The Past 24 Hours In #Ethereum, a thread 🧵

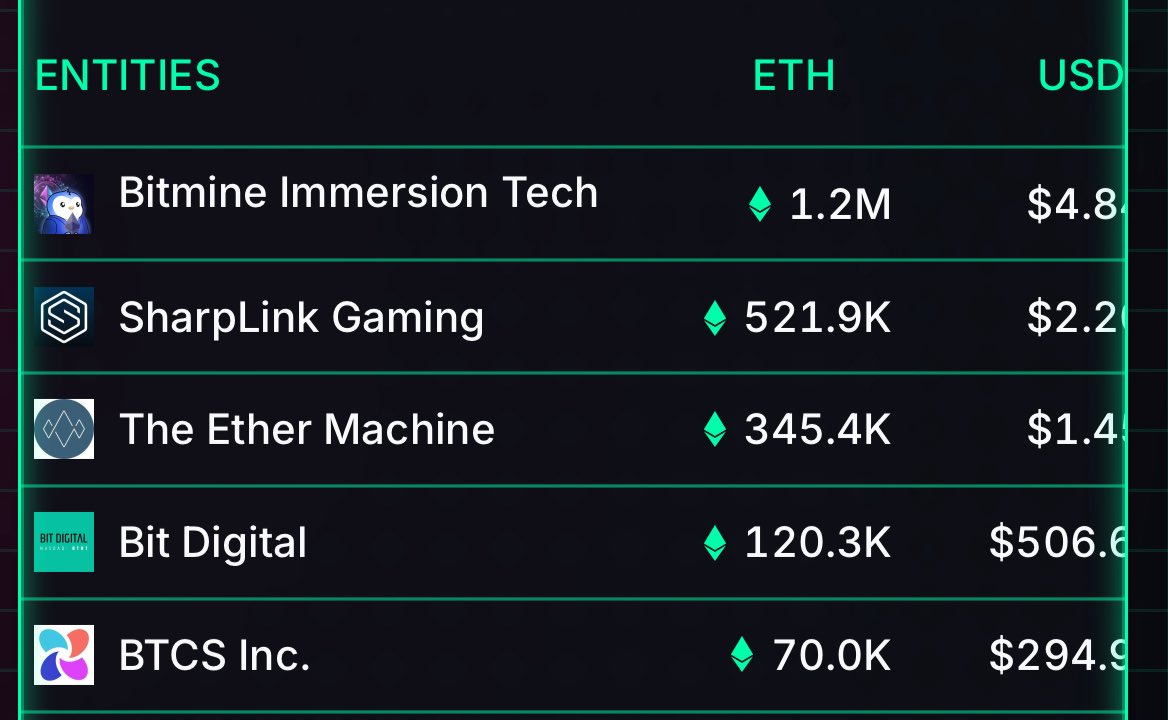

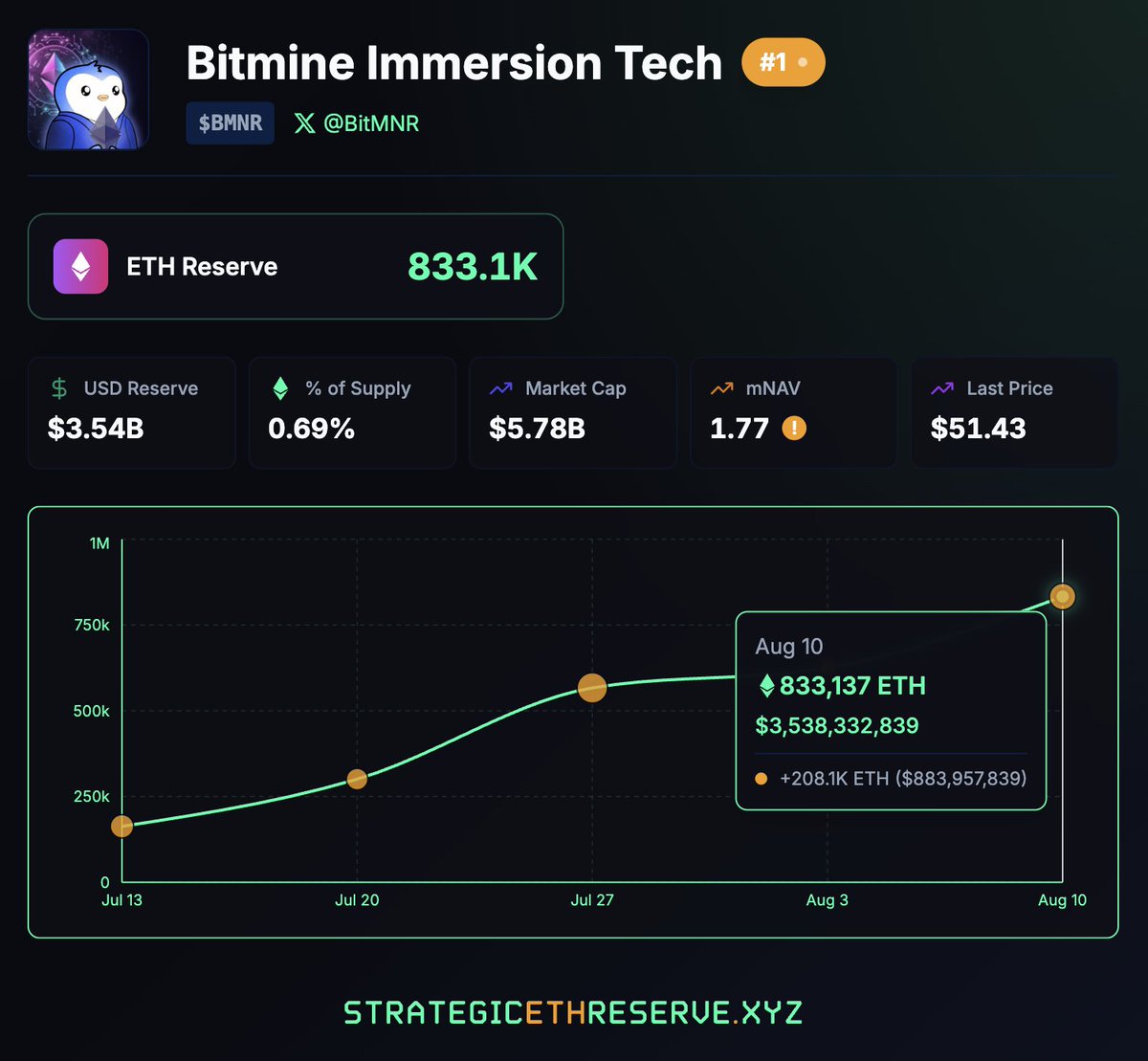

2/ Tom Lee’s Bitmine Immersion just bought another 317,126 ETH

Bitmine is the 1st Ethereum Treasury Company to hold over 1 million ETH

The crazy mf actually did it.

Tom Lee is the first to 1m ETH.

New buys revealed show 1.2m ETH ($5 billion).

In one month he’s made it 20% of the way to his goal to acquire 5% of all ETH supply.

12x faster than Saylor.

We are past the moon headed toward the andromeda galaxy.

3/ FG Nexus buys 47,331 ETH and announce they are going to buy 10% of the total ETH supply

$FGNX now holds 47,331 $ETH! We are thrilled to announce this significant milestone as part of our goal of creating one of the largest ETH treasury holdings companies in the world. Read more here:

4/ SharpLink Gaming acquires another 102,829 ETH and announced they raised $900 million last week to keep buying

SharpLink’s ETH holdings expected to exceed $3B following $400M registered direct offering with institutional investor

5/ Vitalik talks about How Ethereum Becomes The World Ledger on Bankless

LIVE NOW - Vitalik Buterin: How Ethereum Becomes The World Ledger

@ethereum just turned 10, and @VitalikButerin returns to reflect on the last decade—and where it’s headed next.

In this conversation, Vitalik shares what surprised him most about Ethereum’s growth, the hard lessons from challenges like The DAO and NFTs, and what he’d do differently if starting again.

We explore Ethereum’s evolving cultural identity, privacy as a core value, the tradeoffs between L1 and L2, and how Vitalik envisions Ethereum surviving an AI-dominated future.

