Watching the Perps Dex Wars anon?

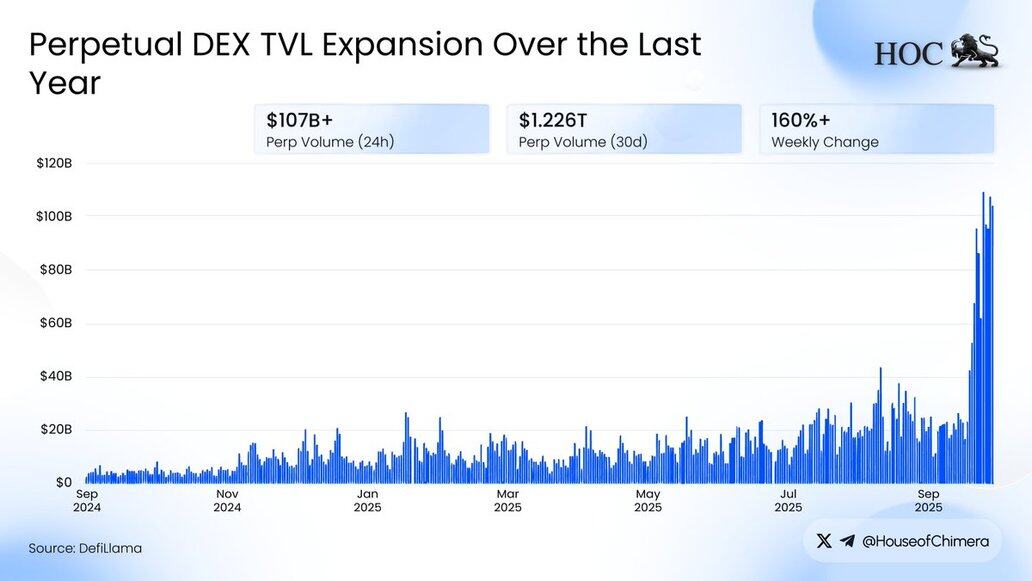

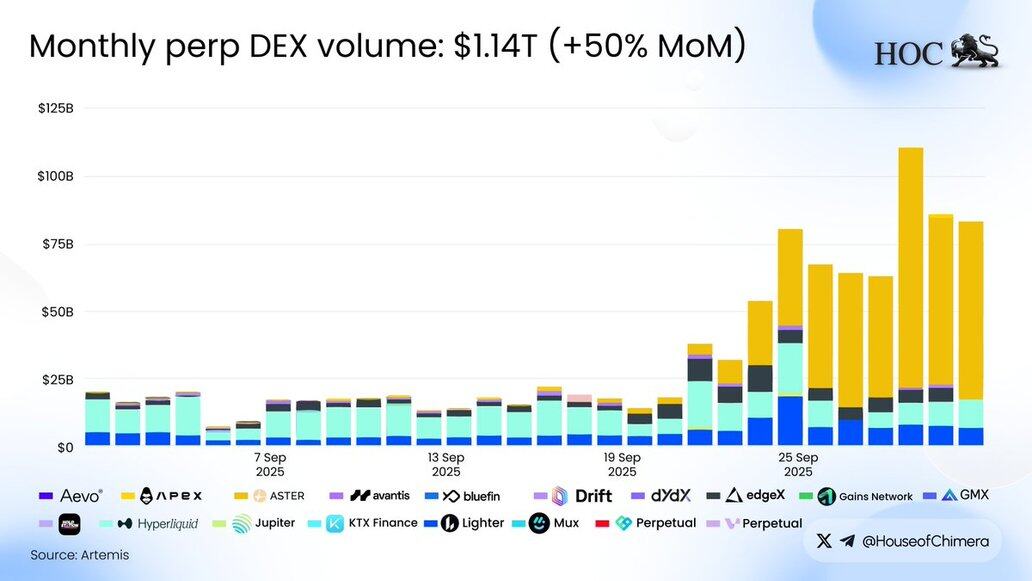

🔹 Perpetual futures DEXs just logged their biggest month ever over $1.14T in volume for September, a 50% MoM surge.

🔸 Incentives, speed wars, and fresh launches are turning perps into the most competitive arena in DeFi.

What’s happening 👇

@TheDeFinvestor @_BillionAireSon @blocknewsdotcom @AnonVee_ @HYPERDailyTK @g13m @RiddlerDeFi CEXs once owned perpetuals.

🔹 But after FTX’s collapse, on-chain rivals exploded.

🔸 Incentives (points, rebates, airdrops) pulled traders in; new L1/L2 infra made execution fast enough.

The result: perp DEXs now clear >$100B weekly, rivaling CEX liquidity.

The September Record

Monthly perp DEX volume: $1.14T (+50% MoM).

