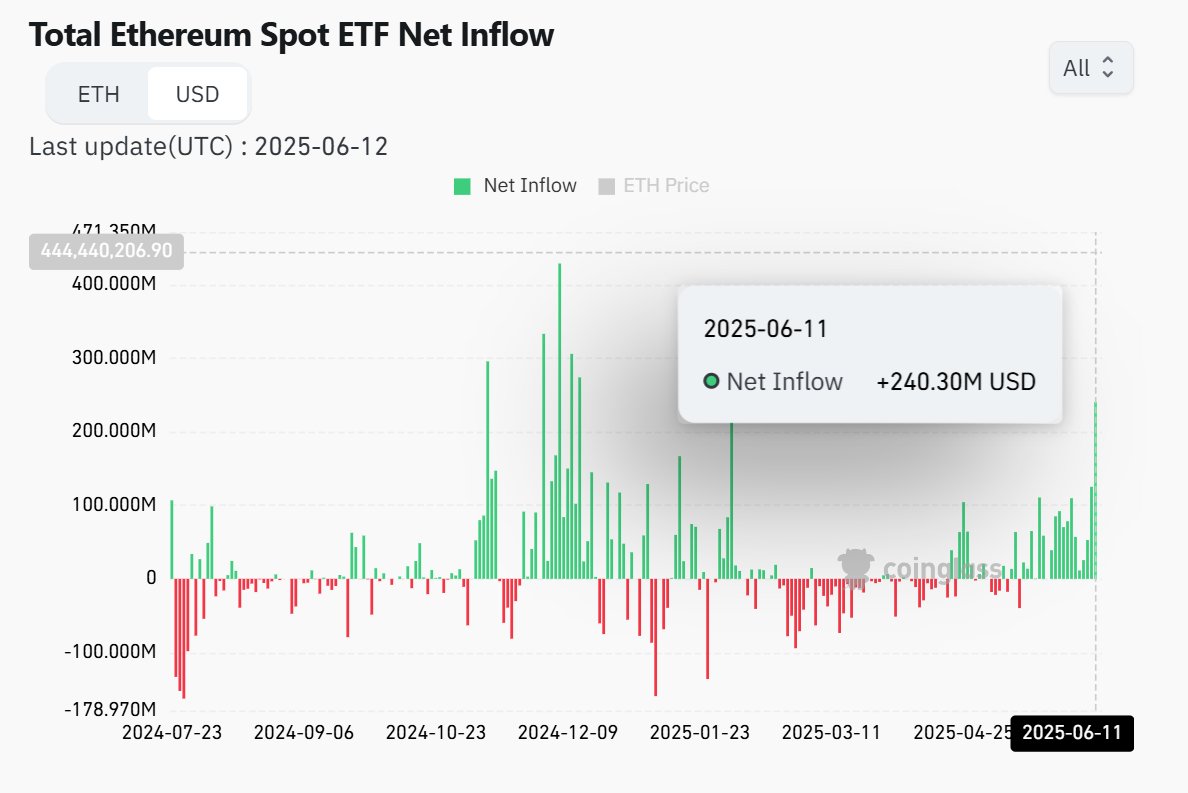

UPDATE: Yesterday Ethereum spot ETFs saw a big spike in inflows @ $240m 📊📈💸

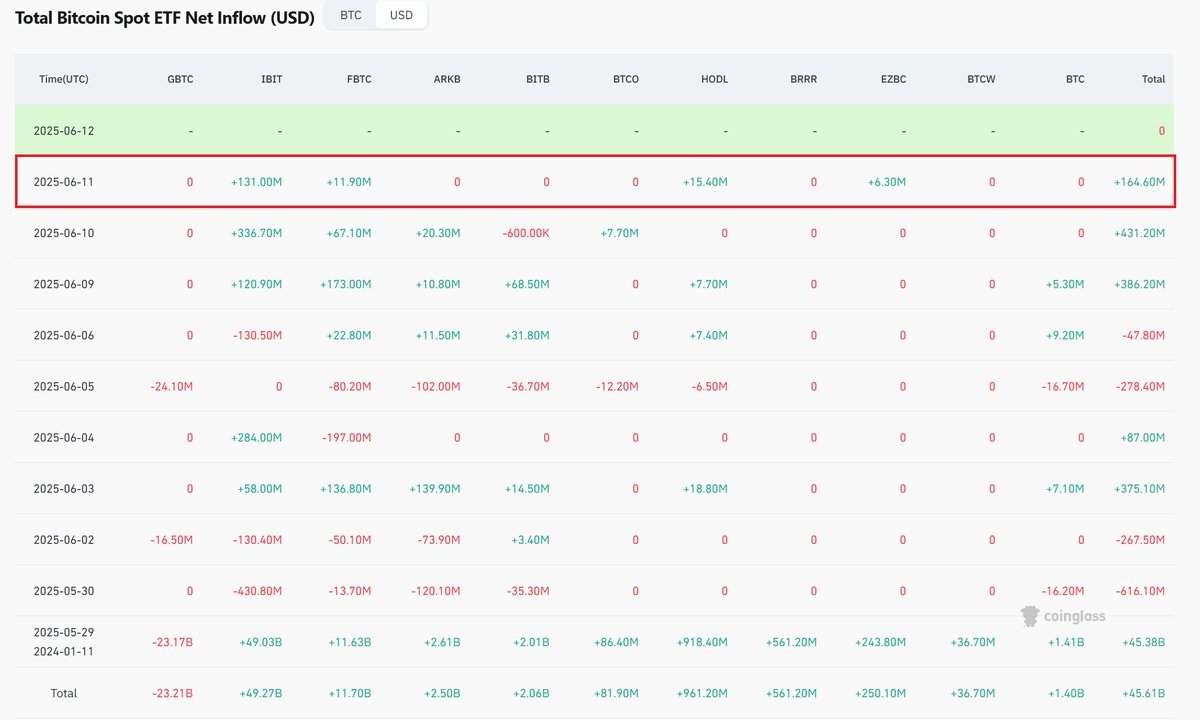

Funny thing is bitcoin ETFs yesterday had only $164m of inflows.

So this is the first day where Ethereum ETF inflows surpassed inflows of bitcoin ETFs !😮

Fair to say this is solid confirmation of a significant shift in sentiment among retail and institutional ETF investors!

Not surprising considering #bitcoin is trading near ATHs while $ETH is trading 44% under its previous ATH of $4800 from 2021.

$ETHA $FETH $IBIT $FBTC

Sentiment around $ETH has shifted quite a bit in the past week among institutional and retail EFT investors.

Since SharpLink's $425M announcement on May 27th, Ethereum ETF inflows have picked up significantly

Total inflows since the announcement: $473.5m📊📈

Also notable is that Bitcoin ETFs have seen multiple days of outflows in the past week totaling more than $1b.😮

Majority of the inflows are into BlackRock's $ETHA

Fidelity's $FETH also showing strong inflows

$SBET

21

5.09K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.