For years, liquidity provision was sold as “set and forget.” Deposit two tokens, earn fees, maybe pick up a yield boost on the side.

But in 2024–2025, that model has quietly broken:

The reason isn’t just tighter incentives or more complex pools. It’s because the underlying mechanics of DeFi liquidity have fundamentally changed. Passive LPing has become structurally inefficient in a world where:

-> Volatility is frequent and narrative-driven

-> LP ranges need constant rebalancing

-> Protocols move toward intent-based execution and fee optimization

And in its place, a new paradigm is emerging:

Active yield management through smart vaults and programmable liquidity.

Let’s delve into why this shift is huge and who’s leading it.

● The Death of “Set and Forget”

In early DeFi (Uniswap v2, SushiSwap), LPs earned fees linearly across an entire price curve. But with the launch of Uniswap v3, a new model took over: concentrated liquidity.

That change improved capital efficiency but added new risk. LPs now had to:

- Manually choose price ranges

- Rebalance their positions as markets moved

- Monitor impermanent loss more aggressively

For most users, this wasn’t feasible.

As yields compressed across ecosystems and token incentives dried up, passive LPs were left with below-market returns and unmanaged risks.

This created space for smarter tools and they’re now going live.

● Kamino, Ambient, and the New LP Stack

A new wave of DeFi protocols has emerged with one goal: abstract away LP risk while maximizing capital efficiency.

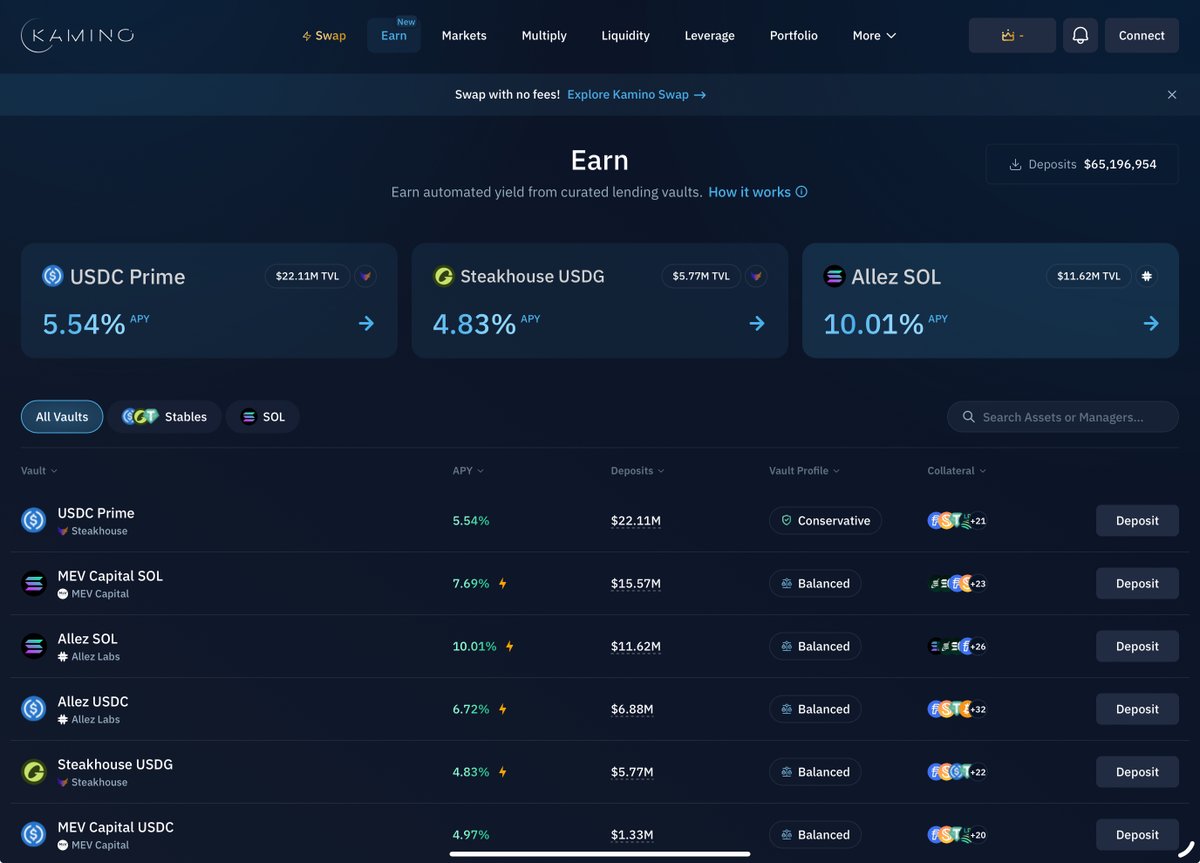

1️⃣ @KaminoFinance (Solana)

