OFFICIAL TRUMP price

in EURCheck your spelling or try another.

About OFFICIAL TRUMP

OFFICIAL TRUMP’s price performance

OFFICIAL TRUMP on socials

Guides

Create a free OKX account

Fund your account

Choose your crypto

OFFICIAL TRUMP FAQ

Dive deeper into OFFICIAL TRUMP

Introduction to the Official $TRUMP Token

The $TRUMP token is the official Trump token, a digital collectible that commemorates a pivotal moment in President Donald J. Trump's history. On July 13, 2024, after surviving an assassination attempt, President Trump emerged with a raised fist and the rallying cry "FIGHT FIGHT FIGHT," exemplifying resilience and leadership. This event quickly became a viral meme, symbolizing unwavering determination and contributing to the rise in the official Trump coin price.

A Historic Moment Turned Digital

In response to this cultural phenomenon, the $TRUMP token was introduced as the only official Trump meme, allowing supporters and enthusiasts to own a piece of this historical moment. The token is not an investment or security; it’s a digital collector’s item for patriots and Trump fans, capturing the spirit of courage and strength. Its growing popularity has also had an impact on the official Trump coin price in recent weeks.

Many enthusiasts remember the Trump coin starting price when it launched, and the token has since become a valuable digital collectible. This highlights the influence of the Trump meme coin launch price in the early stages of its adoption.

