A 15-year price curve at an all-time high: we're going to be part of history

Currently, the price of Bitcoin has exceeded $110,000, hitting a new all-time high. May 22 coincides with the annual "Pizza Festival", a spontaneous anniversary formed by the cryptocurrency community, which once again draws people's attention back to the moment that changed history 15 years ago - the $1.1 billion pizza.

1. The starting point of a value enlightenment

The Bitcoin network in 2010 was still in the stage of "primitive society", the computing power of the whole network was less than one trillionth of today's, the exchange had not yet been born, and the holders were mostly geeks and technology enthusiasts. When Laszlo proposed "Bitcoin for pizza" in a forum post, the "value pegging" of cryptocurrencies was still blank.

On May 22, 2010, American programmer Laszlo Hanyecz bought two Papa John's pizzas for 10,000 bitcoins, marking the first time Bitcoin was used as a means of payment in the real world. At the time, the 10,000 BTC were worth about $41, with an average value of just $0.0041 per BTC.

Now, 15 years later, the value of those two pizzas has reached a staggering $1 billion, based on the price of Bitcoin breaking through $100,000. This number not only became a milestone in the early development of Bitcoin, but also revealed the epic leap of the cryptocurrency from a marginal experiment to a global asset.

2. TheBitcoin price curve in the past 15 years

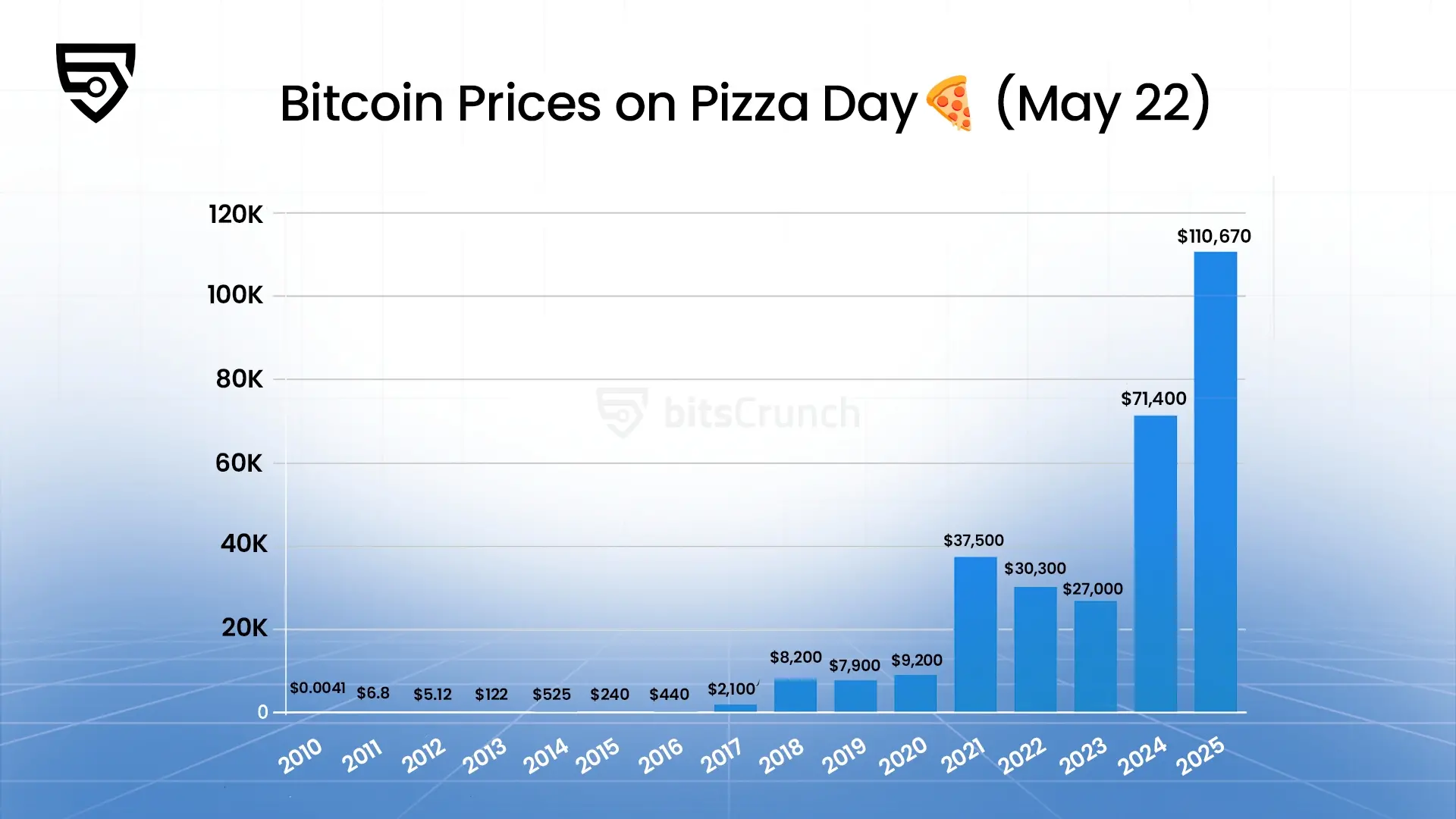

has changed from $0.0041 to $110,000 15 years later, by combing the Bitcoin price data on May 22 of the previous year, according to the bitsCrunch.com data, we can clearly capture the key cycles and driving logic in its development trajectory. The chart below shows the price performance of Bitcoin at the Pizza Festival over the years.