--------------

TIMESTAMPS

0:00 Intro

0:52 Ethereum’s First 2 Years

2:25 Ethereum’s Top Contributions

4:18 Biggest Surprises

7:37 What Took Longer than Expected

9:05 Overcoming Challenges

11:03 Lesson for Younger Vitalik

15:53 Bitcoin vs Ethereum

18:49 Ethereum’s Cultural Evolution

32:11 Privacy on Ethereum

37:42 Nation State Resistant Privacy

43:03 Cypherpunk vs Mainstream

56:05 World Ledger

59:09 Ethereum in 2024

1:02:23 Changes in the Ethereum Foundation

1:10:10 Economic Alignment

1:16:38 Scaling the L1

1:31:21 Ethereum’s Barbell Strategy

1:39:28 Ethereum Nationalism

1:48:28 ETH Treasuries

1:55:19 The Next 10 Years for Ethereum

1:59:35 The Next 10 Years for Vitalik

2:01:25 The Next 10 Years for Bankless

2:02:52 Closing & Disclaimers

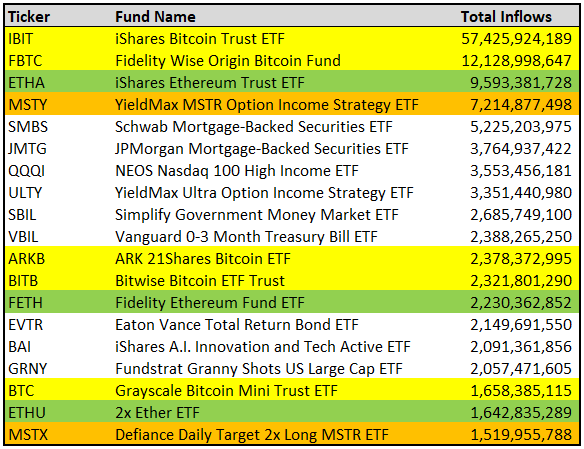

6/ 3 ETH ETFs are in the top 20 of all ETFs for total inflows

1,300+ ETFs have launched since beginning of last yr…

10 of top 20 are crypto-related (incl top 4 overall).

5 spot btc ETFs, 2 spot eth ETFs, 2 mstar ETFs, & 1 leveraged eth ETF.

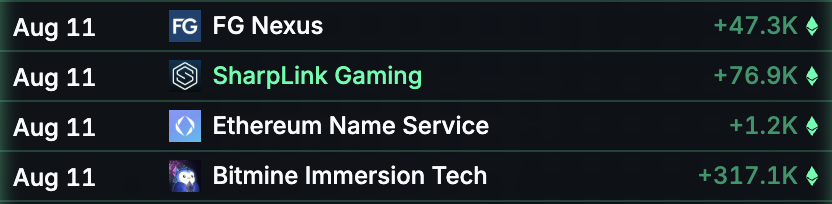

7/ Many treasury companies and protocols contribute to the Strategic ETH Reserve today

Busy day for the Strategic ETH Reserve (SΞR):

