Sonic Liquid Staking is a key component of the current @SonicLabs

Alongside $S and stablecoins, Sonic LSTs represent a new liquidity within the ecosystem, with a market size exceeding $100 million

In the next phase, these LSTs will be further utilized in DeFi, offering numerous high-yield farming opportunities

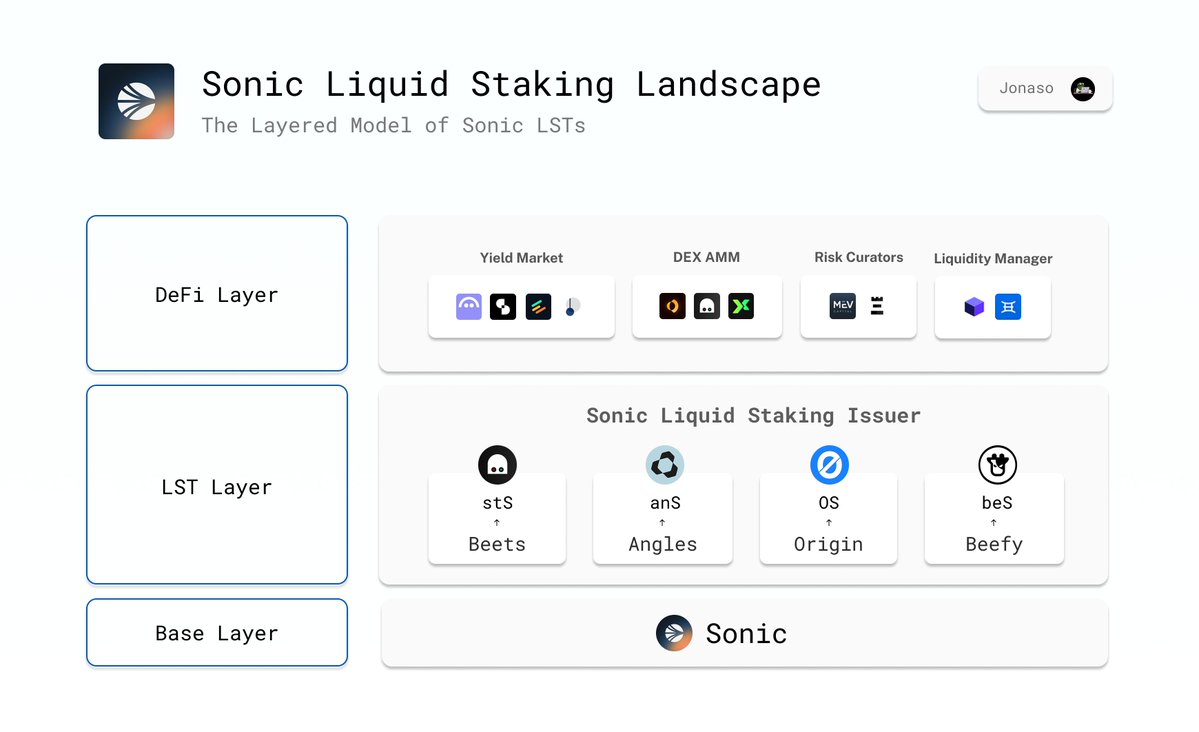

The core pillars of Sonic LSTs:

1. Base Layer: $S staking on Sonic → secure, scalable, high-performance

2. LST Layer: $S → get Sonic LSTs → these LSTs keep staked $S liquid and use it across DeFi without losing staking rewards

+ stS by @beets_fi

+ anS by @Angles_Sonic.

+ OS by @OriginProtocol

+ beS by @beefyfinance

3. DeFi Layer: Where LSTs are deployed to maximize yield and liquidity

+ DEX AMMs: Shadow and SwapX

+ Yield Markets: Pendle, Silo and Aave

+ Risk Curators: MEV Capital and Re7 Labs

+ Liquidity Managers: Stability and Ichi

Stake on Sonic →. Mint your LST → Deploy in DeFi

10.4K

158

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.