Strategy’s foray into preferred stock: financial innovation or a giant Ponzi?

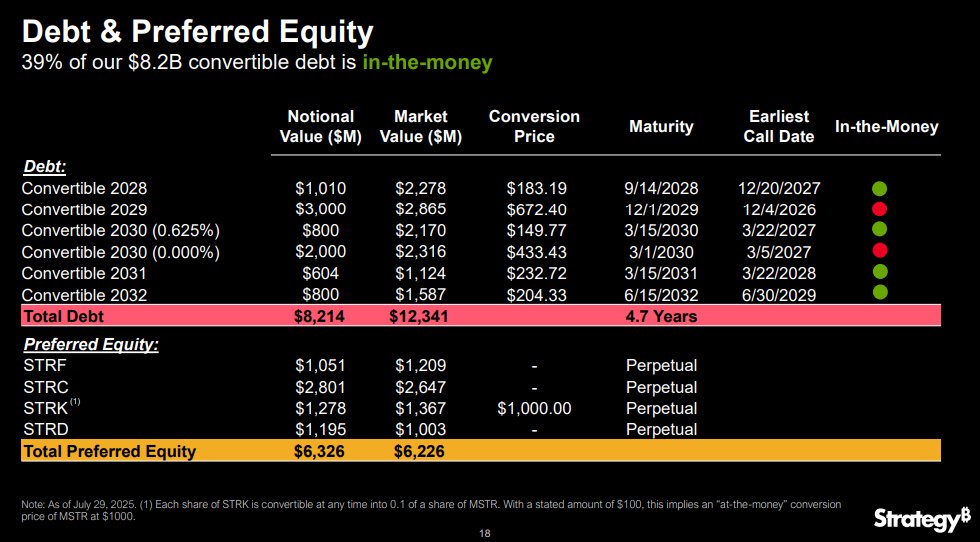

- In addition to convertible debts (which carry an extremely low average interest rate of 0.421%), Strategy has recently issued a large amount of preferred shares (STRF, STRC, STRK, STRD) with dividends/interest obligations, bringing its annual payout burden to $614M.

- Through these dividend-paying preferred shares, Strategy aims to diversify its funding sources and tap into the income product market, competing with money market funds and high-yield bonds. Investors receive higher yields compared to deposits or Treasuries while also gaining exposure to Bitcoin/Strategy. STRC was especially successful, raising $2.5B, five times more than expected.

- While diversification and entry into the income market are positive, the surge in dividend obligations is a heavy burden. Interest expenses from convertibles were only $35M annually, but with the new preferreds, total payout obligations have soared to $614M — 17.5x higher. Notably, Strategy generates no meaningful cash flow from its core operations.

- So how does a company with no operating cash flow cover these payments? By issuing more stock. In other words, part of the proceeds from common stock sales is used to cover interest/dividend obligations.

- So who is actually buying Strategy’s stock? A major source of demand comes from gamma traders — those who sell Strategy call options and hedge by buying the underlying shares. These traders don’t care about Bitcoin or Strategy’s fundamentals; they simply profit as long as the stock’s volatility remains high. Conversely, if Strategy’s stock volatility declines, option activity diminishes, and the gamma-driven demand for Strategy shares also weakens.

- Strategy’s preferred share issuance is therefore a bold gamble. If it succeeds, it could disrupt multi trillion-dollars income product market and attract massive capital inflows. But currently, it lacks sufficient trust and liquidity. At this stage, traditional high-yield bonds still offer a better risk/reward profile than Strategy’s preferred shares imo.

- Strategy could fall into a death spiral, with a probability of perhaps 20–30%, triggered by risks such as: 1) Bitcoin price decline; 2) Decline in MSTR stock volatility and reduced gamma trading demand; 3) mNAV compression; 4) The $3B 2029 convertible bond coming due when MSTR stock is below $672.4 (currently $375); 5) Credit market stress and poor demand for preferred shares; 6) A major hack

- Whether Strategy will be remembered as a financial innovation or a giant Ponzi remains uncertain. The same goes for the broader “crypto treasury” bubble currently in vogue — no one knows when it will burst. What seems clear (at least from common sense) is that companies with no sustainable cash flow (including PoS-based “treasury” firms that rely only on token sales) are unlikely to sustain such leverage and financial engineering for long.

Strategy often promotes the idea of “Intelligent leverage.” But while there may be such a thing as intelligent but risky leverage, there is no such thing as intelligent and safe leverage. Financial history suggests that insufficiently regulated derivatives and leverage inevitably lead to destructive collapses.

Show original

10.67K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.