Tomorrow, Strategy will discuss Q1 earnings and their STRK and STRF vehicles.

Here's some context in advance...

Strategy is a pump - designed to accelerate the flow of capital from Bonds into #Bitcoin .

That’s the mental model to best understand what Strategy is doing.

The other night, I shared this breakdown with 40,000 livestream participants on @MSTRTrueNorth. Saylor retweeted the broadcast. He wants you to know what he’s doing….

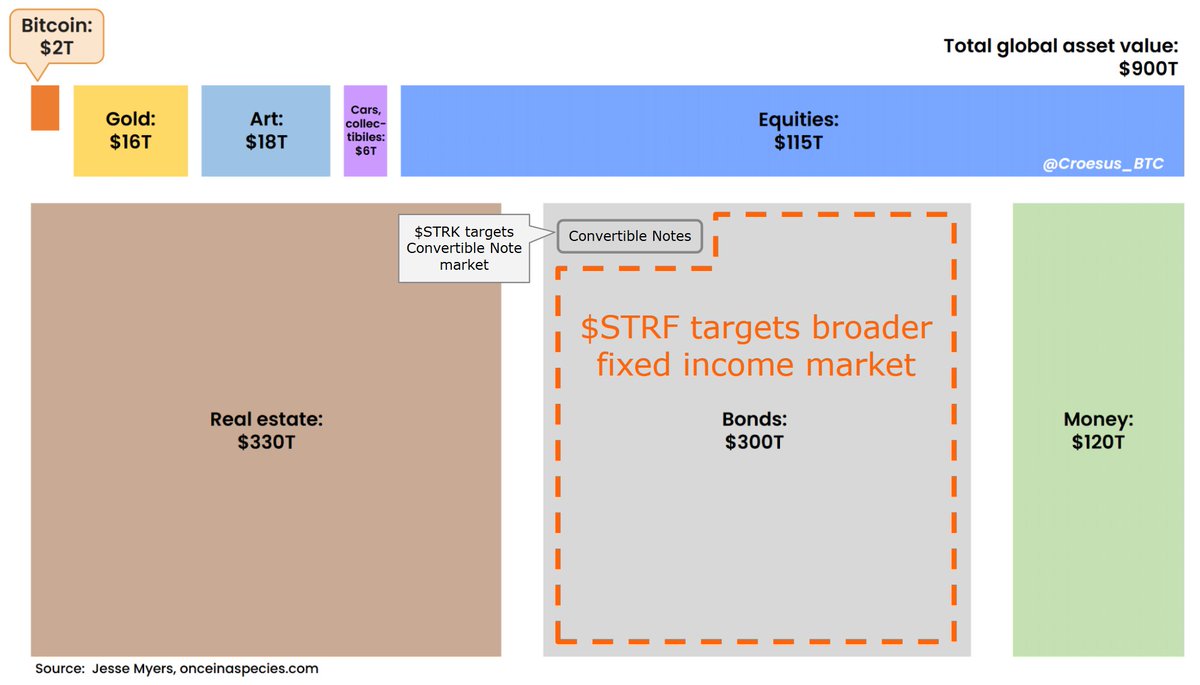

Saylor recently said in an interview “Look, we’re tapping into the bond market… there’s $300T in fixed income, so I want 1% of it.”

He knows there is $300T of capital sitting in Bonds getting not great returns. He shares my chart (see image) in all of his presentations because it sets the stage for what Strategy is designed to do.

It's what @BitcoinPierre coined the "speculative attack."

As of now, 10-year US Treasury bills deliver 4.2% annually. Other bonds, a bit more than that.

Meanwhile, Saylor expects Bitcoin to grow at +50% per year in the near term (and slowing down gradually from there).

Legendary investor Paul Tudor Jones came to a similar conclusion, forecasting Bitcoin as "the fastest horse this decade".

Strategy is leveraging that performance gap between Bonds and Bitcoin for the benefit of its shareholders.

To date, they’ve done that by issuing individual Convertible Notes to institutional buyers. But, the Convertible Note market is just 2% of the overall Bond market. Now, Saylor will be able to tap into the rest of it.

$300T of capital is looking for stable, reliable, mid-single-digit returns every year. Strategy is willing to offer that, and better. With $STRK and $STRF, Strategy is offering 10% and 11.8% annually, respectively.

When fixed income portfolio managers take them up on that offer, they buy $STRK or $STRF shares. In doing so, they hand over dollars to Strategy in exchange for the promise of 10-12% reliable annual yield.

Strategy takes those dollars and buys Bitcoin. Saylor knows that Bitcoin’s growth will vastly outpace the 10-12% annual interest expense on this debt (in the form of dividends).

Sure, it will be volatile along the way, but the average performance over a 4+ year timeline is what matters.

How much money would you borrow if it cost you 10% per year and you could make 50% per year with that capital? As much as you possibly could.

And how much capital getting reliable, mid-single-digit annual returns would be interested in reliable, 10-12% annual returns instead? At least 1% of that capital pool, in Saylor’s estimation.

That comes out to $3T of capital sitting in Bonds that Saylor expects to be able to attract to his new $STRK and $STRF offerings.

What that means for $MSTR shareholders... Saylor expects to add $3T of Bitcoin to the balance sheet over the coming years. All of it will deliver accretive dilution, meaning +BTC Yield to shareholders.

And what that means for Bitcoin is just as wild. Bitcoin is a $2T asset right now. Strategy - just a single company - expects to deploy $3T of buying power over the coming years.

To date, Bitcoin’s growth has come from the natural, osmotic flow of capital from existing asset buckets to Bitcoin.

What that requires is individuals actively deciding to re-allocate some of their portfolio - for example, selling some of their Bonds, then using that money to buy Bitcoin.

This osmotic process will continue as Bitcoin de-monetizes other asset categories while it monetizes as the most attractive store-of-value asset in human history.

And now, Strategy has turned itself into a pump to accelerate that osmotic flow. And with the launch of STRK and STRF, they have greatly upgraded their machinery.

The result will be millions of $ per Bitcoin and Strategy becoming the most valuable company on earth.

Are you paying attention?

4.82K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.