Market Updates, every Monday morning. 📊

Last week Powell pushed back on rate cut hopes even as Q2 GDP was revised up to 3.8%, the strongest in nearly two years. BTC fell 2.7% and the Nasdaq 0.5%, while Gold gained 1.4% on record ETF inflows and the DXY rebounded 0.5%

With payrolls slowing and unemployment rising, the Fed faces a balance that leaves risk assets uneasy. For BTC, October tailwinds and possible cuts into a softer jobs backdrop point to closer correlation with gold, though markets still need to see where it finds footing in Q4

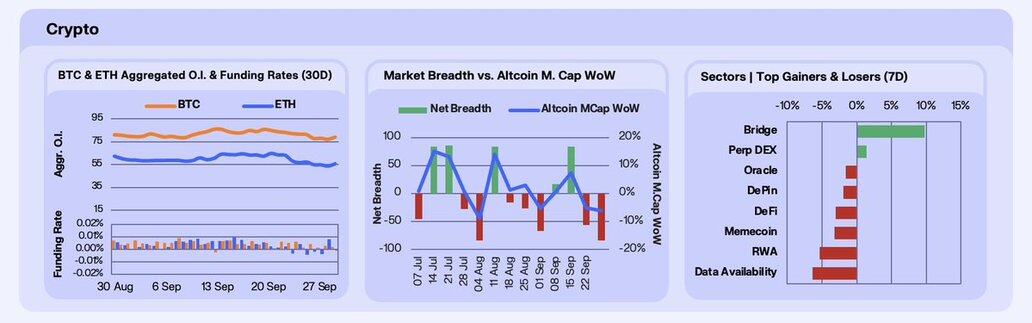

Majors slid this week, pressured by ETF redemptions, in which $BTC saw $363m outflows, and $ETH a record $796m. $1.7b in liquidations market wide and a SOL unlock overhang added to the pressure. BTC OI fell 3.6% WoW while ETH dropped 4.2%.

BTC funding stayed positive while ETH flipped negative mid-week, showing cautious BTC longs versus fading ETH conviction. Alt breadth collapsed to the weakest since August. If ETH ETF bleed slows, breadth could rebound quickly, October ETF reviews are the key pivot to watch.

3.5K

2

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.