After Monero was attacked by 51%, the Qubic community turned pressure on Dogecoin?

Author: CoinW Research Institute

Recently, the AI public chain Qubic reorganized Monero blocks in a short period of time, driven by the "Useful Proof of Work (uPoW)" mechanism, resulting in 60 blocks being orphaned. While it is still debatable whether the attack constitutes a strictly 51% attack, its impact on the market goes beyond the technical level. Uncertainty about network integrity forced exchanges to take risk control measures, putting pressure on Monero's price. This attack revealed that security budgets under the PoW mechanism can be penetrated under external incentives, exposing the structural vulnerability of computing power concentration and security boundaries.

More noteworthy, the Qubic community's subsequent vote listed Dogecoin, with a market capitalization of over $35 billion, as a potential target. This trend has not only deepened market concerns, but also heated up external discussions about the relationship between incentive computing power distribution and network integrity. The boundaries between the portability of computing power and the security budget are being re-examined, and in this context, CoinW Research will provide a deeper analysis of this event below.

1. Qubic's "51% Attack", Is It a Marketing Narrative or a Technical Threat

1.1. How the uPoW mechanism breaks through traditional security

budgets In a standard PoW architecture, the cornerstone of hashrate stability is the on-chain security budget, which is the incentive closed loop formed by block rewards and fees. Taking Monero as an example, the network has entered tail emission mode, with a fixed reward of 0.6 XMR per block, an average of every two minutes, about 720 blocks per day, and a total security budget (approximately equal to miner block subsidies * XMR market price) of about $110,367 per day, which is also the economic lower limit that attackers must bear to continue to control most computing power.

Qubic breaks through this traditional limitation by introducing Useful Proof-of-Work (uPoW). Unlike the model that relies solely on block rewards, Qubic not only rewards miners for QUBIC blocking, but also directs the hashrate to Monero mining, and exchanges this part of the reward for USDT to buy back and burn QUBIC on the open market. In this case, miners can not only directly receive QUBIC block subsidies but also obtain indirect benefits through the deflationary effect of buybacks and burns, resulting in a higher comprehensive return than mining XMR alone. This allowed Qubic to quickly mobilize a large amount of computing power in a short period of time, and led to the anomaly of six block restructuring and nearly 60 orphan blocks. In fact, as early as June this year, Qubic began mining Monero and Tari, and exchanged the rewards for USDT to buy back QUBIC tokens, which were then burned. According to Qubic's official disclosure, this mining mechanism is more than 50% more profitable than mining XMR and Tari alone.

Source:qubic.org

1.2.Qubic 51% The credibility of the attack is questionable

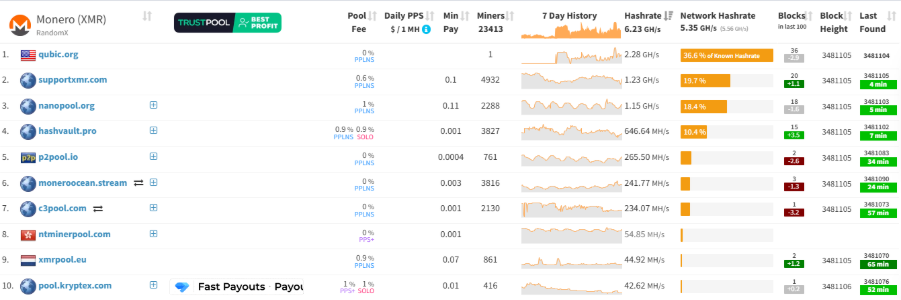

Although Qubic claims to have achieved a "51% attack" on Monero, this statement has been questioned by the community. According to public data from research institute RIAT, its peak hashrate is only about 2.6 GH/s, while Monero's network-wide hashrate is around 6.25 GH/s during the same period. In other words, Qubic's hashrate accounts for less than 42%, which is a significant gap from the true 51% of attacks. Further data also supports this judgment, with CoinWarz data showing that on the day of the incident, Monero reached a peak of 6.77 GH/s across the entire network. The MiningPoolStats monitor value for the day at about 5.21 GH/s. This further shows that Qubic's peak computing power fluctuates instantaneously, not steady-state control. According to MiningPoolStats, the current computing power of Qubic mining pools is about 2.16GH/s, accounting for 35.3% of the computing power. The data differences indicate that its control ability is unstable and lacks continuous determination.