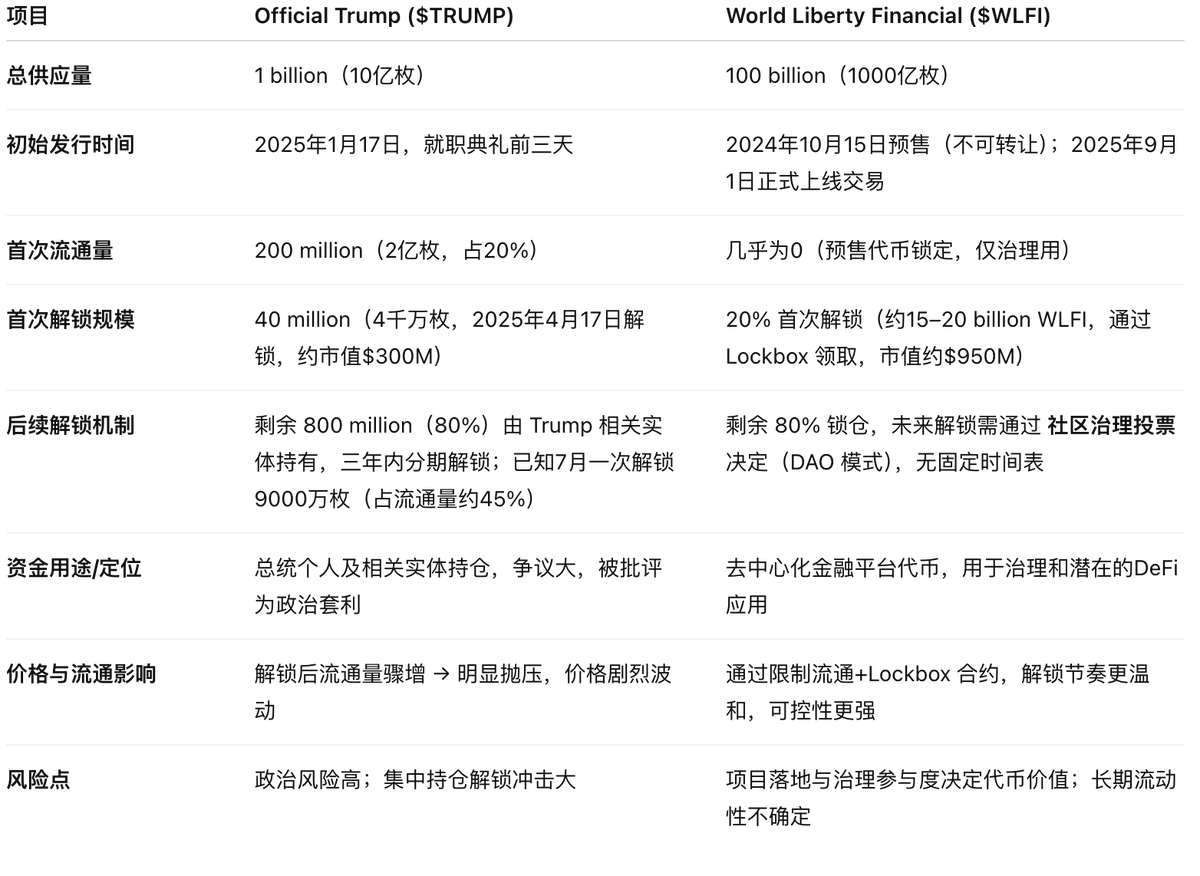

Tokenomics: Supply and Distribution

- Total Supply: 1 billion tokens

- Initial Release: 200 million tokens

- Ownership:

- CIC Digital LLC (affiliate of The Trump Organization)

- Fight Fight Fight LLC

Both entities collectively hold 80% of the Trump Cards, distributed over a three-year unlocking schedule. Revenue generated from the trading of Trump Meme Cards is allocated to these organizations. These factors play a significant role in stabilizing the official Trump coin price amidst market fluctuations.

Recent Performance of the Official Trump Coin Price

As of January 2025, the official Trump coin price stands at approximately $2.68, after reaching a peak of over $30 shortly after its launch. The price movement reflects strong initial demand, followed by consolidation as the token gains utility within the Trump community. The official Trump coin price continues to be influenced by market sentiment, collector enthusiasm, and ongoing trading activity.

The Trump coin starting price was initially set at $0.18, making it highly accessible to early adopters. Early buyers have seen significant returns as the Trump meme coin launch price quickly appreciated in the market. For those tracking Trump coin price prediction trends, this growth has been a focal point of interest.

The TRUMP coin price prediction 2025 suggests continued growth as more collectors and investors enter the market. Analysts believe that the Trump coin price where to buy options will expand as demand rises. This reflects the sustained influence of the token’s name and cultural significance.

How to Buy Truly Official $TRUMP Tokens

Supporters can acquire $TRUMP tokens via debit cards or cryptocurrencies through platforms like Moonshot. The process includes:

- Creating a Solana-compatible wallet.

- Funding the wallet with SOL (Solana’s native cryptocurrency).

- Swapping SOL for $TRUMP tokens on the Raydium platform.

Detailed instructions are available to ensure accessibility for both crypto newcomers and experts. Monitoring the official Trump coin price on these platforms is critical for making informed purchasing decisions. Tracking the Trump official meme coin price during trading is also vital for those aiming to capitalize on its fluctuations.

If you're wondering official Trump coin how to buy, rest assured the process is straightforward. Platforms like Moonshot provide step-by-step guidance to make your first purchase seamless. For more information, visit our learning page.

Join the Trump Community

By joining the Trump Community through the acquisition of $TRUMP tokens, supporters can celebrate a leader who embodies resilience and the spirit of fighting for what matters. This digital collectible stands as a testament to a historical moment and President Trump's enduring legacy. The community's growth and participation have been instrumental in stabilizing and enhancing the official Trump coin price.

Looking forward, the TRUMP coin price prediction 2025 suggests a bright future for this collectible, with market analysts forecasting a potential return to the heights it reached shortly after its launch. For those monitoring Trump coin price prediction discussions, staying informed about the Trump coin price where to buy will be essential for strategic purchases.

With the rising popularity of the token, the Trump coin name has become synonymous with resilience and innovation. Whether you're tracking the Trump official meme coin price or exploring official Trump coin how to buy, this token represents more than just a collectible—it’s a movement.

Disclaimer

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.