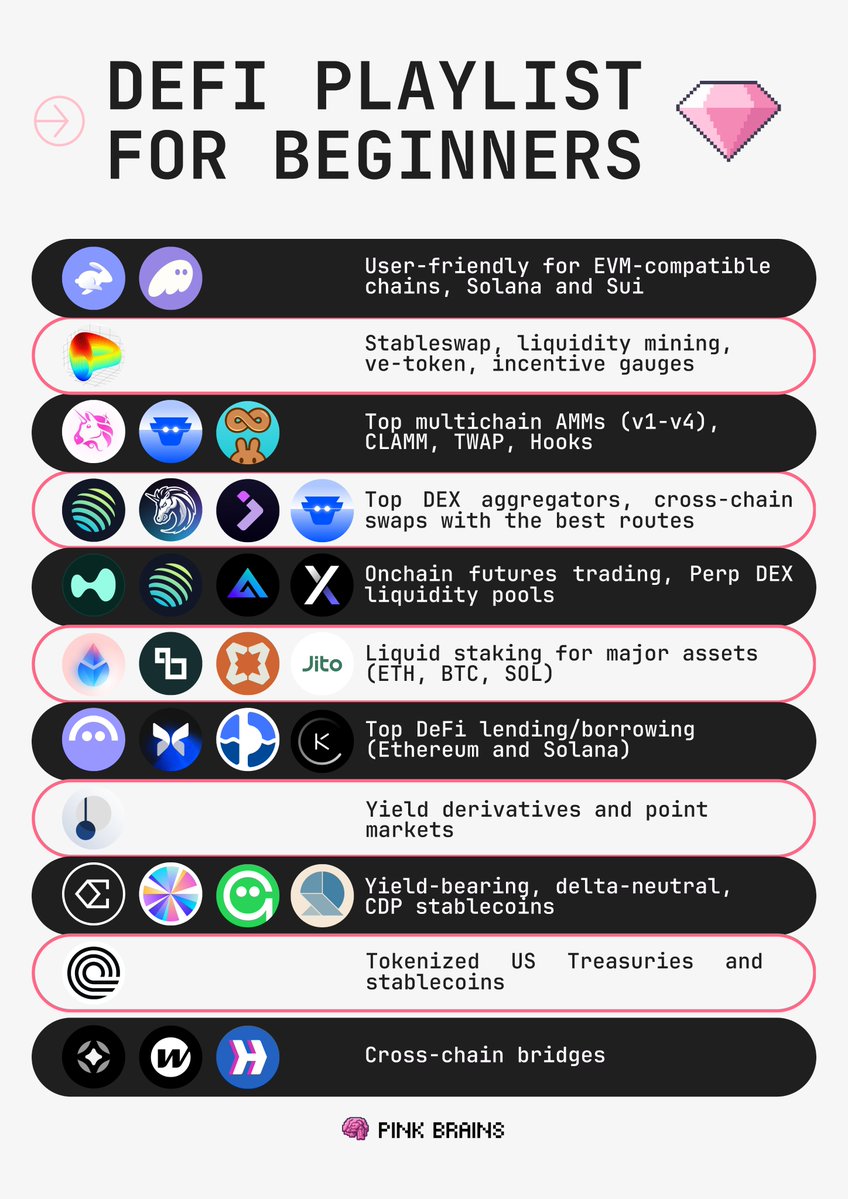

DeFi is tempting, but feels so overwhelmed

It can look like a maze at first, but once you try a few apps and understand the basics, it starts to click.

Here's a beginner-friendly path to get started, with some of the most essential protocols 👇

--------

1. Start with wallets

You’ll need a crypto wallet to interact with DeFi apps.

- @Rabbywallet: Super beginner-friendly and works with most EVM chains

- @phantom: The go-to wallet for Solana, now supports other chains like Bitcoin, Base, Sui, and Monad too.

2. Want to swap stablecoins and more?

- @CurveFinance: The OG stablecoin DEX. Great for swapping one stablecoin to another and for earning yield by providing liquidity. If you're into farming points/yield on stablecoins, Curve is a must-try.

3. Top-of-mind DEXs

@Uniswap / @pancakeswap / @CoWSwap: Swap tokens/provide liquidity with AMMs (v1-4), CLAMM, Hooks. You can always swap, liquidity mining on these DEXs

4. Find the best swap prices

@JupiterExchange / @JumperExchange / @1inch / @CoWSwap: They are DEX aggregators.

Think of them like price comparison sites they find you the best route and rate for swapping tokens.

Some allow cross-chain swaps, making your life much easier.

5. Onchain futures trading?

@HyperliquidX / @JupiterExchange Perp / @GMX_IO / @dYdX: decentralized futures trading platforms.

You can go long/short on crypto, commodities, forex, stocks, or deposit in Perps DEX vaults for yields against PnL.

6. Earn from staking (and re-staking)

@LidoFinance / @Lombard_Finance / @babylonlabs_io / @jito_sol: If you're looking for set-and-forget yields for ETH, BTC, and SOL, while still keeping your assets liquid, these platforms let you earn passive yield.

Use receipt tokens in other DeFi projects to unlock more earning opportunities

7. Borrow and lend crypto

@aave / @MorphoLabs / @0xfluid / @KaminoFinance: Lend your tokens and earn interest, or borrow against them. Lots of strategies here for earning yield or maximizing capital efficiency.

8. Want to trade or farm future yields?

@pendle_fi: Pendle lets you buy and sell future yield. It is also the biggest point market. Great for maximizing your retroactive rewards.

9. Explore new stablecoins

@ethena_labs / @SkyEcosystem / @GHO / @resolvlabs: Newer types of stablecoins, besides the familiar USDT, USDC.

Some are delta-neutral, yield-bearing, or backed by CDPs (collateralized debt positions). You can just hold it for passive yields, or use it in other DeFi strategies

10. Real-world asset yields in DeFi

@ondofinance: Offers tokenized exposure to things like US Treasury yields. If you want TradFi-level returns onchain, this is where to look.

11. Need to move assets across chains?

@wormhole, @stargate, in: Top cross-chain bridges where you transfer tokens between blockchains.

---------

Of course, there are many other great apps out there with similar features or are built for a specific chain.

But if you’re just starting out, this list covers the basics and gives you a solid foundation to dig deeper.

23.74K

36

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.