Have paid attention to @yieldbasis for awhile. It turbo charges adoption rate for $crvusd as YB’s tvl grows.

This will vastly improve the value accrual on $crv. More cash flow fees to veCRV.

Owe it to Mich to think up of new ways to juice up his yuge CRV bags.

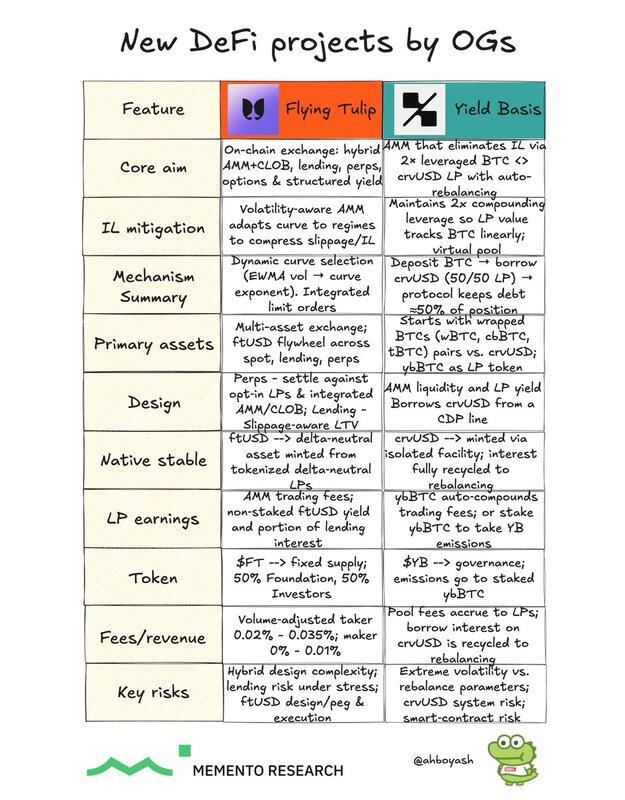

Two OGs, two new DeFi primitives

@CurveFinance's founder @newmichwill is shipping @yieldbasis (a no-IL BTC AMM liquidity platform); while @yearnfi’s founder and god of DeFi @AndreCronjeTech is building @flyingtulip_ (unified AMM+CLOB exchange).

Different bets on the same problem - make on-chain liquidity actually work:

• Yield Basis ($YB): A Curve-native AMM that removes impermanent loss (IL) for BTC LPs by holding constant 2x leverage in a BTC-crvUSD (LP tracks BTC 1:1 while earning fees). You mint ybBTC (yield-bearing BTC)

• Flying Tulip ($FT): A unified on-chain exchange (spot + lending + perps + options + structured yield) built on a volatility-aware hybrid AMM + CLOB, slippage-aware lending, and ftUSD (a delta-neutral USD-equivalent) as the incentive flywheel

- - - - -

Yield Basis

• Classic AMMs make BTC LPs sell into strength (when price goes up) or buy into weakness (√p exposure), causing IL that often is more than the fees earned while LPing

• Saving a longer post for Yield Basis, but essentially users deposit BTC into the platform → protocol borrows equal crvUSD and forms a 50/50 BTC-crvUSD Curve LP at 2x compounding leverage

• A re-leveraging AMM + virtual pool keeps debt ≈ 50% of LP value; arbitrageurs get paid to keep leverage constant

• This results in LP value moving linearly with BTC and earns trading fees

• LPs hold ybBTC, a yield-bearing BTC receipt token that auto-compounds BTC-denominated trading fees

• There is also the governance token $YB, that can be locked for veYB to vote (gauges, pool emissions)

• Yield basis is basically for BTC holders that want to unlock productive BTC in a protocol that solves the IL problem and earn fees

Flying Tulip

• Legacy DEX UX and risk settings are static. FT tunes the AMM curve to volatility and the lending LTVs to real execution/slippage → goal is to bring CEX-level tooling on-chain

• Their AMM adapts curvature to measured vol (EWMA) → i.e. flatter (near constant-sum) in calm regimes to compress slippage/IL, more product-like in high vol to avoid depletion

• ftUSD is produced by tokenized delta-neutral LP positions and is used for da flywheel, incentives/liquidity programs across the exchange

• There is the platform token $FT, where revenue could be potentially reserved for buybacks/ incentives/ liquidity programs

• The DeFi super-app: one exchange for spot, lending, perps, options

• Execution quality depends on accurate vol/impact signals and robust risk circuits during stress

- - - - -

Yield Basis wants to become the venue for BTC liquidity; while Flying Tulip aims to be the venue for everything trading-native on-chain. In the era of a Perp Dex meta, this comes in a timely manner for Flying Tulip to launch. Tbh, Flying Tulip could even route future BTC flow to YB-like pools if that produces best execution.

If Yield Basis delivers, ybBTC becomes the “stETH-for-BTC” primitive: BTC exposure + LP trading fees, without IL. While Flying Tulip has the potential to ship its integrated stack, to allow users to get CEX-level tools; a “one exchange, all of DeFi” attempt.

Remain cautiously optimistic for the 2 projects, while you do not want to fade the OGs and tier 1 founders, both are untested and the founders have other protocols to also take care of (Curve, Sonic).

1.85K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.