Source: bitsCrunch.com

- Technical Perfection Period (2010-2013): From proof of concept to initial adoption, Bitcoin has proven the viability of decentralised currencies.

In May 2011, the price of Bitcoin climbed to $6.8, and the emergence of the dark web "Silk Road" first demonstrated its potential for anonymous payments. In May 2013, the price topped $122, and the Cyprus debt crisis pushed Bitcoin into the mainstream as a "safe haven asset", rising 5,400% for the year.

- Speculative frenzy (2014-2017): The sharp price swings attracted global attention, but also exposed the immaturity of the market.

In 2014, the theft of the Mt. Gox exchange caused the price to halve from $525 to $240 (2015), and the market experienced its first large-scale risk education. Since then, technological breakthroughs such as Ethereum smart contracts and the Lightning Network have promoted the expansion of the ecosystem, and the price has rebounded to $2,100 in May 2017, and even soared to $19,783 in December of the same year due to ICO frenzy, completing the first "super cycle".

- Institutional Awareness Period (2018-2021): Traditional financial institutions are starting to take Bitcoin seriously as part of their digital asset allocation.

In the bear market in 2018, many people left the market directly, but the entry of institutions such as Grayscale Trust and MicroStrategy laid the foundation for long-term buying. In May 2021, the price hit $37,500, and countries such as Tesla and El Salvador added Bitcoin to their balance sheets; In 2024, the approval of the US Bitcoin spot ETF and the fourth halving resonated with the inflationary pressure of global fiat currencies, pushing the price to exceed $71,400, with an annualised yield of 217%.