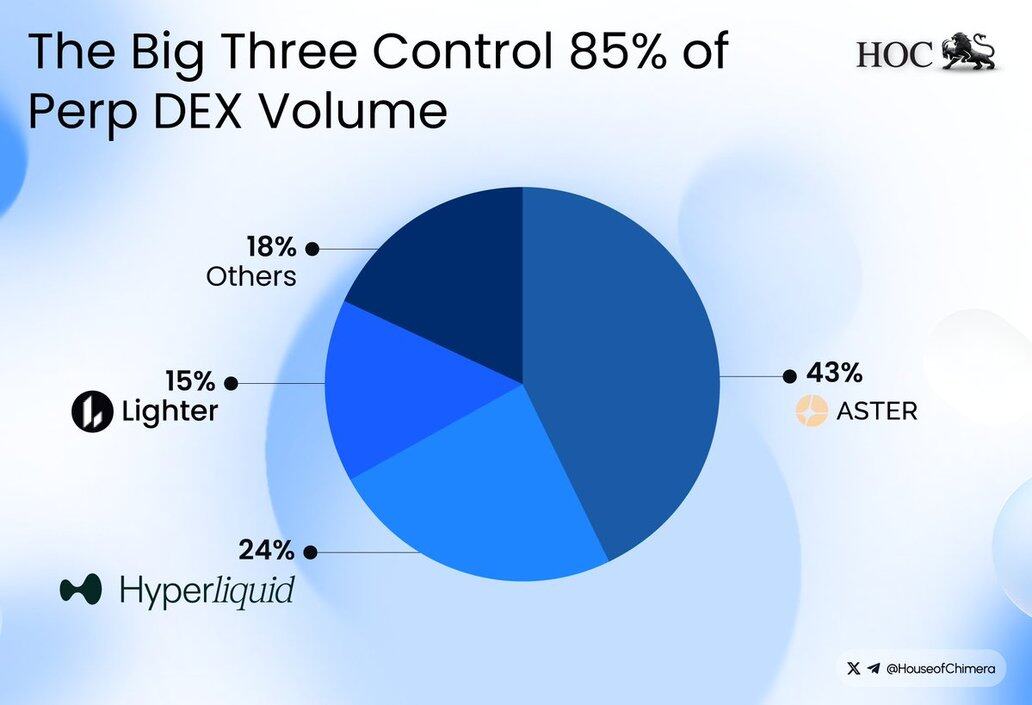

Top 3:

🔹 Aster — $493B

🔸 Hyperliquid — $280B

🔹 Lighter — $165B

For context: all of DeFi spot DEXs combined did ~$120B just a year ago. Perps have redone the narrative.

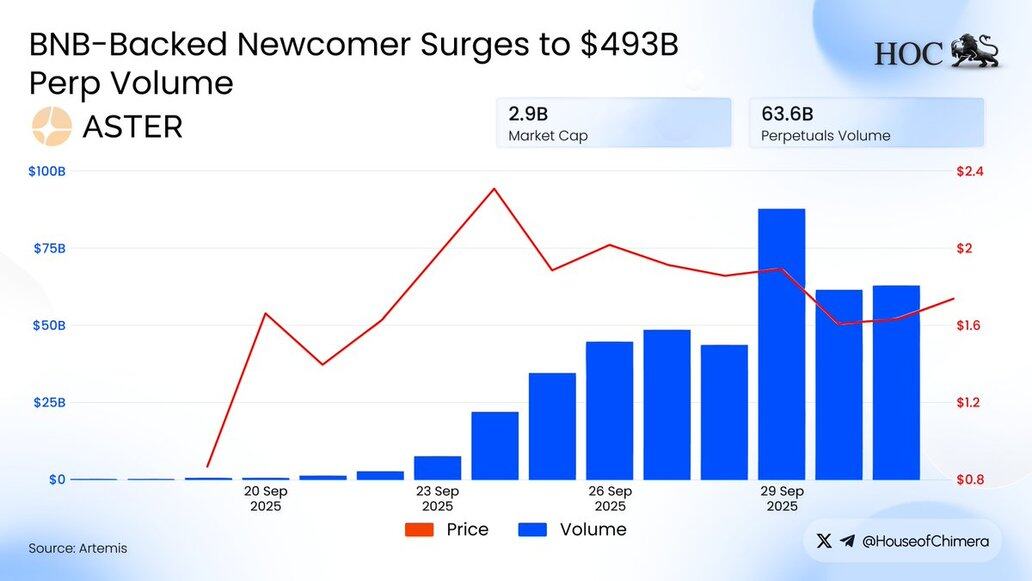

The @Aster_DEX Phenomenon

🔹 From $9B in August to nearly $500B in September.

🔸 Backed by YZi Labs, rumored CZ ties.

🔹 TVL ballooned 6x ($340M → $2.2B).

$ASTER token up +1,600% post-TGE ($0.09 → $1.8).

It’s the fastest DEX growth story ever seen on-chain.

.@HyperliquidX: The Benchmark

🔹 The custom L1 + HyperCore engine still defines the standard.

🔸 $280B monthly volume, $87M in fees.

🔹 Sub-second execution, deep books at $10M+ size.

Flywheel: 99% of fees recycled into $HYPE buybacks.

But its moat is being tested, volumes fell -29% vs August.

.@Lighter_xyz: The Zero-Fee Challenger

🔹 Built on a zk-rollup, ex-HFT team, now out of beta.

🔸 $165B September volume.

🔹 True 0% maker & taker fees.

188K wallets, 50K+ DAUs.

Liquidity at size is thinner, but growth is exponential. The mainnet launch could push it deeper into the top 2.

Risks & Realities

Not all growth is organic. BitMEX’s CEO called it: perp DEXs risk “pump-and-dump” economics.

🔹 Aggressive incentives create “farmed” liquidity.

🔸 Funding rates spike (Aster saw 117% long premium).

🔹 Slippage + low TVL at smaller venues make liquidity fragile.

We’re watching fee wars (0%), infra wars (custom L1 vs zk-rollup vs Solana speed), and incentive wars ($ billions in points & rebates).

The winners won’t be those who farm hype, but those who:

🔹 Retain liquidity post-incentives.

🔸 Build deep order books at scale.

🔹 Secure regulatory survivability.

Right now, perps feel like club-hopping.

🔹 Everyone’s handing out free drinks at the door, but only a few venues will survive when the music stops.

🔸 Who do you think builds the lasting moat in the Perp DEX wars; Aster, Hyperliquid, or Lighter? ⚔️

6.01K

44

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.