This Firm Adds Another 77,210 ETH as Ethereum Dominance Hits 5-Year High

Key Insights:

- SharpLink buys 77,210 Ethereum worth $295 million, bringing total holdings to $1.69 billion.

- Ethereum dominance hits a 5-year high of 12% challenging key resistance levels.

- ETH shows strong performance with 60% gains over a 30-day trading period.

SharpLink Gaming purchased another 77,210 ETH worth $295 million, according to Lookonchain data.

The acquisition brings total holdings to 438,017 ETH valued at $1.69 billion. Ethereum dominance reached 12% for the first time in five years.

ETH price posted 60% gains over a 30-day period with strong momentum.

SharpLink Becomes Largest Corporate Ethereum Holder

SharpLink Gaming executed systematic Ethereum purchases throughout July 2025, building massive holdings.

On July 10, the company completed the direct purchase of 10,000 ETH from the Ethereum Foundation. The transaction occurred at $2,572.37 per ETH, establishing the initial position.

By July 13, SharpLink became the world’s largest corporate ETH holder with 280,706 tokens. The week saw an additional 74,656 ETH purchased at an average price of $2,852. This acquisition pace accelerated consistently throughout the month.

Week ending July 20 brought SharpLink’s largest weekly Ethereum acquisition, totaling 79,949 ETH. Holdings increased to 360,807 ETH at an average price of $3,238 per token. The buying strategy focused on consistent accumulation across timeframes.

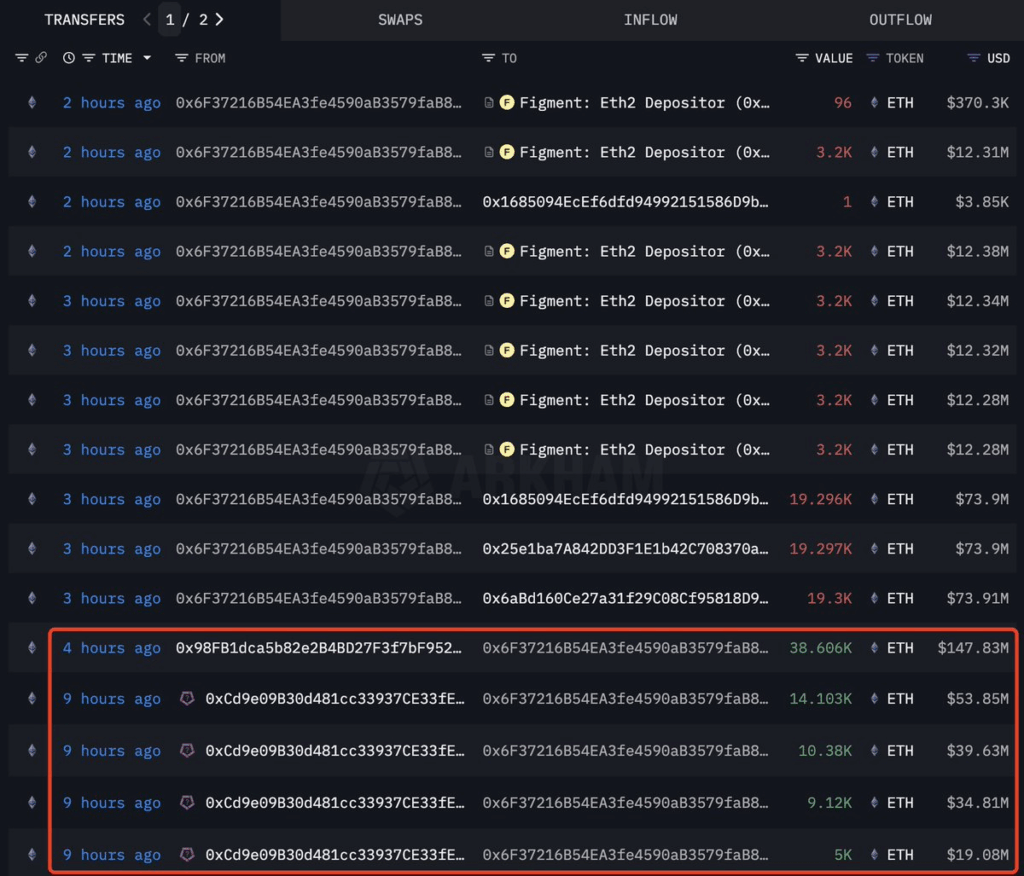

July 25-27 marked a massive purchase wave with $1.45 billion USDC transferred to Galaxy Digital.

The company acquired at least 38,600 ETH worth approximately $1.48 billion during transactions. Additional purchases closed over the same weekend period.

July 27 data shows a total addition of 77,210 ETH worth roughly $295 million. Much of the purchased ETH was immediately staked following acquisition patterns. SharpLink now holds 438,017 ETH valued at $1.69 billion total.

