How do U.S. state governments choose stablecoins to issue public chains?

Author: Zhi Wuyan

I watched a news last night, Wyoming in the United States in order to choose the public chain for the stablecoin WYST to be issued, engaged in a public scoring, and finally 11 chains entered the shortlist, Aptos and Solana tied for first place with 32 points, Sei followed with 30 points, Ethereum and a group of L2 only 26 points or lower, which may be quite different from the ecological activity and currency price of the public chain that everyone feels every day. How exactly is this score played? I was curious, so I studied with GPT teacher.

1/ First of all, give a word of praise to the U.S. state government for building in public. The Wyoming Stablecoin Council, the backing of the stablecoin WYST, was established in March 2023 under the state's Stable Token Act. The committee has a public notion document with a brief description of the project, a calendar of meetings and records, the results of the grading criteria and memo, Q&A, contact information, and a list of its own YouTube channel, X account, Warpcast account, and Github account, which is more serious and transparent than many of today's distracting project parties.

If you are interested, you can go directly to the onlookers.

2/In 2024, the Q4 committee preliminarily selected 28 public chains, and first screened out 14 of them based on whether there is no permissionless access, supply transparency, on-chain analysis, and whether the four rights and wrongs can be frozen; Secondly, 9 indicators (3 points each) are used to score the score, including network stability, number of active users, TVL, stablecoin market capitalization, TPS, transaction fees, transaction finality time, block generation time, and whether it is registered in Wyoming. Finally, 5 additional benefits are scored with 2 points for each of the 5 additional benefits (privacy, interoperability, smart contract/programmability, use cases, partners) and 6 additional risks of -2 points each (entity violations, team violations, history of security vulnerabilities, poor network availability, lack of bug bounties, and lack of code maintenance).

The final recommendation is to include 5 Layer 1 main chains: Solana (32 points), Avalanche (26 points), Ethereum (26 points), Stellar (24 points), Sui (26 points) and 4 eligible Layer 2 chains: Arbitrum (26 points), Base (25 points), Optimism (19 points), and Polygon (26 points) as "candidate blockchains".

3/ Aptos and SEI are actually newly included in the selection in Q1 this year. This quarter, the committee updated the selection criteria, adding a new item of "whether there is supplier support" to the right and wrong criteria, that is, "the blockchain must have the support of the committee's cooperative vendors for development, auditing, and infrastructure deployment." may be undertaken by the Foundation, subject to approval".

Updated to say that "chains must be fully indexed and supported by on-chain analytics platforms (e.g., Chainalysis, TRM Labs) that the Council works with".

Two new additions have been added to the additional benefit items, which are:

- Emerging Market Trends: Whether it hosts emerging track projects such as AI, DePIN, virtual reality, and game assets

- Foundation Support: Whether the Foundation can support one or all of the three aspects of technology development, WYST liquidity, and marketing

In this scoring, Aptos and SEI scored 32 and 30 points, respectively, so they were selected as candidates for the new promotion.

