More HyperEVM content. You love to see it.

HyperEVM will be the reason $HYPE shatters price target expectations, period.

I spent the last week digging into HyperEVM utilization, and the misunderstood 'sidecar' is quietly dominating DeFi utilization

A look into the numbers 👇

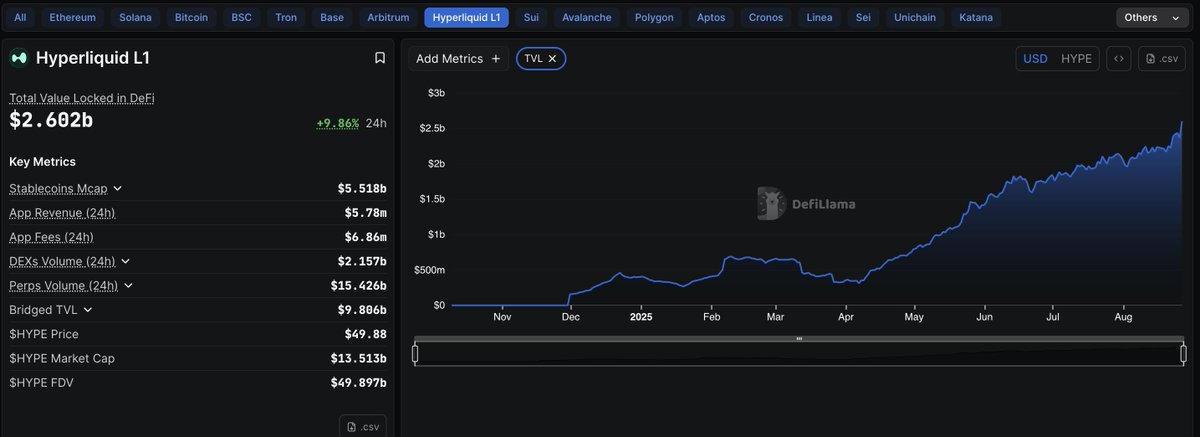

To set the scene, Hyperliquid is currently the 8th biggest DeFi ecosystem in the space with $2.6bn in TVL.

A key cog in the machine? Kinetiq.

Currently sitting at ~$1.9bn in TVL, Kinetiq is comprised of THREE main LST products at this point:

1) The Trojan Horse, $kHYPE.

2) The Institutional offering, $iHYPE.

3) 'Yield as a service', $vkHYPE.

Each of these products operates independently of the others, featuring unique DeFi integrations, but all collectively reside under Kinetiq TVL.

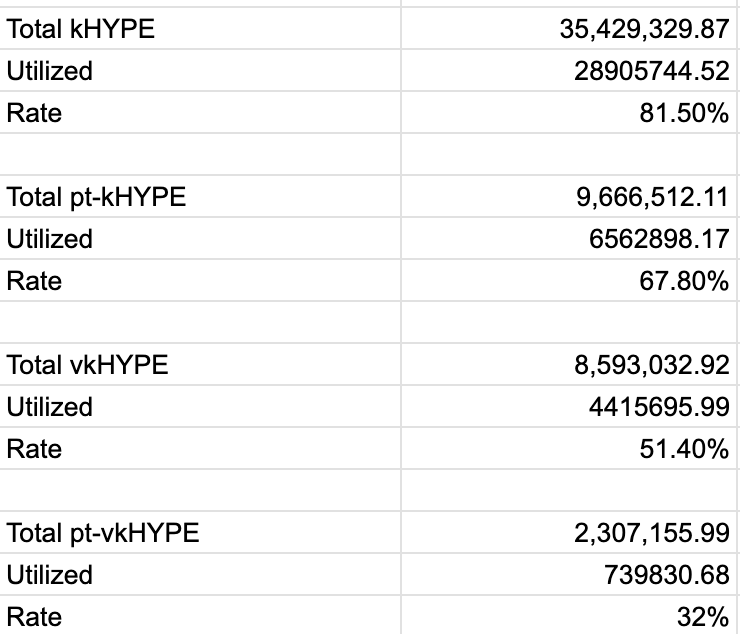

Here is the breakdown of kHYPE, iHYPE, and vkHYPE totals:

kHYPE - 35,429,329.87 units

iHYPE - 872,902.88 units

vkHYPE - 8,593,032.92 units

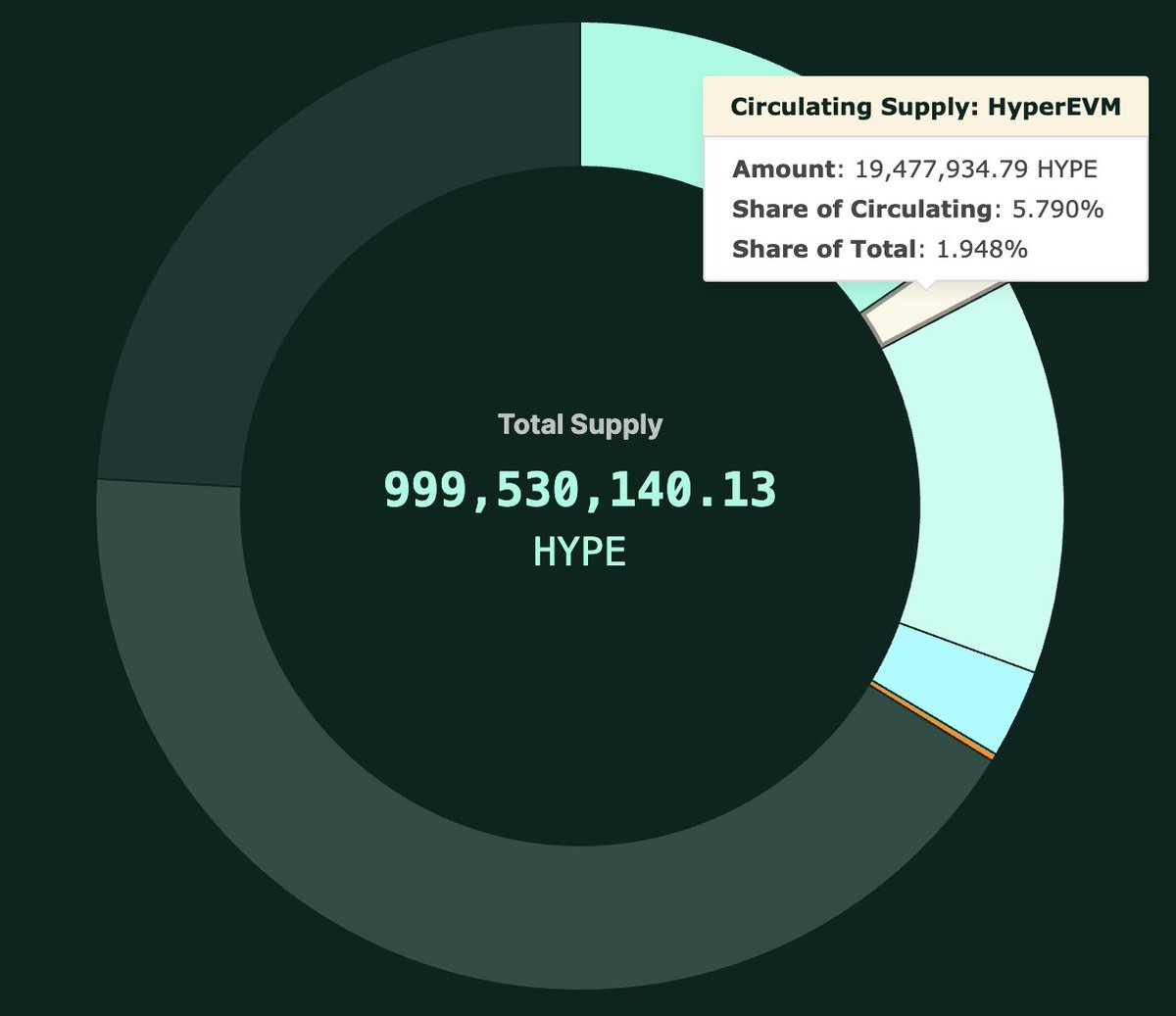

kHYPE alone accounts for 65% of HYPE on HyperEVM.

If you throw vkHYPE into that bucket, Kinetiq liquid staked HYPE accounts for 80% of HYPE on HyperEVM.

A key unlock has been the proliferation of kHYPE and vkHYPE through Pendle pools, which have unlocked PT looping / YT speculating.

Adding PTs as collateral in HyperEVM money markets has unlocked an additional 12mn units of HYPE (~$600mn) into the DeFi ecosystem.

pt-kHYPE: 9,666,512.11 units

pt-vkHYPE: 2,307,155.99 units

So, Kinetiq has proven that there is an appetite for liquid staking, but what does Kinetiq utilization look like?

TLDR- insane usage.

In short:

81.5% of minted kHYPE ($1.43bn) is being used in HyperEVM.

51.4% of minted vkHYPE ($219mn) is being used in HyperEVM.

The rate of consumption AND utilization with kHYPE products will continue to increase as the Hyperliquid team ships new and exciting infrastructure that will bring the crypto masses to the ecosystem.

Kinetiq's Launch will be an additional HYPE sink that will bring an alternative yield strategy for HyperEVM users while bringing useful and exotic markets to the ecosystem.

As the Hyperliquid platform continues to scale into 8 fig revenue days, HyperEVM yield will be a vital tool for power users to maximize their exposure to $HYPE.

Faders will continue to fade, but the analytics do not lie.

Hyperliquid DeFi is coming for the big boys, and $2.6bn TVL will continue to grind up and to the right.

Long live Kinetiq, long live Hyperliquid.

Heavily kHYPE coded

1.22K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.