Institutions are warming up to ETH as a capital reserve asset.

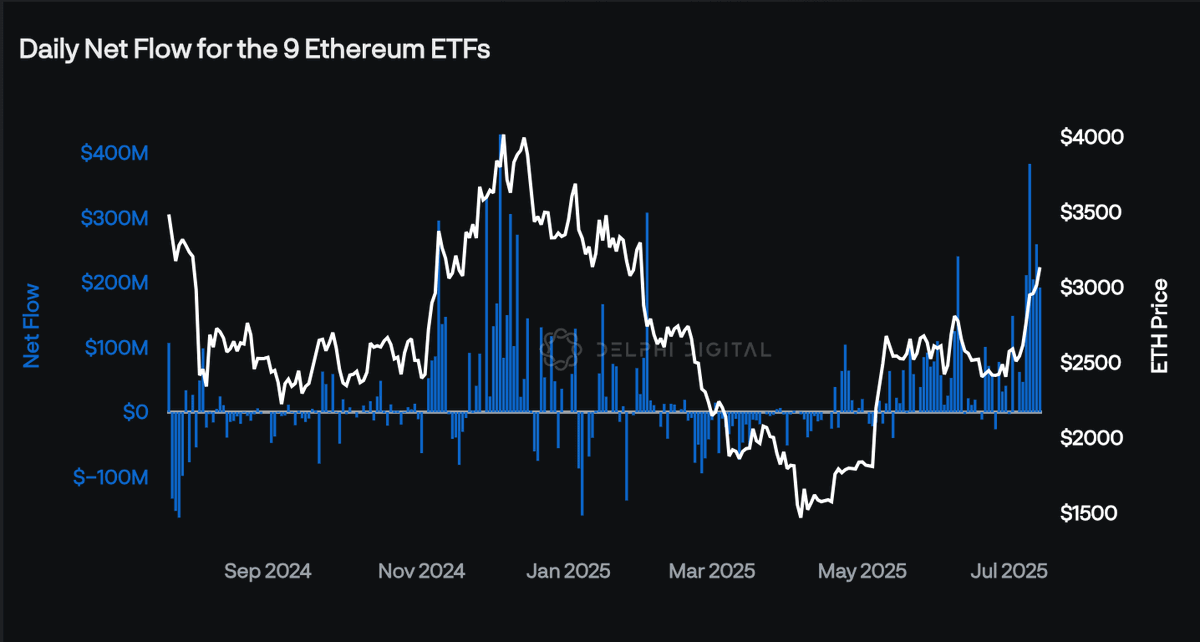

• ETH received $1.5B in net inflows this month

• Bitmine currently holds around 163k ETH worth ~$500M

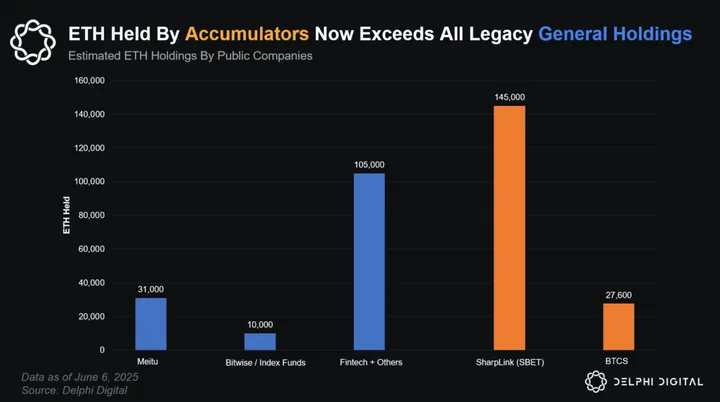

• New ETH accumulators now hold more than all legacy public companies combined

Read the full analysis here.👇

Ethereum is no longer just gas for DeFi or collateral for stablecoins. It’s becoming a Capital Reserve Asset.

