Hyperliquid Outpaces Rival DEXes by Perps Volumes, What This Means

The battle of the DEXes continues to heat up and Hyperliquid has been rising up the ranks.

It was yet to crack into the top 10 DEXes by volume but recent data revealed that it was already winning in the perps segment.

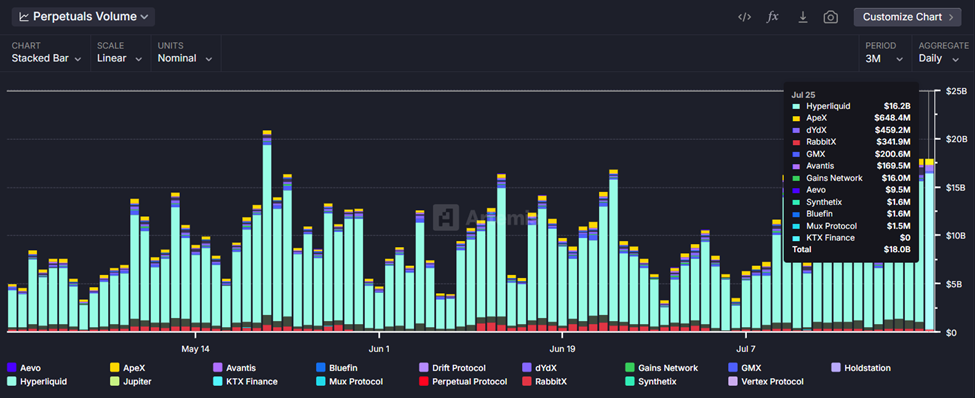

While Hyperliquid was not the best DEX overall, recent data revealed that it had the highest perpetuals volumes compared to its rivals on Friday.

For reference, Hyperliquid perp volumes clocked over $16 billion on 25 July.

The data revealed that Hyperliquid managed to outperform some of its top rivals in the derivatives segment such as DYDX and Synthetix.

These two were present during the previous bull run but Hyperliquid was not. Hyperliquid managed to outperform its older peers despite being a relatively newer addition to the segment.

This performance was testament to just how quickly it grew since its debut in 2023.

Can Hyperliquid Make its Way to the Top of the DEX Hierarchy?

The fact that Hyperliquid had already secured the crown in the derivatives segment was already a sign of the times.

However, market data revealed that it still had a long way to go before being crowned the king of the DEXes.

Hyperliquid’s dominance did not extend to the overall DEX landscape which also accounts for rivals offering spot access.

By this measure, Hyperliquid ranked 11th in the list of top decentralized exchanges by 24-hour trading volume according to Coingecko.

The list also revealed that Hyperliquid controlled 2.2% of the total DEX market at the time. It also offered access to 50 coins and 53 currency pairs which was significantly lower compared to some of the top DEXes.

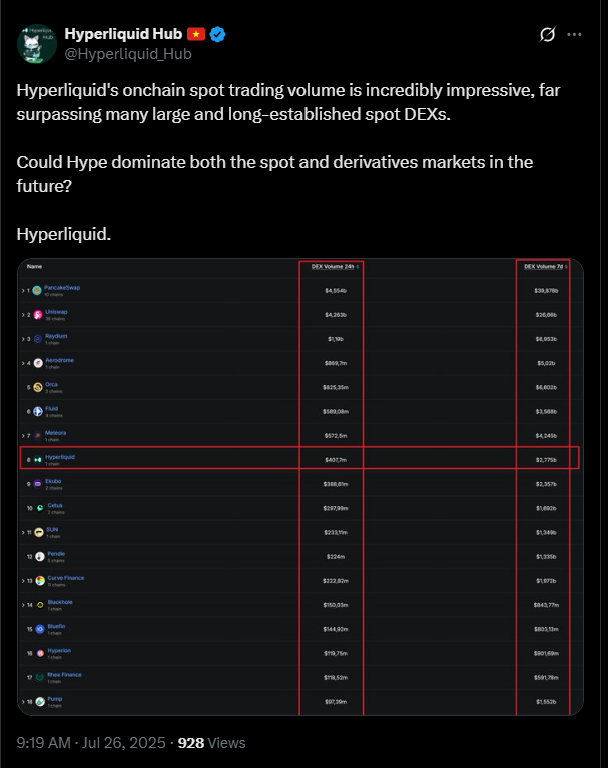

More data on the exchange revealed that it was in the top 10 (8th position) in the spot segment.

Its spot DEX volume in the last 24 hours was just over $407 million. This was about a 10th of PancakeSwap’s $4.5 billion plus in daily volume.

Pancakeswap maintained poll position among the DEXes. This meant Hyperliquid still had a long way to go before it can pose a challenge to the current leaders in the segment.

However, its rapid growth pace was noteworthy, suggesting that it could possibly get there sooner than later.

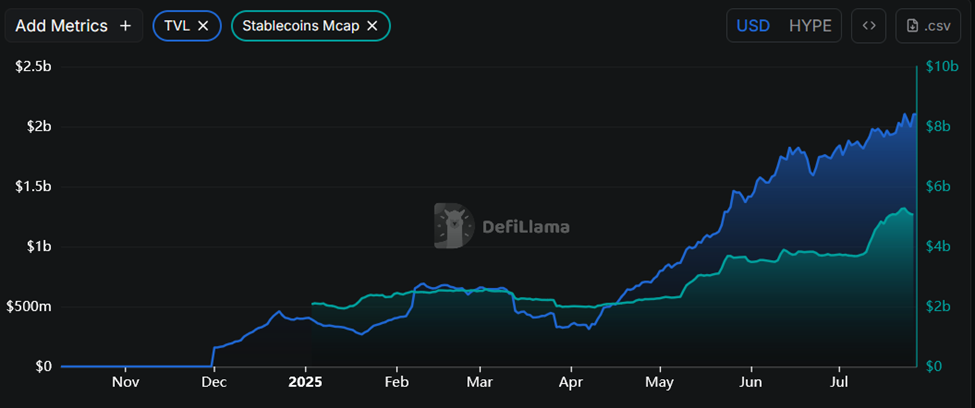

Aside from robust DEX volumes, Hyperliquid also experienced significant growth in key metrics.

For example, its TVL recently achieved a new ATH above $2.1 billion, indicating growing confidence among its users.

Hyperliquid stablecoin liquidity also surged to a new ATH during mid-week. It rallied as high as $5.26 billion but had cooled down slightly to $5.05 billion at press time.

The impressive liquidity levels also played a pivotal role in Hyperliquid’s recent success.

Will HYPE Bulls Make a Comeback at This Critical Level?

HYPE price action slid by over 5% in the last 7 days, extending its retracement for the second week. This was after previously attaining a new top at $49.8 in mid-July.

HYPE price was down by about 13% in the last 2 weeks at its $43 price tag. However, price demonstrated a potential recovery after pushing to the 50% RSI level.

HYPE previously achieved a 330% rally from its lowest point in April to its highest price point in June.

The robust bullish activity was mostly courtesy of aggressive organic demand for the token which was aligned with the heavy demand for Hyperliquid. The rally coincided with the rapid surge in market activity.

If the same trend prevails then its possible that HYPE could push to new highs backed by strong activity. Especially if the market excitement makes a strong comeback.

The post Hyperliquid Outpaces Rival DEXes by Perps Volumes, What This Means appeared first on The Coin Republic.