Twelve years of crypto veteran, Pantera Capital's new battlefield of currency stocks

Original author: Fairy, ChainCatcher

Original editor: TB, ChainCatcher

Pantera is building a "multi-currency version of the micro-strategy investment matrix".

As one of the first batch of bettors in the crypto world, Pantera Capital has bet on the dawn of Bitcoin, the midsummer of DeFi, and the pit of FTX.

Twelve years later, it is still active, even more aggressive in the new wave of currency stocks. Behind many listed companies that raise funds to buy coins, there is a shadow of Pantera.

What kind of VC is this veteran of the crypto narrative and the undead player on the cyclical battlefield? Now, what kind of new territory is being laid out?

Pantera's betting story

Pantera Capital started betting on the crypto industry in 2013 and was one of the earliest crypto venture capitalists. It launched the first Bitcoin-focused investment fund in the United States and bought about 2% of the world's Bitcoin between 2013 and 2015, eventually achieving returns of more than 1,000 times.

However, what truly supports Pantera's journey through the cycle is not a successful bet, but its continuous responsiveness to changes in market structure.

When the ICO boom was on the rise, Pantera was the first to launch an early-stage token fund; DeFi Summer follows the establishment of the Pantera Blockchain Fund, which provides a full range of investment opportunities in the cryptocurrency and blockchain markets. From fund form to strategic allocation, Pantera's adaptation approach is closely related to the market.

Currently, Pantera manages five main funds: venture funds, Bitcoin funds, early-stage token funds, liquid token funds, and Pantera funds. According to the official website, its assets under management exceed $4.2 billion, with a cumulative realized income of about $547 million.

