Honestly, this is spot on.

Most L2s don’t need a token.

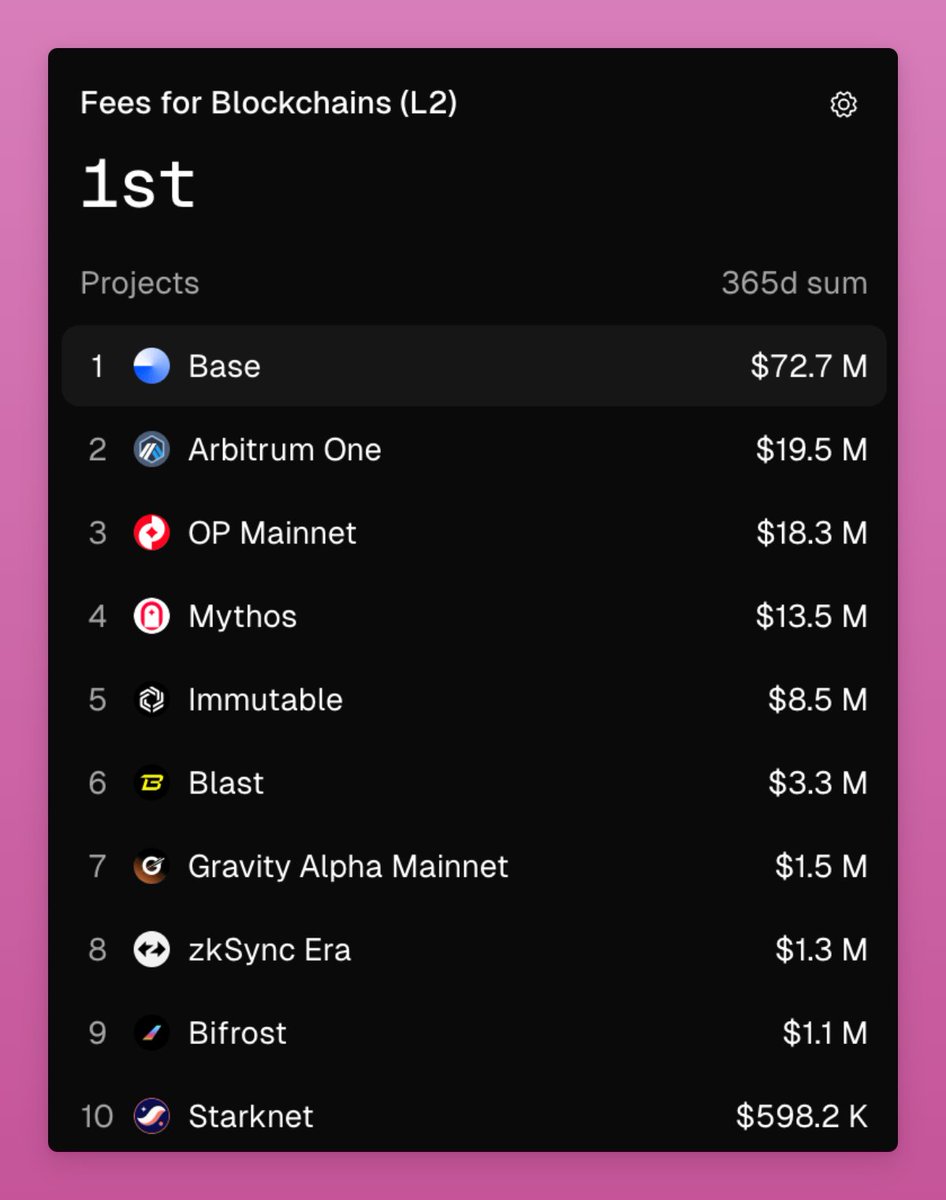

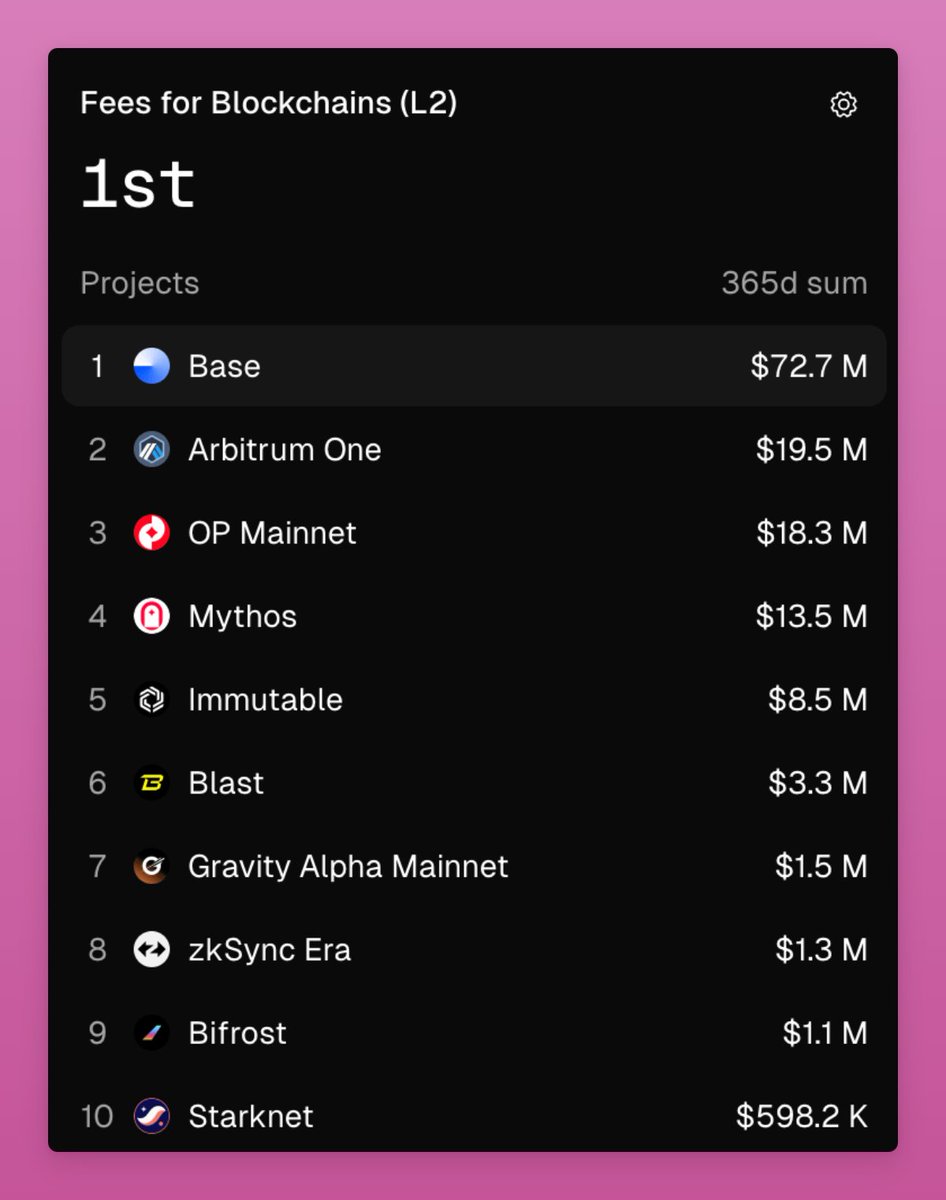

@base has no token. Yet it’s doing numbers.

That alone says a lot.

Governance isn’t enough either.

When 5 ETH can influence $6.5M worth of votes, how serious are we then?

And now Starknet is pivoting to Bitcoin too.

Still struggling on Ethereum but looking for a new home?

But I'm sincerely happy for Polkadot's Mythos and Immutable as they're actually striving.

I sincerely hope L2s finally realize this though but still, i like @Optimism for their tech, @base for their cheap fees and @arbitrum for making us have that old DeFi vibes back then. I hope they give us good protocols and also support them too.

What's the upside for L2 tokens?

Fee sharing?

Even if they turned on fee sharing, it's not much:

Arbitrum made $19.5m in fees in a year. Optimism $18.3m.

zkSync just $1.3m and Starknet $600k.

This Price(FDV)-to-Fees ratio puts Arbitrum at 137.8x, and Optimism at 205.7x

Starknet - 4204x

In context, TSLA trades at 187x P/E ratio so Arbitrum might even look cheap.

But Tesla is an exception. S&P500 trades at ~ 29x the earnings.

This makes L2 tokens overvalued by a lot. Unless we expect their adoption and fees to pick up massively.

Maybe governance?

Hoarding tokens gives voting power to direct incentives.

But projects like @lobbyfinance make bribing cheap. Recently one user paid 5 ETH (~$10k) on Lobby to buy 19.3M ARB (~$6.5m) voting power.

I believe that most projects issue tokens for two main reasons:

- To raise capital

- To bootstrap adoption

L2s are bootstrapping adoption, like the Arbitrum DRIP proposal, which allocates 80M $ARB.

The goal is to attract sticky liquidity, outlive, and outcompete other L2s.

If we apply the Pareto principle, 80% of the liquidity will eventually concentrate in 20% of the L2s.

So, perhaps we need to wait until the L2 winners become clear and then invest in them.

This implies waiting for most L2s to naturally phase out.

Yet as more L2s launch with new tokens, the timeline for clear winners to emerge is extended.

(Except for Base... Which doesn't have a token (just a stock)).

$INK is about to launch a token with liquidity mining to inflict even more pain on the remaining L2s.

A cursed sector to invest.

2.07K

18

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.