Source:miningpoolstats

Although most control is questionable and Monero's cybersecurity has not been affected by reality, Qubic's hashrate disturbance has hit the market in the short term. Kraken suspended XMR deposits due to network integrity risks, raising the confirmation threshold to 720 blocks upon resumption and reserving the right to suspend it again. This indicates that even if it is not a true 51% attack, as long as there is a possibility of computational manipulation, the transaction security chain will be under pressure in advance, and liquidity and confidence will be challenged simultaneously.

2. Dogecoin becomes the next potential target

2.1 Dogecoin becomes the next potential target of attack

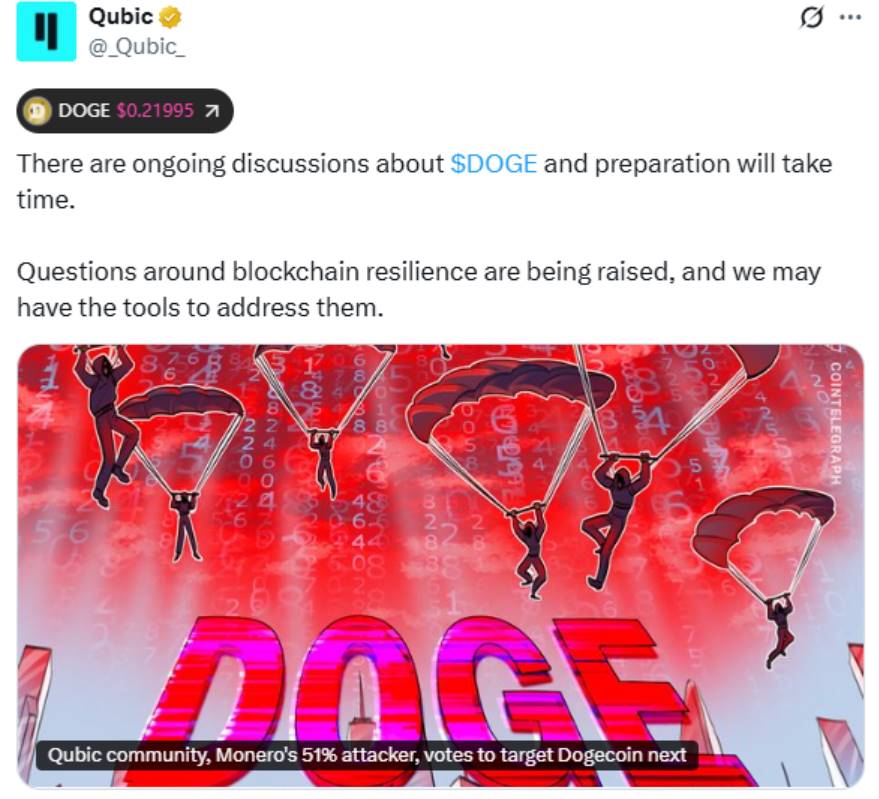

After Monero, Qubic has made Dogecoin its next potential target. Recently, Qubic's community launched a new vote to determine the target of a possible 51% attack next. The final results showed that Dogecoin received over 300 votes, significantly higher than Kaspa vs. Zcash candidates. The vote has attracted market attention, and it means that Qubic's focus has shifted from the privacy coin Monero to a mainstream meme coin with a higher market capitalization and a wider user base.

Qubic gained market attention because it demonstrated a new economic incentive model in the Monero attack. This is not hacking in the traditional sense, but rather using financial incentives to "rent" computing power, thereby reshaping the security assumption of PoW. The current pattern has the potential to be projected onto Dogecoin, amplifying the market's unease. Interestingly, after the vote, the Qubic community also said that it was mining Dogecoin rather than an "attack". Judging from Qubic's official statement, the community generally interprets this incident as a marketing operation rather than a simple technical attack.