Public companies are now raising hundreds of millions in equity to accumulate ETH, not passively, but through explicit treasury strategies that integrate Ethereum into their capital structures.

This shift mirrors the original playbook pioneered by MicroStrategy with Bitcoin. But now, the model is evolving and Ethereum is leading the next wave.

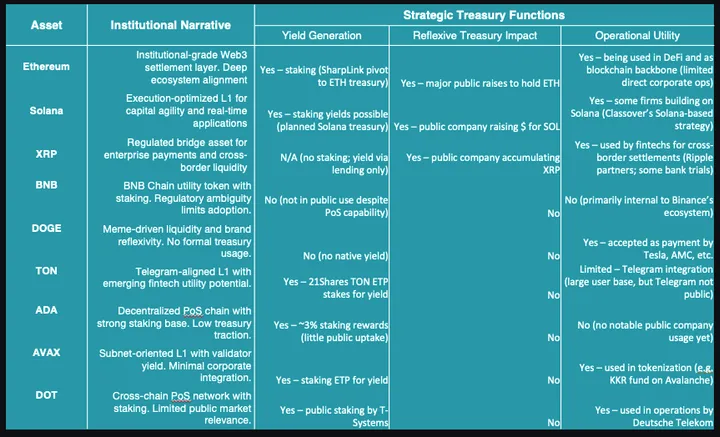

Ethereum isn’t just being held, it is also being operationalized:

🔹 As a yield-bearing treasury asset

🔹 As a programmable reserve

🔹 As on-chain infrastructure powering validator income

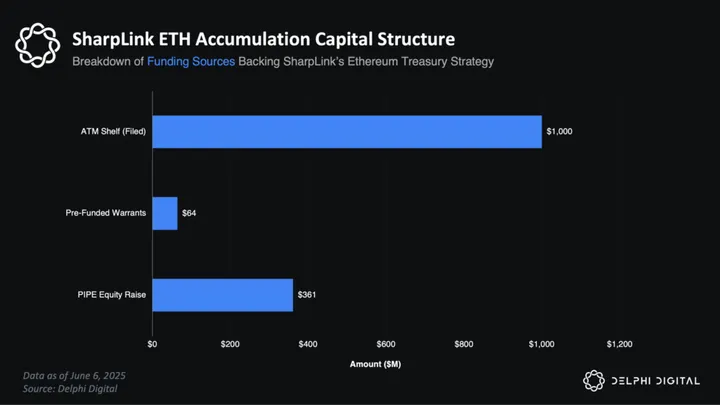

Take SharpLink Gaming ( $SBET ) as an example. In Q2 2025, it raised $435M through equity and warrants to accumulate ETH. This marked the first time a public company positioned Ethereum as its core reserve asset and not just a passive line item.

Why $ETH?

It checks all three pillars of a modern treasury framework:

✅ Institutional-grade custody

✅ Deep liquidity and derivatives access

✅ 4-5% validator yield

✅ Alignment with Web3 infrastructure.

It is not just SharpLink.

📍Bit Digital ( $BTBT ) now holds over 100,000 ETH having fully rotated its treasury into Ethereum and staked a large portion to generate validator income

📍BTCS ( $BTCS) has accumulated 42,000 ETH and is retooling its validator infrastructure to align with an Ethereum-centric staking model.

📍BitMine Immersion Technologies ( $BMNR ) now holds 163,142 ETH (~$500M) and is structuring a full ETH treasury with staking at its core

These are structured, capital-backed strategies designed to build treasury flywheels, enhance equity reflexivity and monetize on-chain participation.

Chart as of June 6 - figures are now higher but the trend holds: Ethereum is becoming a treasury cornerstone for public firms

Ethereum is being reframed.

Not just a Layer 1.

Not just ultrasound money.

But a programmable, yield-bearing corporate reserve that may anchor the next generation of on-chain treasuries.

We break down these capital mechanics, validator strategies, and treasury models in our latest Delphi The Public Crypto Accumulator Era report.

8.16K

30

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.