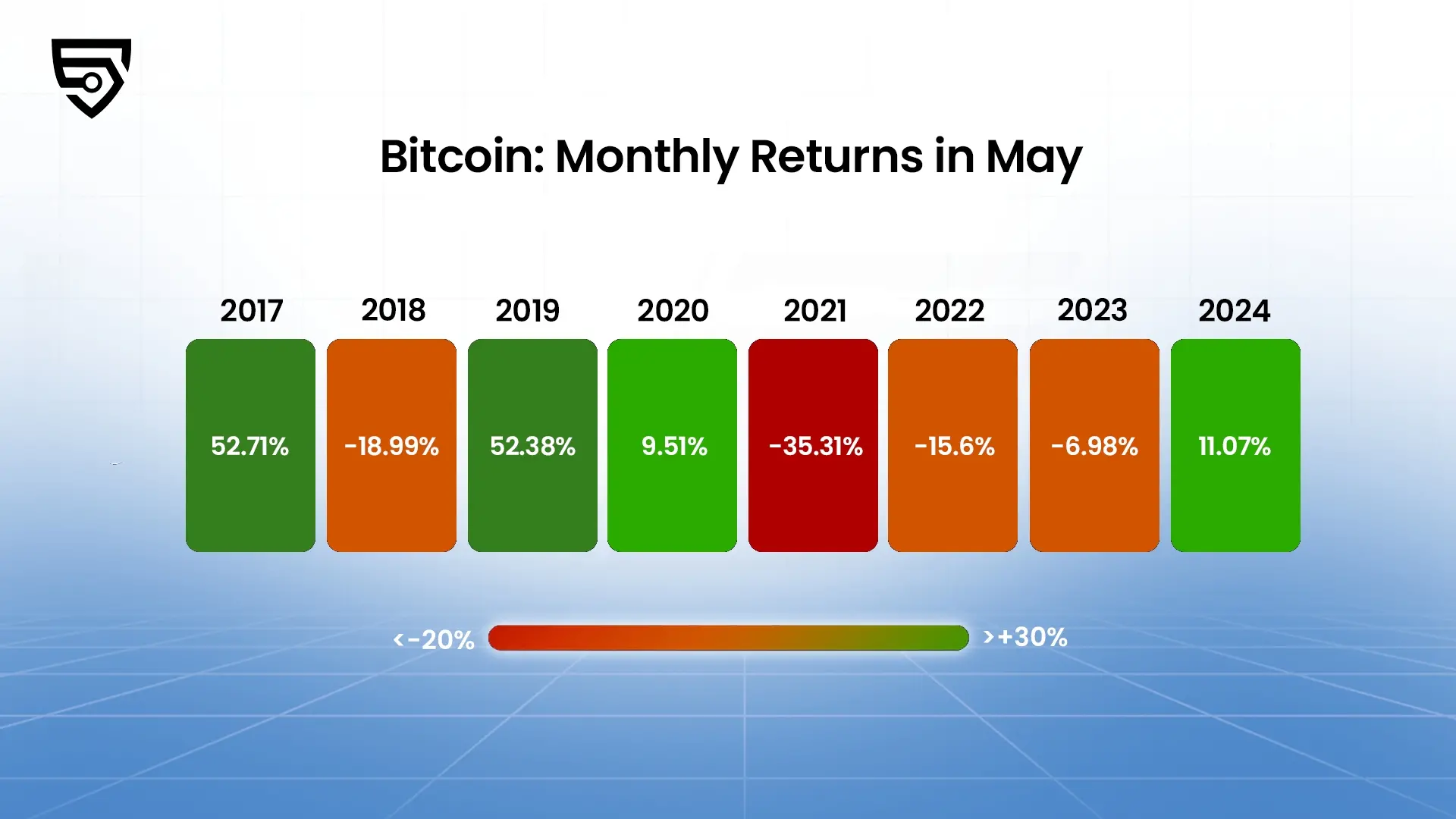

The chart below shows the monthly performance of Bitcoin in May from 2017 to 2024.

Source: bitsCrunch.com

- Mainstream Acceptance Period (2022-2025): The regulatory framework has been gradually improved, ETFs have been approved, and Bitcoin has officially entered the traditional portfolio.

With the advancement of global central bank digital currency, the maturity of the Web3 ecosystem, and the in-depth application of blockchain technology in all walks of life, digital currency is reshaping our economic system. As a pioneer of this revolution, Bitcoin's value is not only reflected in the price, but also in the decentralisation and technological innovation spirit it represents.

3. Thestructural shift behind the all-time high

Today, Bitcoin's market capitalisation has exceeded $2.1 trillion, surpassing Amazon to become the world's fifth-largest asset. Its value support logic has undergone essential evolution: first, it has strengthened its macro hedging attributes, second, the US and European crypto market supervision laws have been implemented, and third, compliance channels such as Coinbase and BlackRock have opened up traditional capital entrances.