It used to be said that "going to Binance is a ladder": Alpha → contracts → spot.

However, the actual delivery is not the end, because spot assets also have collateral coefficients.

Just like the "big realm" in the novel, each "big realm" is divided into several "small realms".

Today I just talked to my friends about LTV, and I will share it with you by the way.

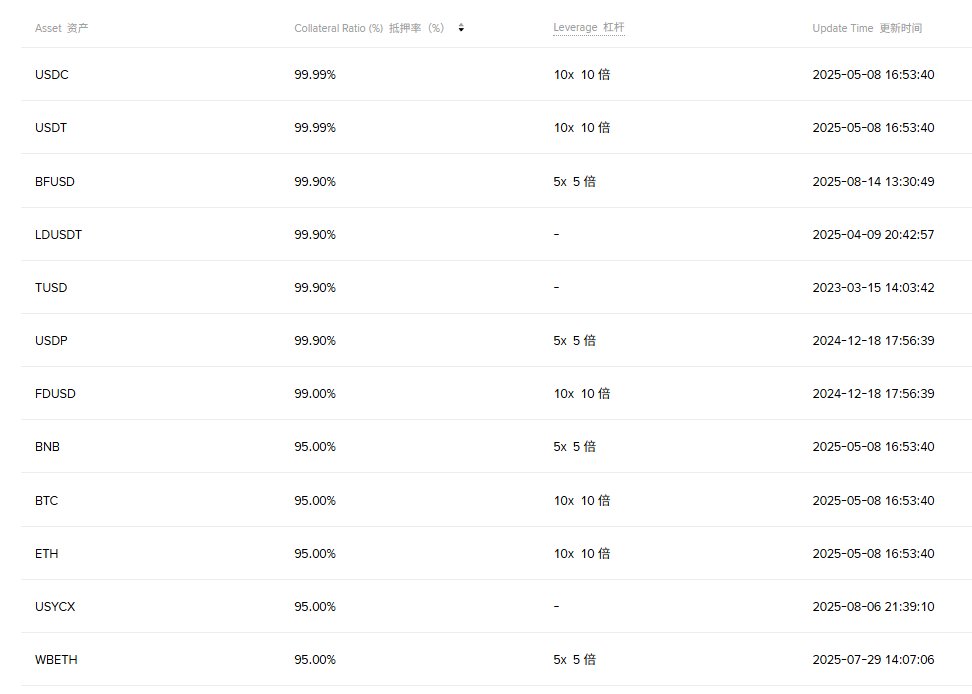

In the Binance system, the highest collateral ratio is the S tier (95%–100%), and all the assets in it can be used as real money.

Among them, USDT/USDC is among the top tiers: the collateral ratio on Binance is 99.99%, and the maximum leverage allowed is 10x; While BFUSD is slightly lower at 99.90%, allowing 5x – that's the difference between "four nines" and "three nines."

95% have only three major coins: BTC / ETH / BNB (of which BNB can be regarded as "self-made admission").

95% means that $1 of BTC can be opened and leveraged at a value of $0.95.

The second tier A (65%–90%) is basically top altcoins, such as SOL, DOGE, etc.

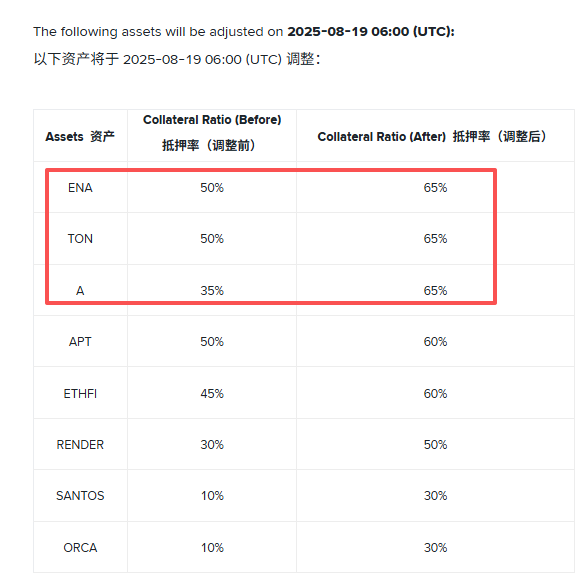

The reason why it is said to be a "ladder" is because there are also promotion channels - such as ENA, TON, and A (formerly EOS), which have just been promoted this time.

In particular, A has been directly increased from 35% to 65%, spanning two small realms, which is a high-spec leap promotion. If you want to rank among the A-tier altcoins, liquidity, reputation, and chip structure are indispensable.