Source:@_Qubic_

2.2. Can Qubic attack Dogecoin be realized?

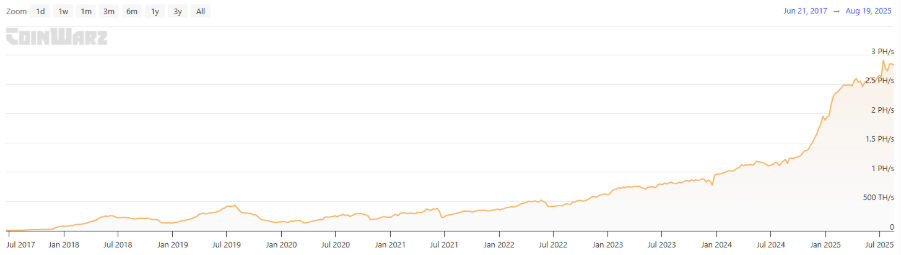

It should be noted that Qubic also uses the method of mining first and then "attacking" Monero. As a result, the community speculates that Qubic may also "attack" Dogecoin in the future. Can it be achieved? To understand the risks, one needs to first examine the scale of Dogecoin's hashrate. According to CoinWarz data, Dogecoin's current computing power across the network is about 2.69 PH/s, with an all-time high of 7.68 PH/s, which shows the scale of miners' investment in hardware and power. According to the network mechanism, Dogecoin produces an average of one block per minute, with a fixed reward of 10,000 DOGE per block, so the network adds about 14.4 million DOGE every day. At a current price of around $0.21, Dogecoin has a daily security budget of around $3 million. In contrast, Monero added only 432 XMR per day during the tail emission phase, corresponding to a security budget of about $110,000, which is much lower than Dogecoin. This gap indicates that under the same conditions, if Qubic attempts to launch a 51% attack on Dogecoin, the attack on Dogecoin is much higher than Monero's in terms of capital and technical thresholds.

Source:coinwarz

Qubic's strategy is not to directly invest huge amounts of money, but to attract temporary migration of computing power through a subsidy model. If enough miners are incentivized by QUBIC to leave other chains and switch to Dogecoin in the short term, it may still have an impact on block stability. Even if "double-spending" cannot be truly realized, it may lead to increased block latency and an increase in orphan block rate, thereby interfering with the normal operation of the network. It can also be understood that Qubic's attack does not have to be "successful", as long as it creates chaos, it is enough to undermine market confidence.

Three. From the perspective of Qubic events, the new game of PoW under AI computing power

3.1. Miners' liquidity and loyalty dilemma

The traditional PoW consensus relies on the logic that computing power is security, that is, the higher the computing power, the greater the cost of attacking the network, forming a solid moat. However, the Qubic incident has exposed a new reality that computing power is not locked on a single chain for a long time, but is a resource that can be quickly transferred, rented, or even speculated. When computing power is highly liquid, its properties are more like liquidity in the capital market, and it will flock to areas with higher returns at any time.

This liquidity directly changes the relationship between miners and the network. In the past, miners were mainly incentivized by block rewards and fees, forming a long-term bond with the chain. In the Qubic model, miners' revenue streams are redefined. This allows miners to gradually transform into arbitrageurs of hashrate rather than long-term guardians of a chain.

The more far-reaching impact is that the security of PoW networks will no longer depend on the scale of the computing power itself, but on the stability of the computing power. Once the hashrate can be bought by the higher bidder at any time, the attack cost of the network is no longer a static absolute number, but is highly correlated with the fluctuations of the external market. As a result, PoW is no longer a solid security cornerstone but a temporary defense subject to external market dynamics, where security boundaries can be breached at any time.

3.2.AI The New Game of PoW in the Computing Power Era

In the context of the continuous high demand for AI computing power, the security of PoW networks has been redefined. In the traditional model, the hashrate only circulates within the chain, and the security budget relies entirely on block rewards and fees. In the Qubic mode, it proves that computing power can also be channeled off-chain. For miners, the hashrate naturally flows to the market with the highest reporting. This means that PoW's security budget is no longer a static cost within the chain, but is tied to the global hashrate market, and may even experience a security flash crash when AI hashrate prices soar.

In this environment, PoW is likely to be just a short-term transition solution for AI public chains. The model of relying solely on PoW to maintain security is difficult to maintain in the context of long-term computing power outflow. More similar projects may turn to PoS or hybrid consensus mechanisms in the future. Whether the migration of the consensus mechanism can be smoothly completed may become an important factor in judging the long-term competitiveness of AI+PoW public chains.

At the same time, external security binding is becoming a more feasible path for PoW and AI to combine public chains. For example, through a secure leasing market, similar to EigenLayer's re-staking mechanism, Ethereum's pledged capital is outsourced to AI public chains, providing them with a more stable and attack-resistant security budget. In this way, it no longer relies on its own computing power scale, but instead hedges the liquidity risk of computing power by binding the long-term security of mature networks, which may become an important direction for AI public chains to break through the limitations of PoW.