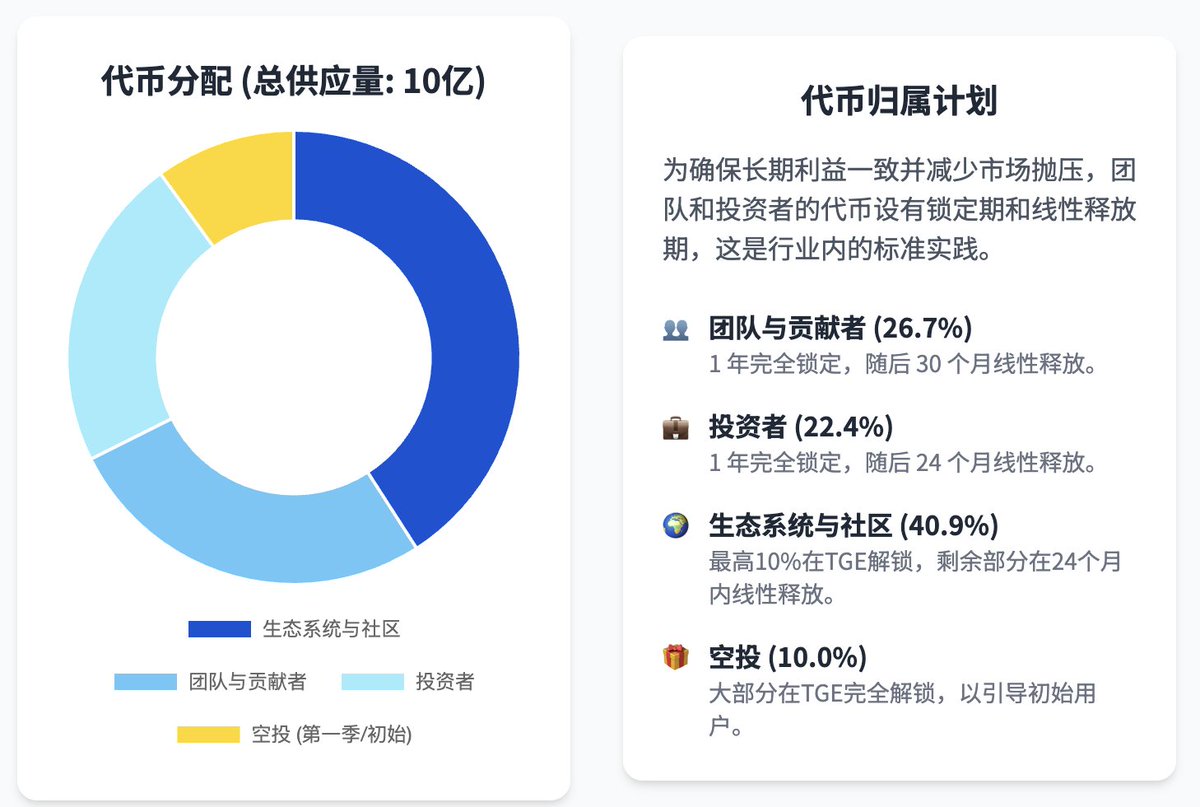

The total supply is 1 billion, and the distribution structure is detailed in the table below

➤ Team & Financing

1. Founding team

CEO Ivan Kozlov, co-founder Tim Shekikhachev, and CTO Fedor Chmilev all have a strong background in financial engineering and derivatives structure design, having worked for VTB Capital, KPMG, Moscow Credit Bank, etc

2. Investors and Partners

$10 million seed round from investors including Cyber. Fund, Maven11, Coinbase Ventures, Arrington Capital, Animoca Brands, Delphi Labs, and more

Strategic partners: Fireblocks (custody), Hypernative (security monitoring), Binance (liquidity and markets), etc