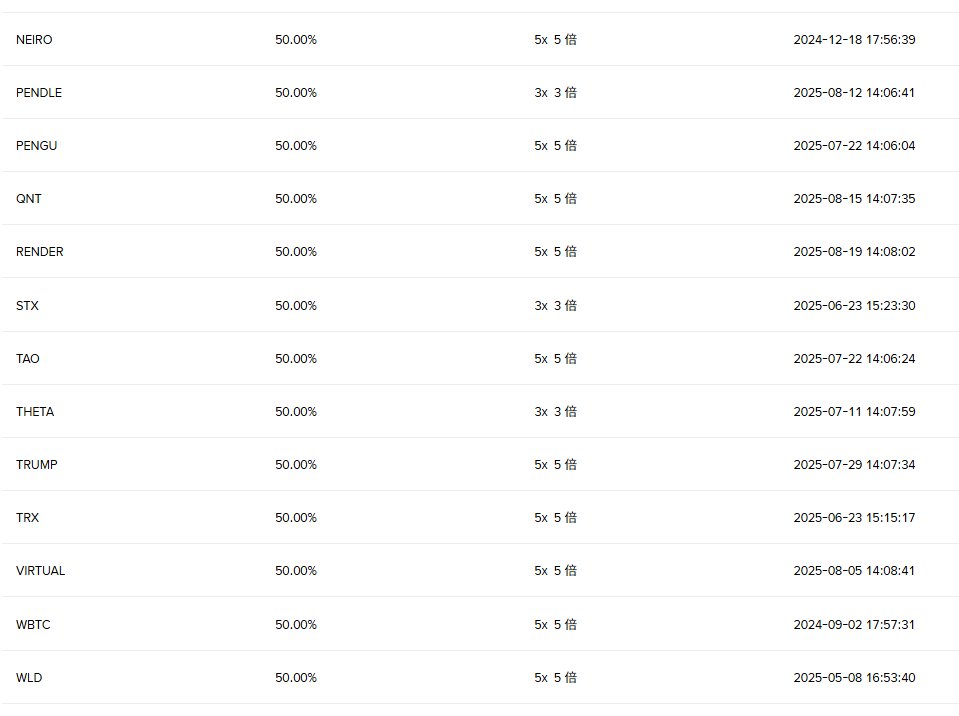

Next is B-gear (35%-60%), which are also relatively hard copycats, leaders of various small tracks, or strong sub-new copycats. For example, TRUMP and Worldcoin are only 50%.

You know, if the collateral ratio is raised too high, theoretically the project can mortgage a bunch of chips to Binance to cash out, which is no joke.

Many copycats are stuck in this gear for the rest of their lives, and some even fall back to this gear if they perform poorly.

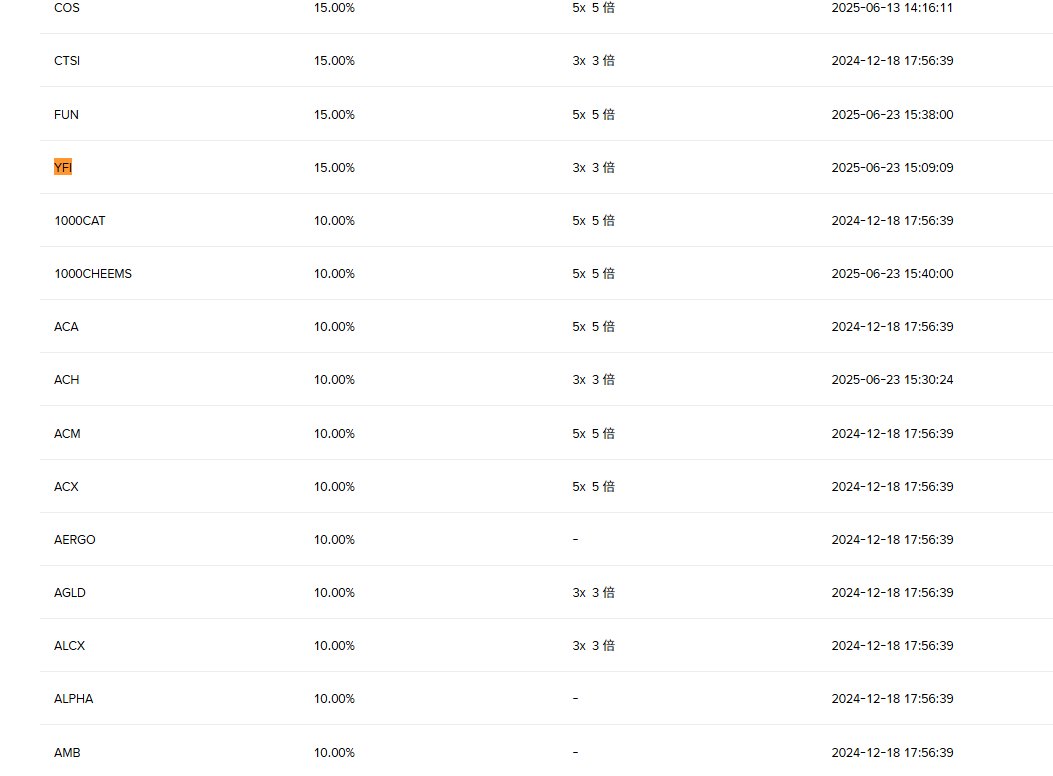

Then there is the C file (10%–35%), which is generally particularly new, either very strong or "hard", as well as old copycats (which have been laid flat); Perhaps in the eyes of Binance's liquidity department, they are "not fully tested by the market" or identified as "pure pension".

Many new coins have been listed recently, such as Huma, LA, SAHARA, SPOK, etc. Veteran lying flat like YFI and ZRX.

But C gear is also good, because there is also D gear.

Finally, there are some altcoins that are really not very good, which have no collateral qualifications and cannot be used as collateral, that is, Gear D (I will not name them here).

Of course, even the D tier is already the winner of the "Binance ladder" - the spot end 😂 that many contract projects and even alpha projects dream of.

No wonder people have been saying lately: "It's finally been discovered that it may be easier to get on Nasdaq than on Binance." ”

This "ladder road" is too real.

Show original

75.63K

56

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.