Tonight, using my own @ReiNetwork0x UNI01 (a dedicated smart agent for on-chain project research), I asked:

Help me conduct an in-depth research on $alpha, the official Twitter is @netprotocolapp, the official website is: , take a look at the secondary market's chip distribution and investment opportunities.

UNI01 replied:

Net Protocol is building a decentralized, on-chain native token issuance and social empowerment platform, supporting users to participate in project incubation through an Upvote mechanism, forming a "community as VC" model. Currently in the Expansion Early stage, opportunities are limited but have narrative observation value. (For more analysis details and overall research structure it provided, see the screenshot)

The accuracy of UNI01's project summarization and data retrieval made me feel very impressed; it is on par with any on-chain research assistant with over 2 years of experience around me. Moreover, it can work 24/7 without rest 🤣

The only thing it didn't research was: "For every token launched on the net platform, 50% of the transaction fees and voting costs must be used to buy $alpha, creating a positive buying pressure." This indeed requires human effort to piece together information and details from several places.

After digesting the token project analysis comprehensive model V1 that I repeatedly fed to ChatGPT 5, Claude, Gemini, Manus, and Flowith, UNI01, after training, has shown the ability to collect information, structure data, organize analysis, observe, and provide action suggestions when initially processing the projects I provided. I am very satisfied with it as my assistant.

Continuing to optimize a few points:

1. Continuously train it to think associatively like a human;

2. Teach it to analyze dynamic data, that is, after structuring on-chain data from different time periods, analyze the investment insights brought by derived factors, providing the owner with more angles of thought to help substantiate more possibilities;

3. Feed it more knowledge bases and project analysis case libraries.

【 $REI: A memory-capable, evolving on-chain brain, a bet against the paradigm of new technology vs. the structure of giant whales】

We must acknowledge that @ReiNetwork0x is a typical bet on "rewriting the underlying paradigm + a very fragile secondary structure."

