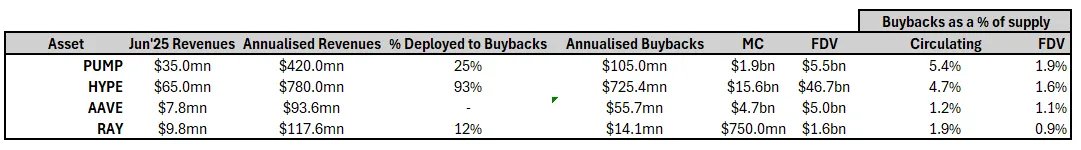

If $PUMP really uses 25% of its revenue for buybacks, then the current valuation is indeed not expensive, and it’s even a bit cheap.

◽️Super strong earning ability: Based on June's data, @pumpdotfun has an annual income of up to $420 million. In today's market, it's hard to find projects with such clear and aggressive cash flow.

◽️Relatively "undervalued" valuation multiple: The FDV/Rev of $PUMP is about 13 times, which is indeed the lowest compared to other profitable protocols (like $AAVE, $RAY).

If we only look at buyback income, $PUMP's multiple is also the lowest, meaning that for every dollar you spend to buy PUMP, you get a larger share of platform income compared to other leading protocols.

Of course, opportunities and risks always go hand in hand. The biggest uncertainty for $PUMP is actually very simple and direct:

⚡️The biggest variable: the team itself. This is an unavoidable topic. What everyone fears the most is "the team crashes and then disappears." This risk cannot be quantified; it can only be described as a huge unknown, completely dependent on the team's vision and ambition.

⚡️Web 2 earning mindset vs. crypto culture: Pump's success relies on a very "Web 2" approach—simple, direct, and quick monetization. This concept may seem a bit out of place in the crypto culture.

But we have to admit that the Pump team achieving this level is not just luck; they do have some real strength. If they are ambitious, the TGE will definitely not be the last step, and don't forget they are also the team with the most resources to pump the price.

In the crypto world, valuation is often not a precise science, but more like a "narrative." Wasn't $HYPE also driven up by this narrative?

When a story starts to be believed and discussed by more and more people, its "valuation" will slowly become real and reasonable.

Show original

5.6K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.