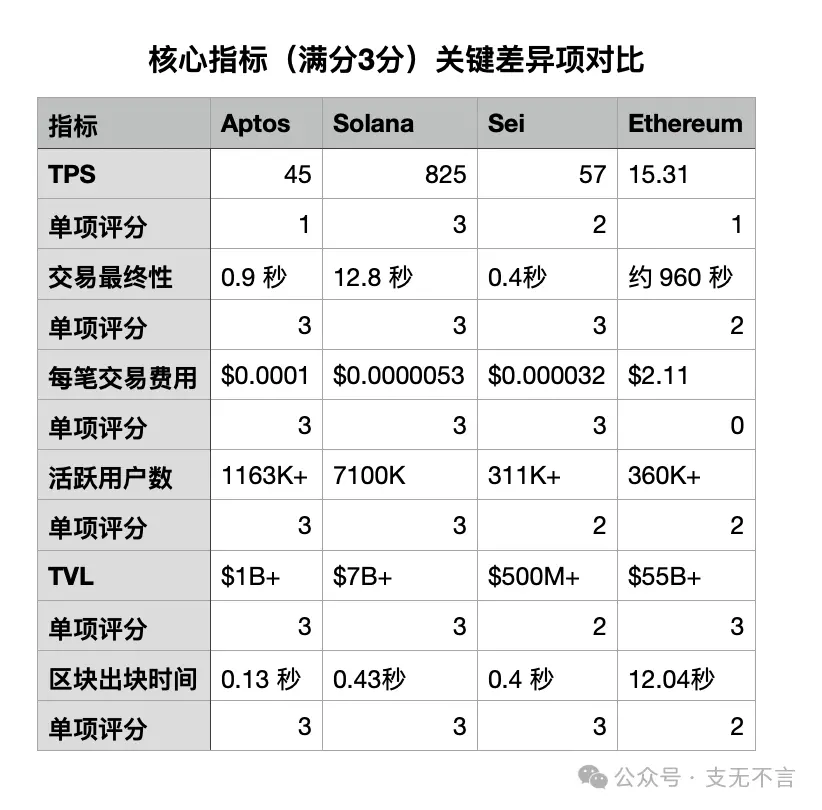

4/ So how did this score difference come about, I first made a comparison chart of the key difference items around the core indicators. Please note that since the new round of scoring does not re-score the 9 public chains that have been selected before, some of the data here is from the end of 2024 and is not the latest.

It can be seen that Ethereum's TVL is ahead of a cliff, but this decentralized chain still suffers a lot in terms of the number of transactions per second (TPS), transaction finality duration, transaction fee per transaction, and block generation time. It can also be seen here that the diversion of Layer 2 has led to the number of active users on the Ethereum mainnet being only in the same order of magnitude as SEI, far behind Aptos and Solana.

But how did Aptos manage to tie Solana for the highest score? I read it and found that on the one hand, Aptos is indeed very balanced, with strong compliance, fast speed, low cost, and relatively stable network, and on the other hand, it is also because the second round of scoring added two new points to the additional advantage bonus points, but Solana did not re-participate in this round of scoring. If these two items are removed, the actual highest score should still be Solana.

5/ It is worth noting here that although Ethereum has always advertised itself as the best choice to carry real assets on the chain, it actually falls to the technology selection at the government level, similar to the permissionless network is a threshold, and network stability only accounts for one of the core indicators; Lack of technical barriers and insufficient network availability are risk deductions, and Solana has been deducted 1 point each, but it has little impact on the whole. There is no rating on the degree of decentralization, and the state government is more focused on whether it can freeze and whether it has an entity in Wyoming; The vast majority of core metrics are performance, cost, and scale.

Of course, this state-level stablecoin issuance has stated from the beginning that it will abide by the principle of "multi-chain support and technology neutrality", and will continue to update the rules and collect feedback, and at the same time welcome the chains that have not been shortlisted to continue to submit applications to participate in the selection, so the public chains that have entered the shortlist and even those that have not yet entered the list have a chance in theory.

6/ In addition to the public chain selection, this Wyoming-based state-level stablecoin project is also noteworthy. As the first state in the United States to plan to issue a stablecoin, WYST was originally planned to launch by July 4, but during the regular meeting at the end of May, this timeline has been postponed to the third quarter of 2025, and the new proposed date is August 20. Subsequent work also involved soliciting public comments and final approval of the Reserve Management Rules, developing a committee-specific general ledger/chart of accounts, setting up trust and liquidity fund accounts with third-party custodians, and engaging with licensed service providers, including centralized exchanges, payment platforms, digital wallets, market makers, for the purchase and resale of WYST, and more.

Eventually, the reserves behind the stablecoin will be managed by the Franklin Templeton Fund, with Chainalysis responsible for on-chain analysis, integration with LayerZero and Fireblocks, completion of the decentralized verification network and official website launch, deployment of the WYST contract to mainnet by August 20, and a public statement at the Wyoming Blockchain Symposium.

In addition to Wyoming, Nebraska has passed its "Financial Innovation Act" to authorize entities called Telcoin to issue a state-backed stablecoin, tentatively called eUSD. Tinian Island, part of the Northern Mariana Islands, an overseas territory under the federal jurisdiction of the United States, attempted to issue a dollar stablecoin called the Marianas US Dollar (MUSD), which was rejected by the governor in April this year, and the Senate overturned the governor's veto in May.

This scenario of U.S. states and corporations gearing up to issue their own stablecoins is reminiscent of the free banking era from 1837 to 1866, when states, cities, private banks, railroad and construction companies, shops, restaurants, churches, and individuals issued about 8,000 different currencies by 1860, a wide variety of currencies, and a lack of uniform standards, with the picture here illustrating the $1 private currency of the Delaware Bridge Company in New Jersey from 1836 to 1841.

7/ There has been a lot of talk about RMB stablecoins recently, and some large companies are also eager to try it. After the question of whether to have it, it may be which chain to run on. Whether to launch a special chain, whether to use the large company's own alliance chain such as Ant Chain and JD Chain, whether to access the common public chain in the world, or to use some domestic public chains such as Hashkey Chain, Conflux, etc., this issue is a new topic for governments and enterprises in China and the United States and even other countries around the world. Wyoming's scoring system and publicity system may not be perfect, but it can be regarded as an example for latecomers. We should see more interesting governance developments in the future.