$SBET $BMNR According to @fundstrat, a few drivers to treasury vehicles mNAV premiums are a function of:

1. P/E

2. Liquidity / Volumes

3. Velocity (rate at which ETH per share increases)

4. Sovereign Put (value to a large acquirer)

Let's take a look at each

$SBET P/E

Sharplink currently holds 521,939 ETH fully staked and will earn 3.25% or 17,000 ETH in annual rewards. Today, that's about $63M in annual *net income* less opex.

Tom points to the S&P 500, which trades at 29x earnings and would imply a $1.8bn valuation.

$BMRN P/E

Bitmine currently holds 833,137 ETH but has yet to begin staking.

We may also assume that these vehicles will continue to grow ETH holdings, venture further into yield generating opportunities (e.g., restaking, Linea, etc.), and ETH will appreciate.

Liquidity / Volume Premium

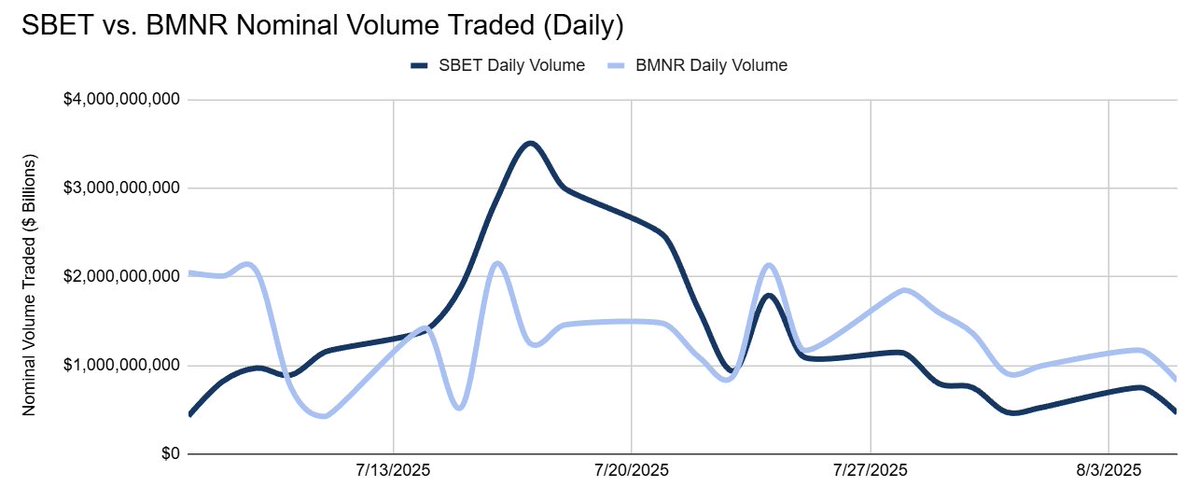

$SBET largely led $BMNR in daily nominal trading volume through July, which was notable given it traded at a smaller market cap since inception.

Liquidity / Volume Premium

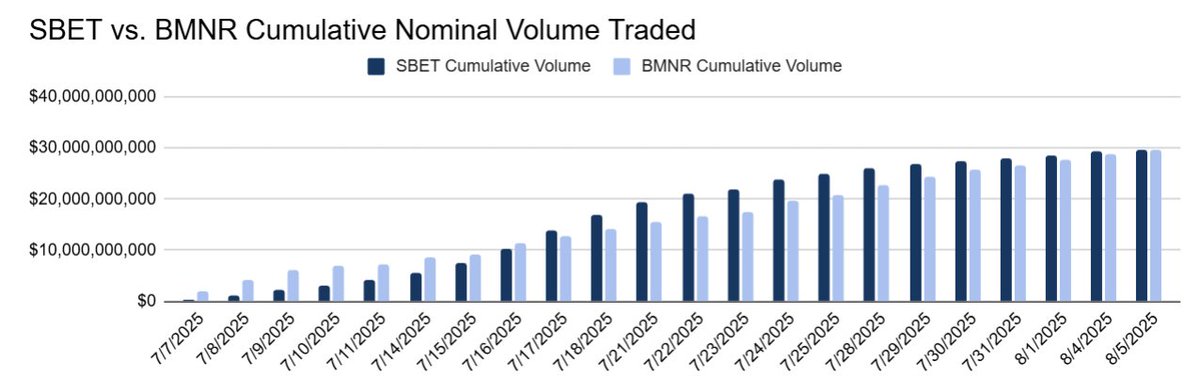

On a cumulative basis, $SBET has traded more nominal volume than $BMNR. However, the two are nearly on par through August 5th with Bitmine experiencing higher volumes in August.

Velocity / ETH Concentration

Tom shares that treasury vehicles demand a premium to holding the underlying because they actively increase shareholders' ETH per share.

Since June 2nd, $SBET has increased ETH Concentration 83% to 3.66 ETH per 1,000 shares.

Staking accelerates this.

Velocity / ETH Concentration

$BMNR has not shared ETH Concentration metrics, but has reportedly increased underlying value per share to north of $20

Sovereign Put

Tom states that in a world where governments are seeking to acquire billions of dollars worth of Ethereum, the easiest path to doing so is through treasury vehicles as opposed to on the open market

And that demands a premium

Sovereign Put

$BMNR has started to run away from the pack as the largest ETH holder on the planet with ~$3 billion in ETH and a stated goal to acquire up to 5.0% of the total supply. $SBET is #2 with ~$2 billion.

Both $SBET and $BMNR trade at around 1.5x mNAV and if you believe that premiums are a function of PE + Liquidity + Velocity + Sovereign Puts...

That might be too low

1.84K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.