Valuing L1s based only on fees is shortsighted.

If that was the case, $TRX should trade higher than $ETH.

But it's not.

Decentralization (meaning security), dev activity, TVL, ecosystem maturity, tokenomics... all these factors matter.

Opinions that ETH is dumping because fees are dropping as activity shifts to L2s are getting louder.

Standard Chartered cut ETH price forecast from $10k to $4k because fees were outsourced to L2s.

Sure, fees matter, but if they were the only factor, BTC would trade lower than ETH.

But it's not.

For some, ETH is money as pristine and yield-bearing collateral in DeFi (like Maker and Ethena).

For others. ETH serves as a store of value differently from BTC. While BTC hedges against macro instability and money printing, ETH is a store of value in the digital economy. A stable macro environment and fiscal prudence risk BTC but not ETH.

For those like me, ETH, SOL and other L1 tokens are productive assets. I use them to farm ecosystem token airdrops while benefiting from L1 price appreciation if the ecosystem expands.

I know it's speculative, but it has nonetheless helped me outperform pure ETH spot price.

Tron's $TRX is none of the above things even it generates higher fees.

Many are likely bearish and selling ETH because of the low fees.

However, this is a natural shift in the narrative from viewing ETH solely as digital oil to recognizing its value beyond just being a fee generating database.

Good counter arguments for fee-based thesis:

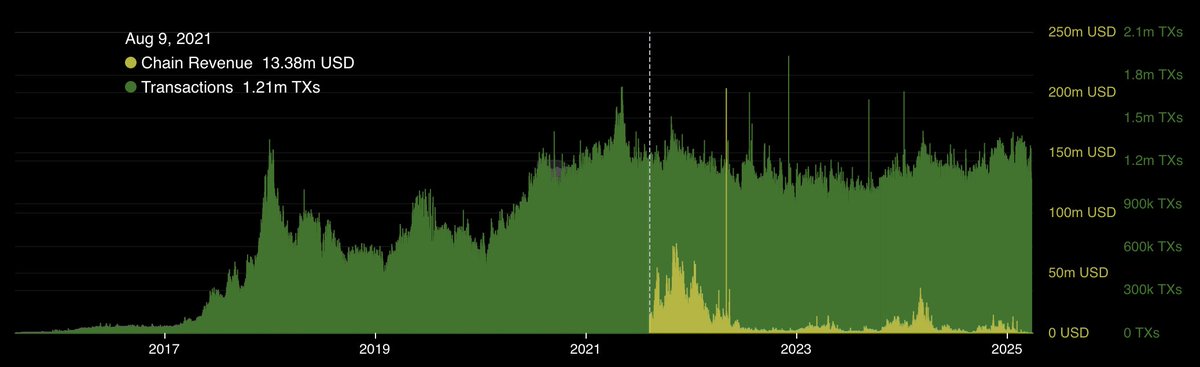

"Revenue 📉" == "Ethereum dying"

Meanwhile:

- Prior to PoS, Ethereum had no revenue

- Ethereum blocks have consistency been full

- Ethereum is doing 15x transactions with Rollups

- Fees on Ethereum sub $1

- Issuance lowered from 4.06% -> 0.7%

Ethereum ain't dying. It's going through a transformative design that ensures it's long-term viability.

495

79.12K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.