The tokenization of U.S. stocks exploded, but the underlying infrastructure team xStocks exploded its history

Written by Bright, Foresight News

With Robinhood, Kraken, and Bybit successively announcing the deployment of U.S. stock tokenization, and major ecosystems such as Chainlink and Jupiter successively announcing their support for tokenized stock trading such as Apple, Tesla, and Nvidia, this "wall-breaking" concept exploded overnight in the cryptocurrency circle. Among them, crypto-native exchanges Kraken and Bybit chose to adopt the underlying architecture of the stock tokenization platform xStocks, which is based on Sol, while the digital brokerage Robinhood chose Arbitrum as the token issuance chain.

Just when the ecological enthusiasm of various companies is still high, there is a news of "pouring cold water" on the market. According to LinkedIn information, the three co-founders of Backed Finance, the Israeli company behind the stock tokenization platform xStocks, namely Adam Levi Ph.D., Yehonatan Goldman, and Roberto Klein, have all been confirmed to have worked at the bankrupt DAOstack.

Among them, Adam Levi, Ph.D., served as the co-creator of DAOstack to provide endorsement, Yehonatan Goldman was the COO of DAOstack, and Roberto Klein was responsible for legal and regulatory work at DAOstack.

ICO Drops data shows that DAOstack raised a total of about $30 million through multiple funding rounds from Q4 2017 to May 2018, and closed in late 2022 due to funding depletion. The DAOstack team has been accused of being a "soft RUG PULL".

According to crypto KOL @cryptobraveHQ, DAOstack issued a token $Gen in 2019 and allowed the token to "free fall" after the 2021 bull market. "The team didn't even bother to go to a small office, and they let it go to zero after issuing the coins."

How xStocks work

However, in terms of mechanics, at least for now, xStocks provides an operational path.

xStocks is operated by Backed Assets, a Jersey-based publisher registered in Switzerland. Backed Assets buys shares in the U.S. stock market through IBKR Prime under Interactive Brokers, which are then transferred to segregated accounts with Clearstream, a depository affiliated with Deutsche Börse.

When the buy-transfer-deposit "three-step" operation is completed, the issuer Backed Assets will trigger the contract that has been deployed on the Solana chain, corresponding to the additional issuance of stock tokens, that is, for every 1,000 Tesla shares bought and deposited, 1,000 TSLAx tokens will be minted on the chain 1:1. The controlling address of the token contract is owned by the issuer Backed . After that, third-party exchanges, such as Kraken, Bybit, Jupiter, etc., can directly list the spot and contracts of these tokens.

If investors and market makers actually buy TSLAx tokens greater than or equal to 1, they can go to Backed to apply and exchange them for actual Tesla shares under the brokerage. At the same time, dividends are automatically airdropped with more of the same token after the snapshot.

During the market period, the price of the entire stock token will refer to Chainlink's oracle, and if it deviates significantly from the price of the U.S. stock, arbitrageurs can profit by buying and selling tokens on the xStocks platform, Kraken, and Bybit, thereby driving the price back into a reasonable range.

