Liquidity farming on each DeFi protocol on Aptos has its own style. However, @earnium_io seems to be quickly becoming my favorite for liquidity farming.

Here's why:

1️⃣ Better APRs -> Earnium's APRs stand out on the Aptos Platform.

I was providing liquidity in other platforms but after seeing the APRs in Earnium I moved my assets there. The returns are undeniably better.

2️⃣ Dual Rewards -> Earnium from liquidity pool APR is not the only reward. Earnium Stardust points is also a reward which is a huge benefit considering Earnium token allocation in the near future. One action, two rewards.

3️⃣ Rapidly Expanding DEX -> Earnium surpassed $2.6M in trading volume and nearly $1M in TVL just a few days after launching and maintains quick growth.

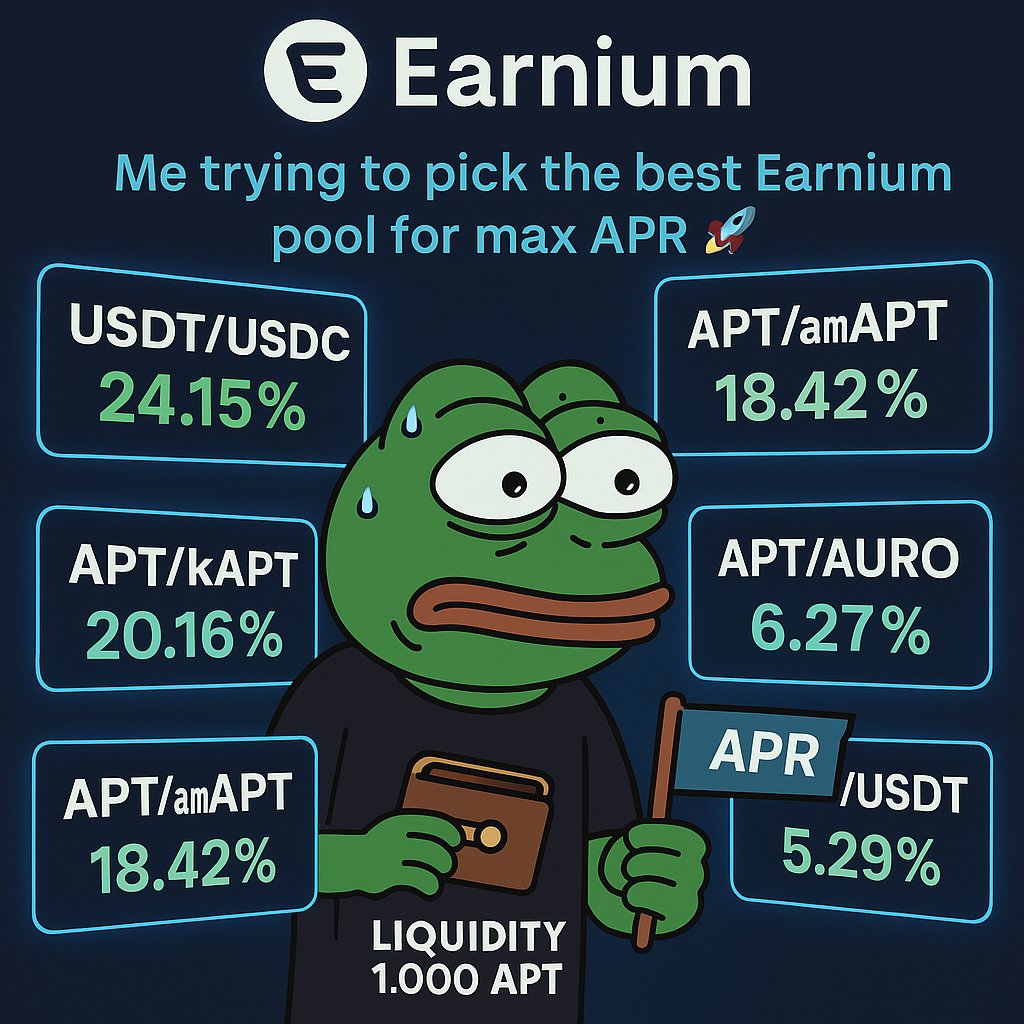

Top Pools Today:

• USDT/USDC — 24.15% APR

• APT/kAPT — 20.16%

• APT/amAPT — 18.42%

Farm LP, Earn Stardust. Get set for what's next.

5.33K

29

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.