Kamino creates actively managed, auto-compounding vaults for LPs on Solana DEXs like Orca and Meteora. Each vault:

- Optimizes range selection dynamically

- Rebalances positions as market conditions shift

- Auto-compounds earned yield back into the LP position

Instead of “set and forget,” Kamino makes LPing feel like staking with built-in strategy logic under the hood.

TVL has grown steadily as users rotate out of unmanaged LP positions into vaults that mitigates risks associated with range drift through dynamic rebalancing.

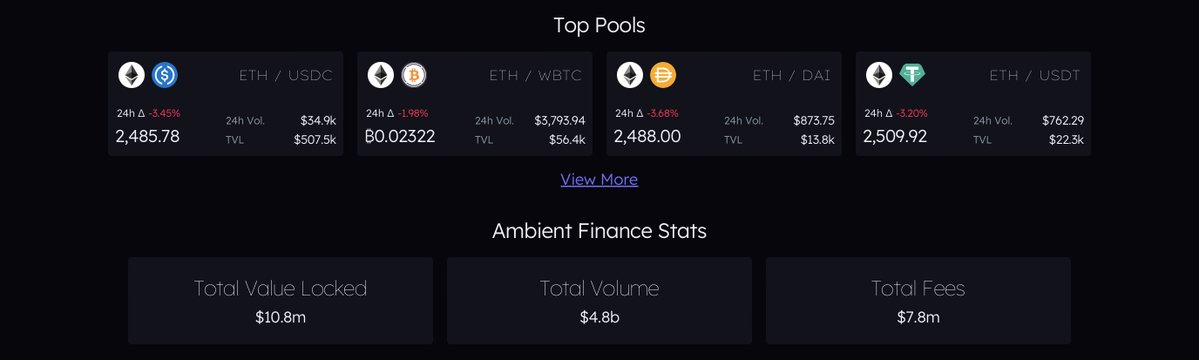

2️⃣ @ambient_finance (Ethereum)

Ambient builds on Uniswap v3 logic, offering “ambient” (wide) and “concentrated” (tight) strategies for LPs.

The protocol runs:

- Auto-rebalancing positions

- One-click deposits into yield-optimized bands

- Advanced fee-sharing models based on active management

Ambient caters to more sophisticated LPs, including funds and DAOs, but the core principle is the same: Don’t just provide liquidity manage it like an asset.

3️⃣ Uniswap V4 Hooks

Uniswap v4 introduces Hooks, customizable smart contracts that can run logic before, during, or after swaps.

v4 also introduces:

- A singleton architecture (all pools in one contract)

- Flash accounting (more efficient internal token accounting)

- Lower gas fees and faster liquidity deployment

Hooks enable developers to build vaults with dynamic fees, automated range adjustment, volatility-sensitive liquidity strategies, and more without forking the protocol.

This positions Uniswap v4 not just as an AMM, but as a full-fledged liquidity strategy platform.

● What’s Changing In The Landscape?

The shift from passive to active LPing reflects three deeper trends:

- Volatility is back:

As narratives rotate faster, token prices move sharply. Static LP ranges get invalidated faster.

- Fees are dynamic, not static:

Some protocols reward more active market-making strategies (i.e. positioning near volatility bands), which passive LPs miss out on.

- Protocols want sticky, intelligent liquidity:

Projects increasingly reward vaults, aggregators, and professional LPs with better incentives and partnerships.

In this landscape, smart vaults are no longer optional they’re the entry point.

✍️ The Alpha

We’ve moved beyond the days when you could park tokens in a pool and walk away.

Now, edge comes from:

-> Choosing the right vault (Kamino, and Ambient, etc.)

-> Understanding how rebalancing strategies behave in trending vs. mean-reverting markets.

-> Tracking new primitives like Uniswap v4 Hooks and intent-based LPing protocols.

Active yield management isn’t just a smarter way to LP, it’s becoming the only viable way.

Protocols that abstract this complexity into simple interfaces will win. Users will stop thinking of themselves as “LPs” and start thinking of vaults as smart wrappers around idle capital.

Show original

32.94K

137

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.