The company overtook firms like Bitmine and Coinbase in corporate ETH holdings. SharpLink’s treasury strategy focuses on long-term Ethereum accumulation rather than trading.

Ethereum Dominance Reaches 5-Year Milestone

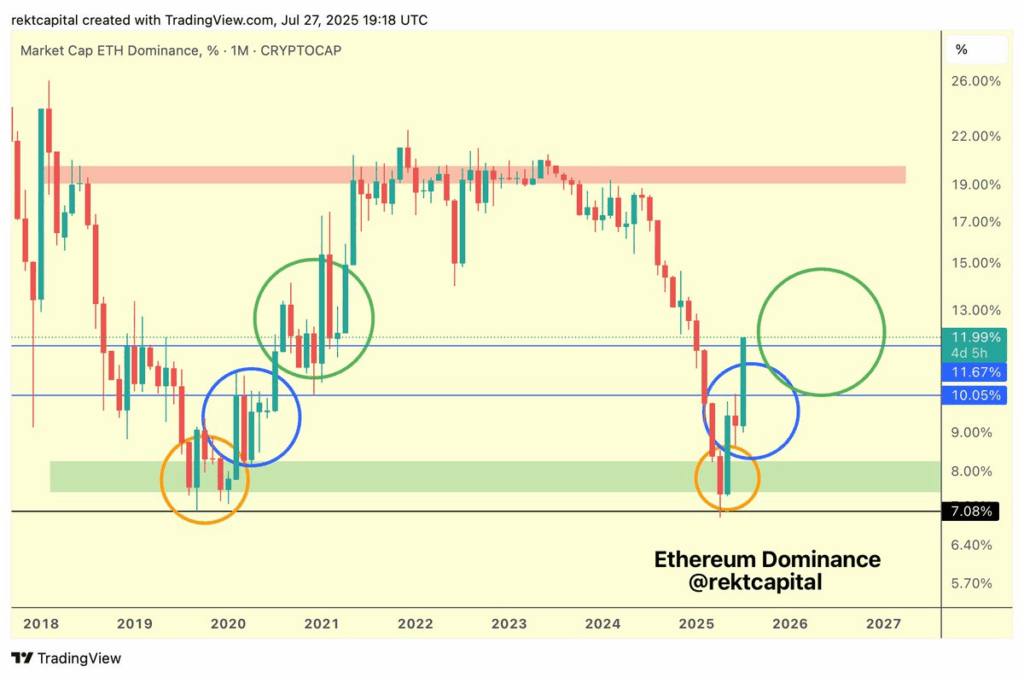

Ethereum dominance rose to around 12% for the first time in five years. The previous time it occurred was five years ago, in July 2020. ETHDOM now tests the green circled phase transition as per analyst Rekt Capital.

The 12% dominance level is a significant technical milestone for Ethereum’s market dominance.

Timeline trends indicate that this level has preceded major price action in past cycles. The present increase in dominance coincides with institutional buying and corporations embracing treasury.

ETH price action indicates firm growth across several timeframes with steady gains. 24 hours registered 2.7% and 7-day performance at 2.4%.

Month-to-month performance at 60% gains signifies network activity growth and institutional buying. The price action is consistent with dominance growth, resulting in a bullish confluence.

Analyst forecasts have $4,000 ETH on the horizon next week based on technical direction. BitBull has ETH at a 4-year resistance level with several growth catalysts in place. Growth in network activity, ETF buying, and institutional demand form a perfect storm.

August in the past has had positive performance in halving years with 64.2% average returns. History repeating itself, Ethereum price can touch $6,000 next month based on patterns.

Analysts Project ETH Price To Hit $4,000

Network activity growth drives fundamental demand for Ethereum across multiple sectors. Corporate treasury adoption follows SharpLink’s lead with companies buying ETH holdings.

ETH burn mechanism reduces the circulating amount, inducing a deflationary force on tokens. Merging greater demand and lesser supply creates a favorable market situation.

BitBull expects ETH to break above the 4-yearly level of resistance at confluence. $4,000 ETH is viewed by the analyst as imminent next week under the given conditions. Various drivers of growth lie behind the bullish expectation on horizons.

Crypto Rover indicates that, on average, there is a 64.2% return in August. If history is any indicator, ETH could hit $6,000 next month.

The following year, after the halving, Ethereum benefited during August trading. Besides, historical data also indicate favorable indications for the upcoming month.

Having said that, the current price action with a 60% monthly profit (for July) offers a solid foundation. The alignment of key and technical factors offers perfect conditions.

ETH positioning is supported by a number of positive catalysts occurring simultaneously.

The post This Firm Adds Another 77,210 ETH as Ethereum Dominance Hits 5-Year High appeared first on The Coin Republic.