1. What does $REI aim to do?

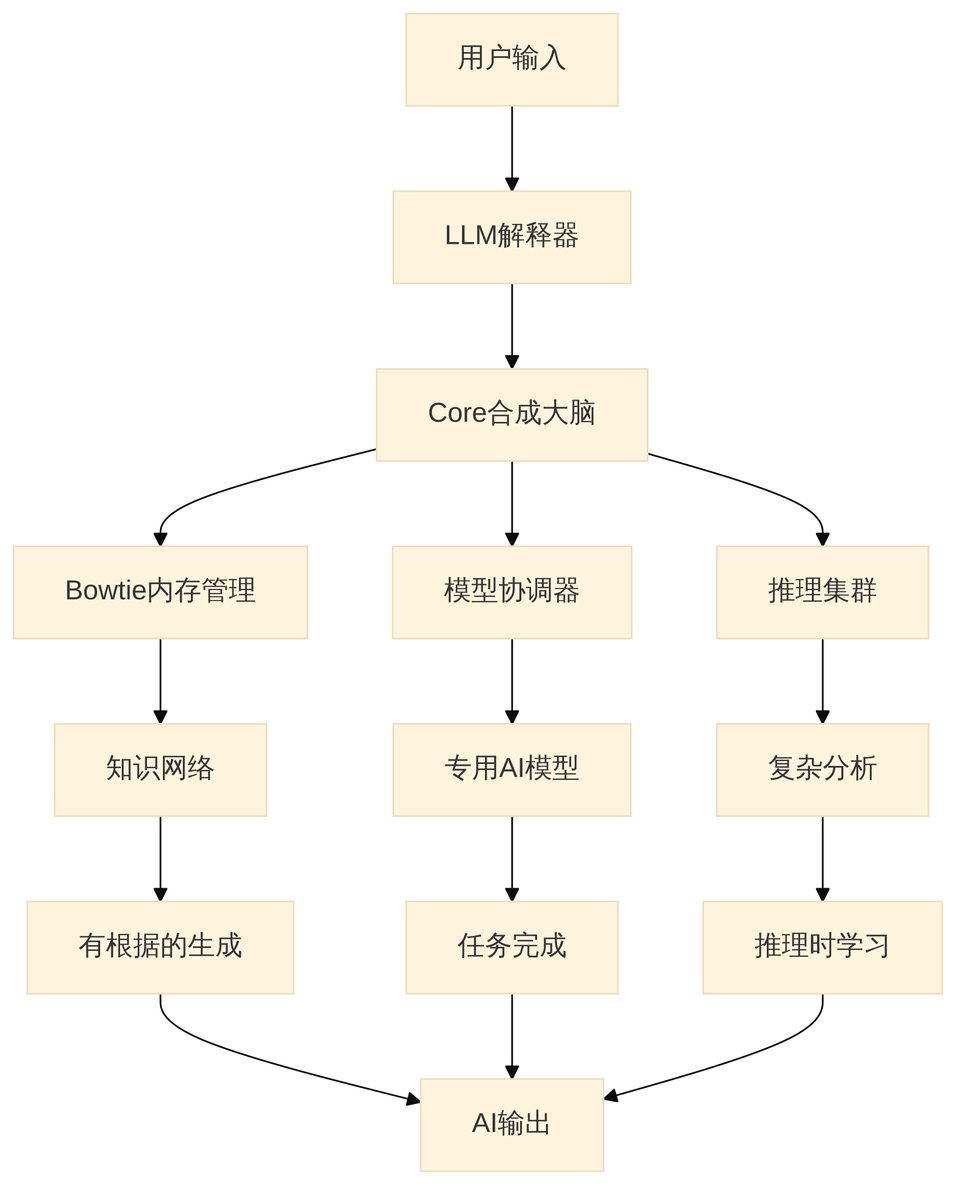

It is not just another #AI narrative wrapped up; it is genuinely attempting to reassemble "memory / reasoning / model collaboration" into an "evolving on-chain brain."

It seeks to address several critical flaws of current LLMs (Large Language Models):

forgetfulness (no persistent memory), hallucinations, and lack of ownership (non-possessable/non-transferable).

@ReiNetwork0x proposes a solution: let it learn while being used, retain memory, and also be assetized.

2. In one sentence:

Rei's core positioning is as a foundational research AI lab benchmarked against OpenAI and Anthropic, not just another LLM, but a revolutionary "synthetic brain" architecture called "Core."

Core fundamentally resolves the current AI bottlenecks in memory, learning, and reliability through three core components and three technological breakthroughs.

Crypto provides it with three powerful tools: on-chain logs = verifiable, assetization = tradable and reusable, open incentives = attracting developers to supplement specialized capabilities.

Thus, retail investors have had no opportunity to access equity in early foundational research labs, and the publicly traded $REI is a scarce entry point, which is also a risk exposure.

3. Token/Economic Model:

Advantages: high initial circulation, fewer subsequent unlock bombs;

Disadvantages: but early concentration of low-cost chips is massive;

Biggest gap: it hasn't clearly explained how $REI captures value—is it a usage fee? Creating Unit collateral? Fee buyback? None of this is currently clear.

4. On-chain & Data Highlights:

1. The top 250 addresses hold >81% of the supply; let's not deceive ourselves, this is a core systemic risk;

2. Monthly operations: tens of TB of data written, over 600,000 patterns, nearly 99% sync rate, indicating it is genuinely running, not just a PPT.

3. Market cap range: mid-tier AI concept, with a premium on technical narrative + discount on holding structure.

5. Differences from similar benchmark projects:

Bittensor @opentensor: An open network incentivizing computational power/model contributions, focusing on external contribution incentives; REI is more like an integrated brain of architecture + memory + reasoning.

Autonolas @autonolas: More focused on multi-agent collaboration and decentralized service orchestration; REI emphasizes "single-brain continuous learning + internal knowledge structure."

LangChain @LangChainAI: Developer tools/orchestration framework, lacking long-term memory or incentives; REI binds memory-reasoning-incentives together.

6. Risk Points (no sugarcoating):

1. Concentrated holdings: whale chips have low costs, any slight disturbance could trigger a run.

2. Anonymous team: currently, "code = reputation"; if the iteration rhythm breaks, trust will quickly backfire.

3. Technical realization: learning during reasoning/hallucination reduction requires third-party evaluation, not self-reporting.

4. Ecological validation: external real business application scenarios and third-party Units scale will take time.

5. The token value capture mechanism is currently in the "empty framework" stage.

7. Current key focus indicators:

1⃣ Chip concentration: can the top 250's share drop below 75%; whale buying and selling.

2⃣ Development progress: Core version updates continuously (monthly or bi-monthly frequency), GitHub weekly submissions maintained (≥30 level).

3⃣ Ecological applications: the number of external Units continues to rise; real API/SDK calls.

4⃣ Economic model incentives: once fees/collateral/leasing are implemented, see if they generate real token consumption or lock-up.

8. My entry and holding strategy:

Using Nansen tools, I have completed: on-chain monitoring, focusing on top addresses, CEX trajectories & LP liquidity changes; built a position of 25% at 0.19U.

In the past few days, during the overall pullback of AI + crypto projects on Base, I have increased my position to 50% at 0.11U.

Moving forward, I will continue to monitor: concentration of the top 100 holdings / real ecology of Units / fee consumption & incentives & lock-up models / hallucination testing / whale fund inflows/outflows.

Core view:

This is not just about creating another AI application; it is a laboratory for new foundational paradigms and new attempts, and it also has a part of the project party's structural time bomb in its chip structure.

If it can run smoothly, the market valuation ceiling will be far higher than ordinary AI x Crypto projects; many such "underlying reconstruction + 'the bigger the storm, the more expensive the fish' structural risk" AI + crypto projects are beginning to emerge on Base, so keep tracking and DYOR!

Some materials summarizing $REI:

1.@blocmatesdotcom "Reconsidering Large Language Models from Scratch"

2. @bes_______ "Rei Paper"

3.@0xreitern's "Basic Resources/Information Guide for @ReiNetwork0x"

27.03K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.