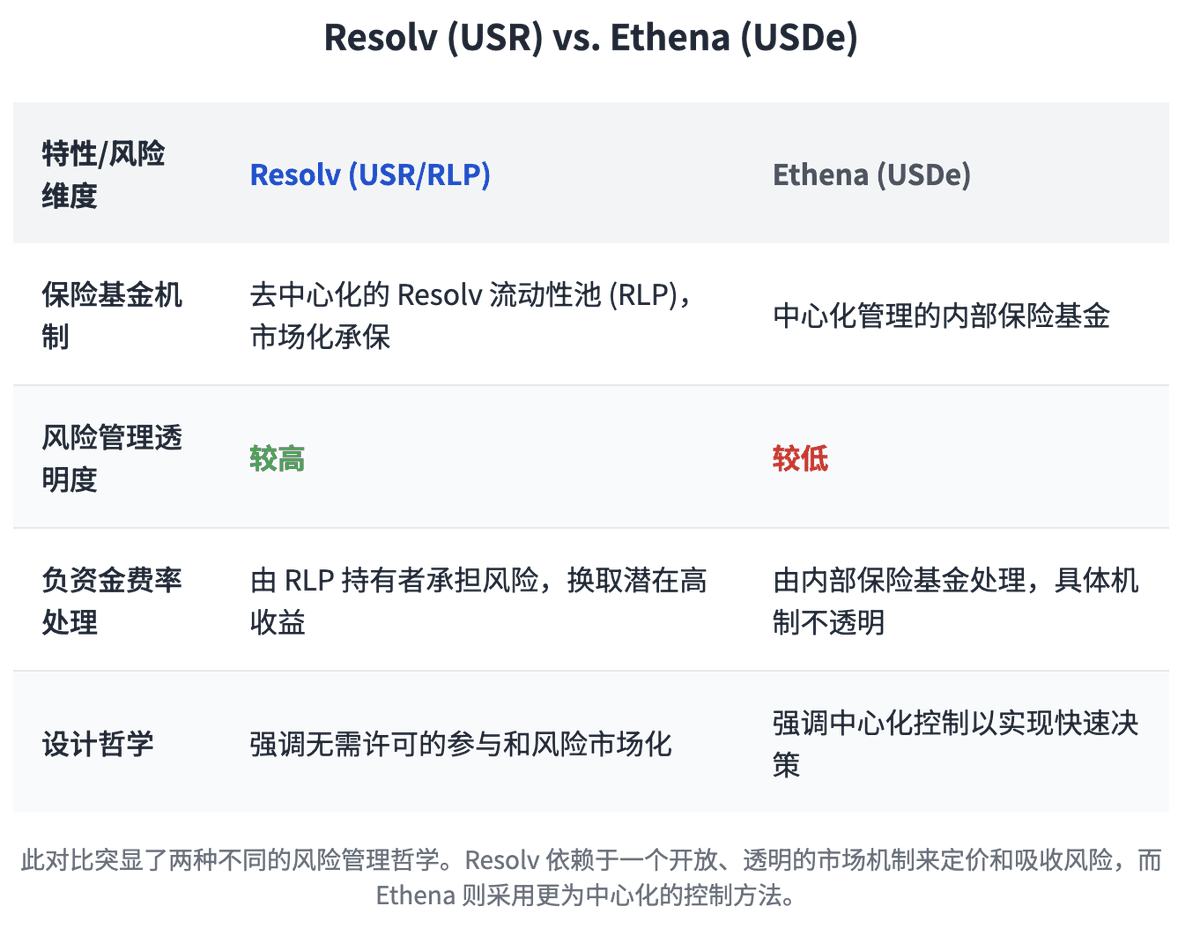

➤ Comparison of Resolv and Ethena competitors

In the Delta neutral stablecoin track, Ethena (USDe) is Resolv's most direct competitor. The mechanisms are similar, but there are key differences in risk management and decentralisation

Resolv's innovation lies in its dual-token model (USR & RLP), which separates users looking for stability from risk-takers looking for high returns, enabling refined risk management.

16

46.3K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.