Tuesday, April 15, 2025

- As expected, Trump did not choose to ruin his career after tariff rates soared to 100%+, but instead began to rescue the industries most affected.

- Meanwhile, domestic financial capital in the U.S. is exerting pressure in the treasury bond market, and the Trump administration is facing increasing challenges—whether it's DOGE anti-corruption efforts or the funds saved from the tariff war, they seem insufficient to cover the growing interest on national debt. The biggest threat to Trump's ability to step down gracefully still comes from within the country.

- Back to the market, we observed a rebound in $BTC at 746. The range from 8.7 to 8.8 is a strong resistance, and the 4-hour Bollinger Bands are narrowing at the high level.

- If the resistance at 8.7/8.8 is forcibly broken, the risk of a pullback is very high. It might be worth considering a small position short order as a swing trade.

- Apart from major coins like Bitcoin, the altcoin market remains lackluster, showing significant weakness. Many of the small coins that surged a few days ago have already retraced by more than half, and some junk coins like $BR have even fallen below previous lows. Caution and observation are advised.

Special mention of Ethereum 💊

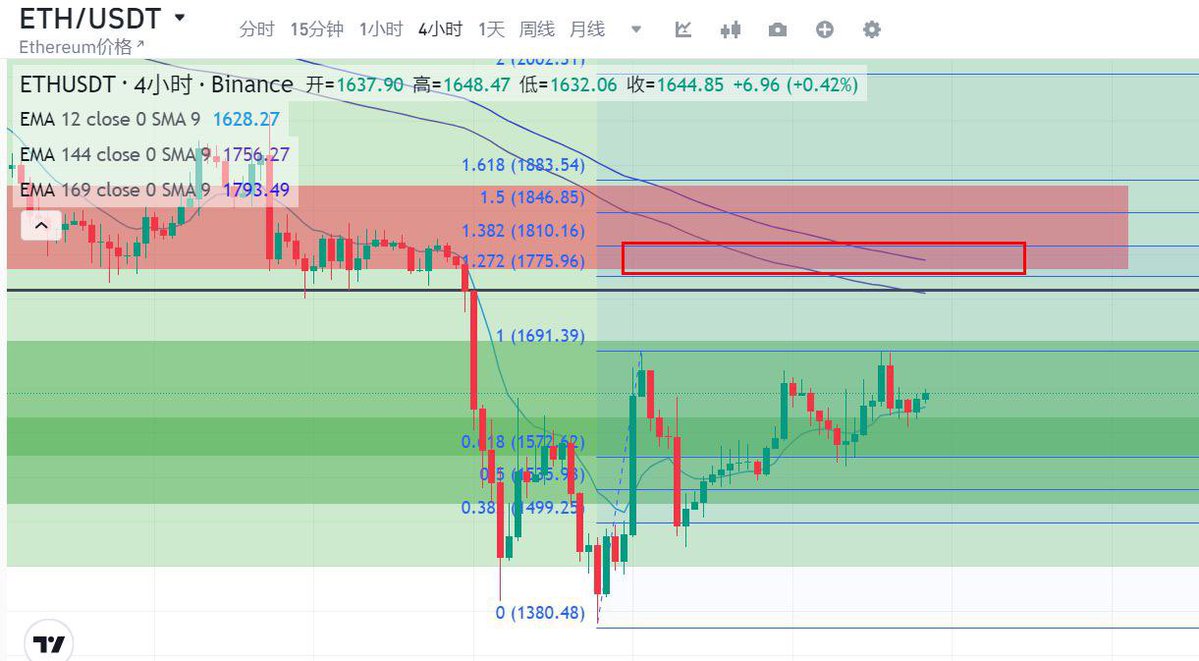

$ETH faces significant resistance in the 1750 to 1800 range. The 4-hour Vegas moving average, the downtrend pivot, and the bullish extension zone are all concentrated here, making this a strong short-term resistance.

The reason is simple: Ethereum has completely detached from other major coins and is increasingly behaving like an altcoin. Since January this year, Ethereum has been declining alongside altcoins, showing almost no signs of recovery. This indicates that neither Ethereum nor altcoins have bottomed out yet.

Currently, Ethereum's lowest point is around 1370, which is precisely the 1.618 support level for new shorts and is also close to the lower Bollinger Band support. Combined with Bitcoin's trend and news-driven rebounds, it’s clear that discussing a reversal is still premature.

From 4000 down to 1370, if Ethereum were to rebound based on this level of decline, it should have a rebound range of at least $800 to $1000. The lack of strength in the rebound after an oversold condition highlights the plight of most altcoins in the market.

$ETH's lowest point near 1370 roughly corresponds to $BTC's 746 to 737 range. Therefore, identifying Bitcoin's lower range can help locate potential support for Ethereum. If support can be found between 900 and 1100, although it sounds unbelievable, given the current market conditions, unless Bitcoin hits new highs and triggers a significant rebound, Ethereum might indeed have a chance to revisit three-digit levels.

What do you all think?

Show original

71.58K

14

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.