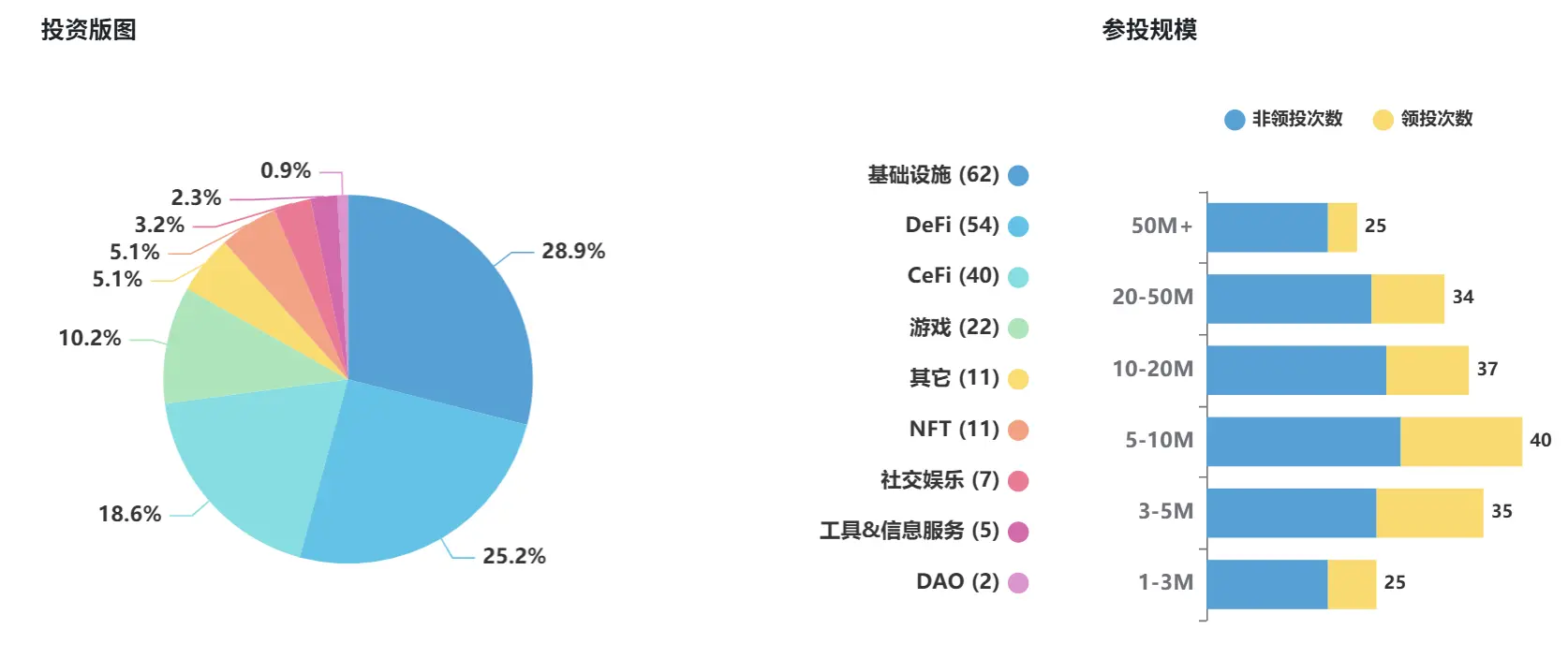

Pantera still has a tight tempo. According to RootData, it has invested in a total of 214 projects, ranking 13th among all investment institutions, and has invested in 18 projects in the past year. The investment layout is mainly concentrated in four major sectors: infrastructure, DeFi, CeFi and blockchain games.

In its portfolio, there is no shortage of star projects such as Circle, Ripple, Polkadot, Coinbase, StarkNet, etc. However, not every move has achieved good results, and so far, 33 projects have announced the termination of operations, including FTX, Lithium Finance, etc.

In 2024, Pantera had made a high-profile bet on TON, believing it had the potential to have a network of 900 million active users. This judgment prompted it to make the largest investment in the fund's history. According to on-chain analyst Aunt AI, Pantera's investment in TON could exceed $250 million. However, the TON price has now retraced more than 60% from its 2024 high.

Even so, Pantera's investment trajectory clearly shows the self-iteration and phased adventure of an established crypto VC.

New Battlefield: The Rise of Coin Stocks and Pantera's Strategic Switch

In early 2025, the primary market cools down, and liquidity and exit paths become new propositions for crypto VCs. However, against this background, the "currency stock wave" has quietly emerged.

This time, Pantera Capital once again smelled the battlefield switch. Within a few months, it evaluated more than 50 listed companies with "financing + currency buying" as its core strategy and began to participate in depth.

To eat this new piece of cake, Pantera has also launched a special "DAT Fund". At present, a number of Pantera fund limited partners have committed to contribute capital, and it is expected to invest more than $100 million in multiple DAT projects.

Nowadays, in the "micro-strategy" of different currencies, its capital contribution and layout can be seen. Here are some of the Digital Asset Treasury (DAT) companies that Pantera has invested in:

It is worth noting that several companies in the table have increased their stock prices more than 100 times in just one month. Pantera partner Cosmo Jiang calls this type of investment a structure that "wins on the heads and doesn't lose much on the negatives."

[Note: Pantera usually enters when DAT is not publicly traded or is still priced close to its token net assets (1.0x NAV) to avoid the high premium in the open market. 】

In any case, Pantera Capital has taken a key position in this wave of coin stocks. As crypto KOL AB Kuai.Dong said: "Live, die, Pantera. ”

Dan Morehead, the crypto turn of the "macro player"

When understanding Pantera Capital's style, it's hard to avoid its founder, Dan Morehead.

Dan Morehead's resume is extremely "traditional": he graduated from Princeton University with an engineering degree, then went to Wall Street, honed his trading skills at Goldman Sachs, Deutsche Bank and other institutions, and eventually became the chief financial officer and head of macro strategy at hedge fund giant Tiger Management. At that time, he managed billions of dollars in assets and was able to navigate between global currencies and interest rates.

In 2003, he founded Pantera Capital, which started as an ordinary investment firm. It wasn't until 2013 that he had a four-hour in-depth discussion with two friends. That conversation completely ignited his interest in Bitcoin. Since then, Pantera has transformed into a venture capital institution in the crypto space.

At the time, the price of Bitcoin was on par with Tesla's, and Morehead made a bold decision: sell all Tesla shares and bet all on Bitcoin. And this is also the first success of Pantera Capital - a Bitcoin investment fund.

Dan Morehead once admitted that the key to investing is to lock in opportunities where the potential returns far outweigh the risks. Risks are always there, but what really matters is to find the target that can bring explosive returns.

"If you want to get excess returns, you can't follow the mainstream, you can't invest in projects where every Wall Street company has 20 analysts staring at it," he emphasized. This is why we have repeatedly emphasized in our investor letters that 'making alternative investments more alternative'. ”

Today, while Morehead rarely appears in the public eye, Pantera Capital retains his mark: bold, forward-looking, and close to the market structure.

Twelve years, multiple rounds of narratives, hundreds of projects, Pantera Capital searches for signals in chaos and reshapes paths in structural fission.

Crypto In this endless race, Pantera is still betting.

Original link