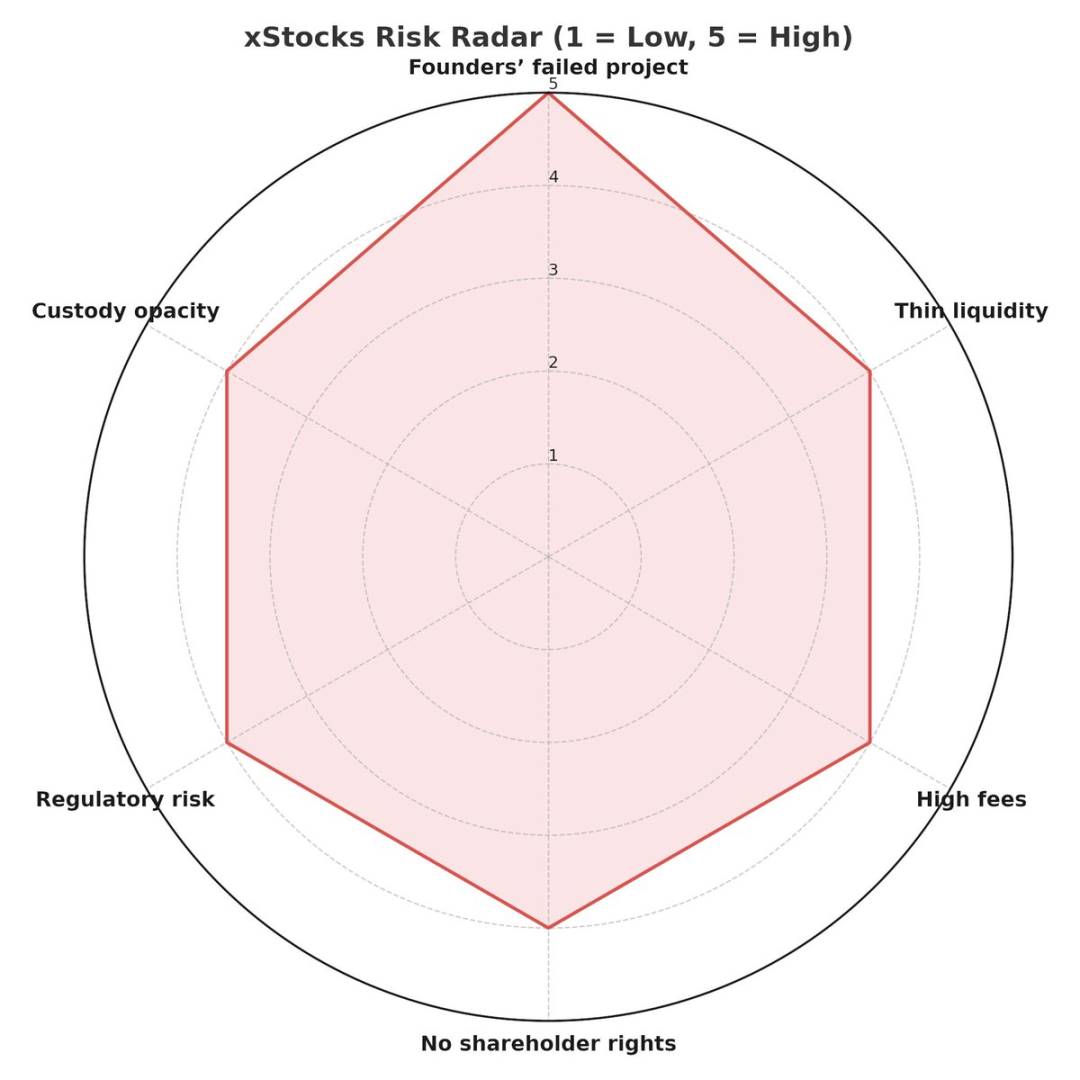

Potential apprehension

However, in addition to the aforementioned "soft RUG PULL" history of the founder, the current community users still report that xStocks has many shortcomings, and some are difficult to improve substantially. Some users bluntly stated: "On-chain stock tokens are just castrated stocks built for tax avoidance."

For example, users generally believe that xStocks is very liquid, with only 6,000 tokens per stock currently listed, and there has been a significant amount of on-chain volatility that exceeds the real situation of U.S. stocks.

Secondly, the processing fee is too high. On-chain tokenized shares on xStocks have a burn of up to 0.50% + and an annual management fee of 0.25%, an additional feature that makes holding US stocks on-chain more expensive than holding real shares.

In addition, there are community members who believe that the collateral shares are held in custody by an off-chain custodian, which lacks public audits and poses a risk of a thunderstorm. However, the on-chain shares do not have the voting rights of shareholders, and the actual holdings are unsecured notes, which is also worrying. The actual experience of slow purchase and redemption is unbearable.

To borrow a comment from a KOL who broke the scandal of the founder of xStocks, "Israeli web3 projects have both the 'Buddhist' temperament of European projects and the capitalization ability of American projects; In summary, it is not responsible for the user from beginning to end. 」