eth's lack of supply is concerning, while it may shoot the price up, it can have adverse effects on eth defi (possibly)

why? let's figure out🧵

when etc supply starts to dry up even on otc desk, due to high demand, there is a way desks can get more eth

- borrow eth against their other inventory (like btc, or usdc)

they either do that via private lending or using defi which has $100b+ tvl, quite decent liquidity

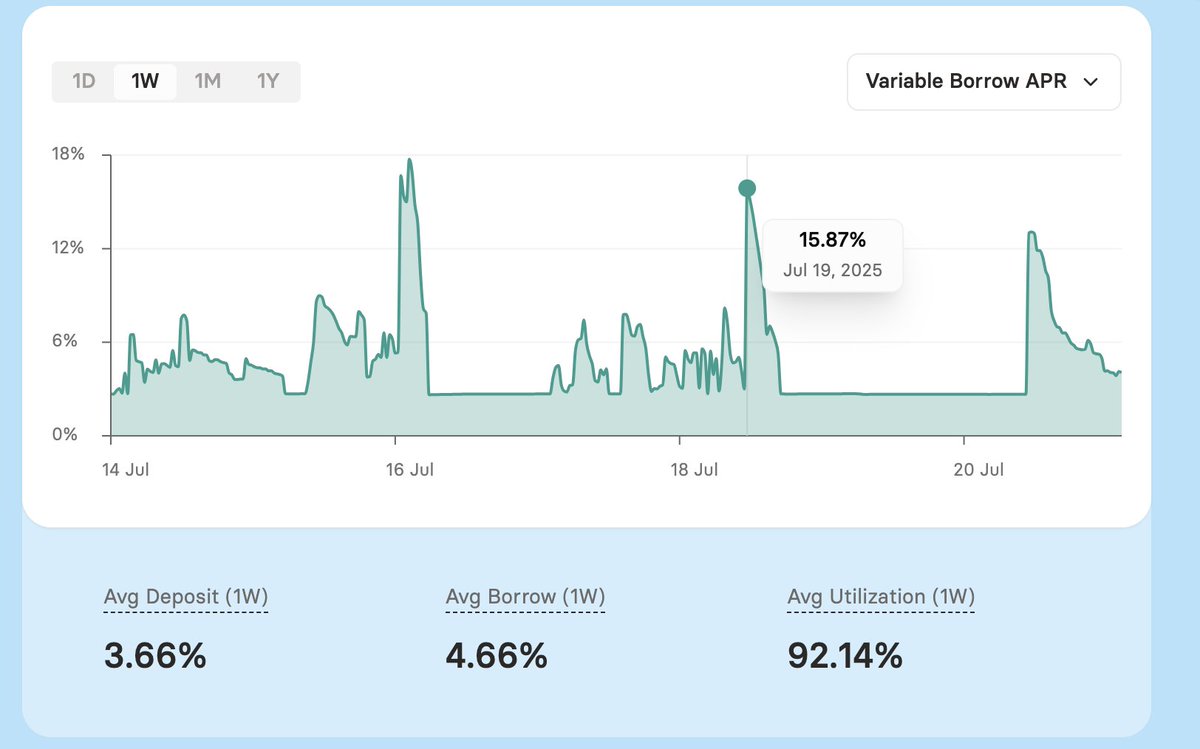

if a lot of these desks start borrowing ETH from Aave for example, then the borrow rates of ETH will start shooting up

the demand we are seeing on ETFs, and other indicators, suggests that the demand is huge, and supply is less

explains the sharp upticks in borrow rate below

now that's good right? a lot of demand, make the price go up

but there's a catch, and it's a billion dollar catch

since the introduction of eth staking and then restaking, staked and restaked derivatives make up a large collateral base on aave for a historically very profitable arb trade

which is you deposit stakedETH, like lidoETH, borrow ETH, stake it and redeposit in Aave

rinse and repeat and you can get up to 7x exposure on the yield differential that exists between staking APR and ETH's borrow rate

which has been positive, till now, but sustained demand for purely holding ETH may make this loop or yield differential negative

if the difference does become negative, on a 7x leverage the negative difference becomes even massive and it may force lps to unwind their trade

(remember japanese yen trade?)

which can result into two things

- unwinding of this trade

- resulting into net outflows and even less eth available to be borrowed

which in turn can shoot borrow rate up more, more unwinding

majority of this unwinding happens through flashloans that may stress test dex liquidity or immediate redemption capacity of staking protocols

net result might be reduced total deposits in aave, or defi overall!

now there's one more thing that can happen

surge in borrow rates will also lead surge in eth deposit rate up to a point where eth lending may become more attractive than staking it

if that trend stays for a decent time, we might also see a lot of unstaking of eth overall and entering into vanilla lending

which can sort of backstop the tvl outflow in some sense, but whatever happens, it sure is fascinating to see able to see such large scale strategies happen onchain, with anyone being able to reason about potential behavior of liquidity given certain situations

we at @SuperlendHQ track all of it, and are building a universal interface for lending across all chains and protocols to make sure anyone if able to access aggregated deep liquidity for onchain finance

excuse all typos and formatting, one giant cup of coffee and writing a thread in a minute without proofreading is not ideal i guess

52.28K

21

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.