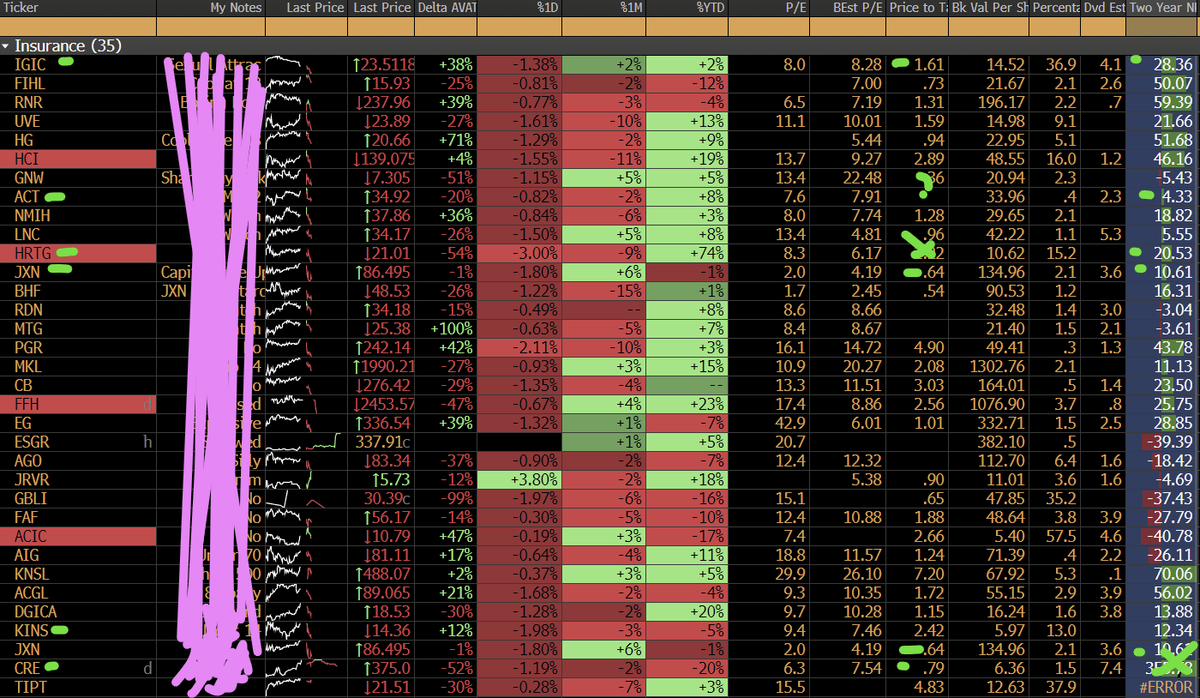

"Paint the town red" yet again in insurance, not a shocker.

There's been a major headwind from $BRK and $PGR coming back to life, but honestly, who TF cares? A lot of people crowded into them as infallible "giants", with both down roughly 14% over the past 8 weeks there's been pressure everywhere.

Still, even with global pricing cooling off I think the smaller, localized players will be able to run circles around the larger guys. For example, $KINS with its Long Island niche, and also a tailwind from taking over Amguards policies as yet another insurer bails from the region.

$IGIC of course, as they dance around from line to line getting "busy" in areas with a much more improved risk to reward (like California reinsurance), US E&S, and also given their lower expense structure.

$ACT is just cheap, a buyback cannibal since Genworth owns 80% and has huge NOLs and wants to monetize their stake, so they keep selling shares back to Enact who is happy to buy them with no price impact.

$CRE is London is interesting. It's essentially a less dumb version of Fidelis (who has massive related party issues in my opinion since they just do the bidding of their MGA partner). Trading at a 20% discount to book and buying back shares, new leadership, everyone hates it but I think sentiment probably couldn't be worse.

I also like $JXN, the capital management there is excellent and the investment portfolio is much more clean than $BHF, at roughly 4.5x earnings and a massive payout ratio and steady dividend hike it has all the markings of "a company who is doing everything right but people still hate it".

I think "small quality / small outperformer" is a theme that will work well over the next 12 months in insurance. The outperformers should run circles around the larger guys who are largely at the whim of overall pricing.

I also prefer insurers with lower rate investment portfolios, if that makes any sense. Glass half full vs glass half empty, Fairfax has excellent capital management and a great investment portfolio, there's no denying that. But the smaller guys with previously bad portfolios like $KINS or $HRTG, or even guys like $IGIC who just keep a bunch of a cash and less than 2.5% equities, they have significant room for improvement by going risk on. I think it's way easier to "juice" investment returns than improve underwriting.

Show original

15.61K

94

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.