Chainlink is finally getting its moment again.

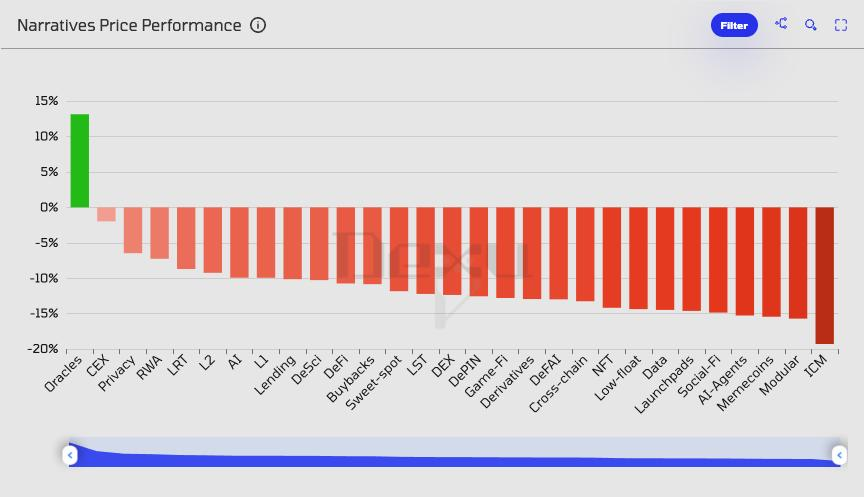

The Oracle narrative is heating up, and it’s clear the market is beginning to understand that oracles are the backbone of both DeFi and the next wave of tokenized RWA.

Among the majors, Chainlink remains the leader. But if you're looking for asymmetric plays within the same thesis, one project stands out to me: @redstone_defi

They’re growing fast and remain massively undervalued relative to peers.

The best way I’ve found to compare oracles is using TVS (Total Value Secured) vs FDV. Think of TVS as the oracle equivalent of TVL - except arguably even more important since oracles underpin protocol security and function.

Here’s how it looks:

Chainlink (LINK): 90B TVS / 25B FDV = 3.6

Pyth Network (PYTH): 8B / 1B = 8

API3 (API3): 1B / 0.2B = 5

RedStone (RED): 7B / 0.4B = 17.5

Worth noting: DeFiLlama is still updating its oracle methodology, so some of these numbers will likely shift. But the direction is already clear.

When fundamentals start to diverge from price, opportunities appear.

Disclosure: I’m an advisor to RedStone.

38.49K

651

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.