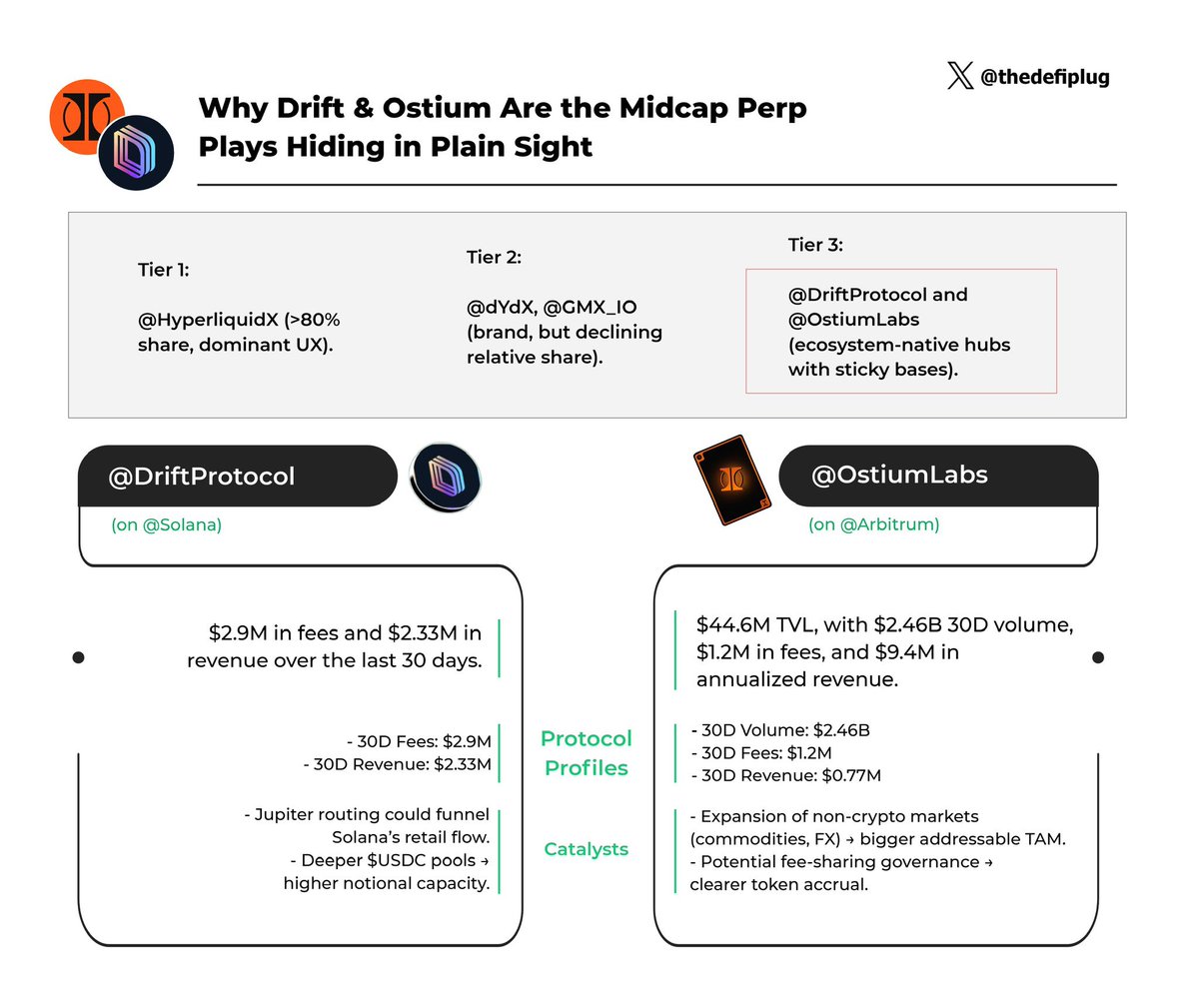

Perpetuals are the cash engine of on-chain trading. @HyperliquidX, @GMX_IO, and @dYdX dominate the narrative, but midcaps are where real alpha hides. → @DriftProtocol (on @Solana): $2.9M in fees and $2.33M in revenue over the last 30 days. → @OstiumLabs (on @Arbitrum): $44.6M TVL, with $2.46B 30D volume, $1.2M in fees, and $9.4M in annualized revenue. Both are operating like ecosystem-native exchanges, not “apps.” Their ability to generate revenue and retain liquidity positions them for re-rating once the market looks past vanity TVL. ● Market Landscape The perp sector is stratified: Tier 1: @HyperliquidX (>80% share, dominant UX). Tier 2: @dYdX, @GMX_IO (brand, but declining relative share). Tier 3: @DriftProtocol and @OstiumLabs (ecosystem-native hubs with sticky bases). Key Insight: Traders don’t migrate endlessly. They anchor to ecosystem-native venues if the product is good enough. That’s why Drift rules Solana, and Ostium is emerging as Arbitrum’s challenger beside GMX....

Show original

11.14K

22

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.