🟢 $BMNR surpasses 1M ETH by acquiring 317.1K ETH

🟢 $SBET adds 76.9K ETH & announces a $400M raise

🟢 $FGNX enters the SΞR leaderboard with 47.3K ETH

🟢 $ENS adds 1.2K ETH

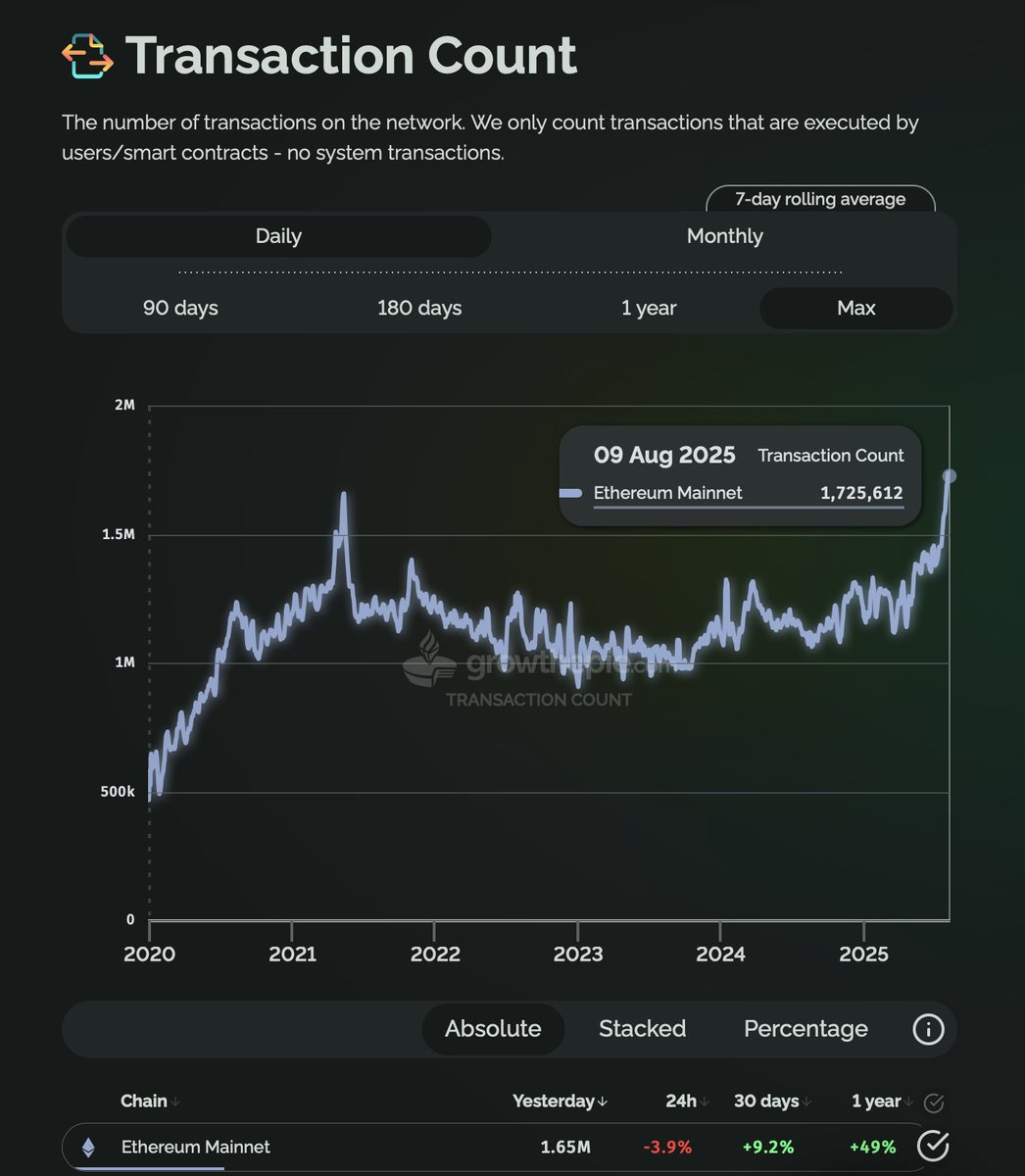

8/ Ethereum Mainnet Transaction Count hits a new ATH

🥧 Not only are we nearing a new ATH for ETH the asset, but we recorded a new all-time high for Ethereum Mainnet's Transaction Count.

And that's not the only metric with new records, Throughput, Stablecoin Supply and more, all 🆙.

Check it out yourself on our platform.

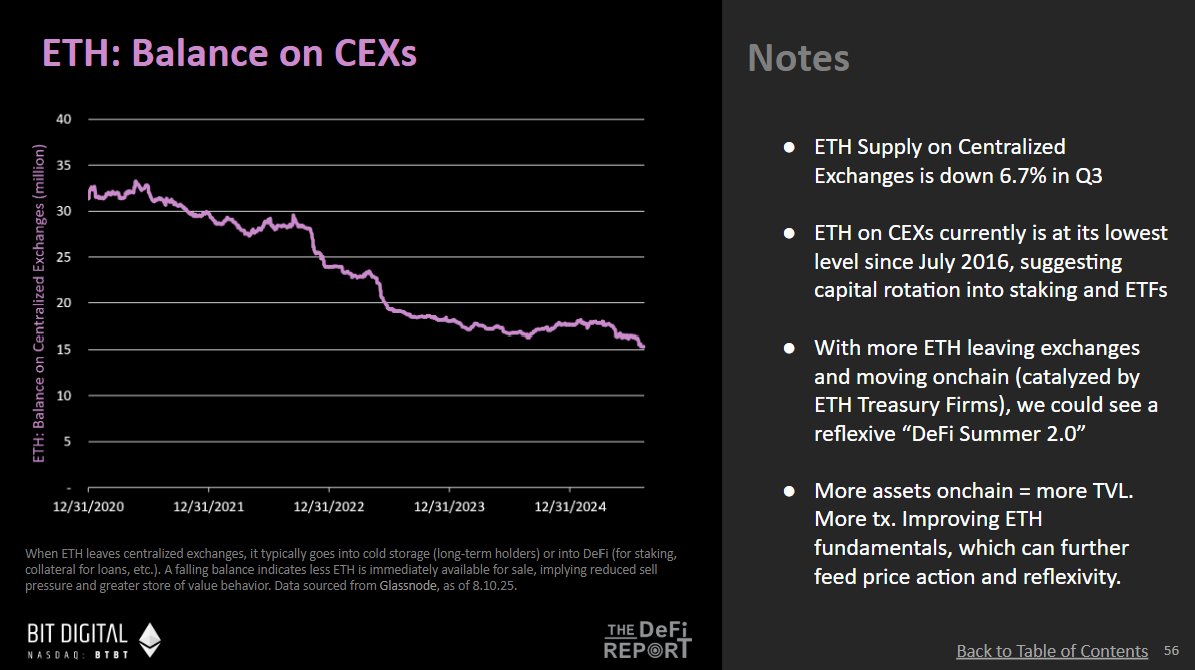

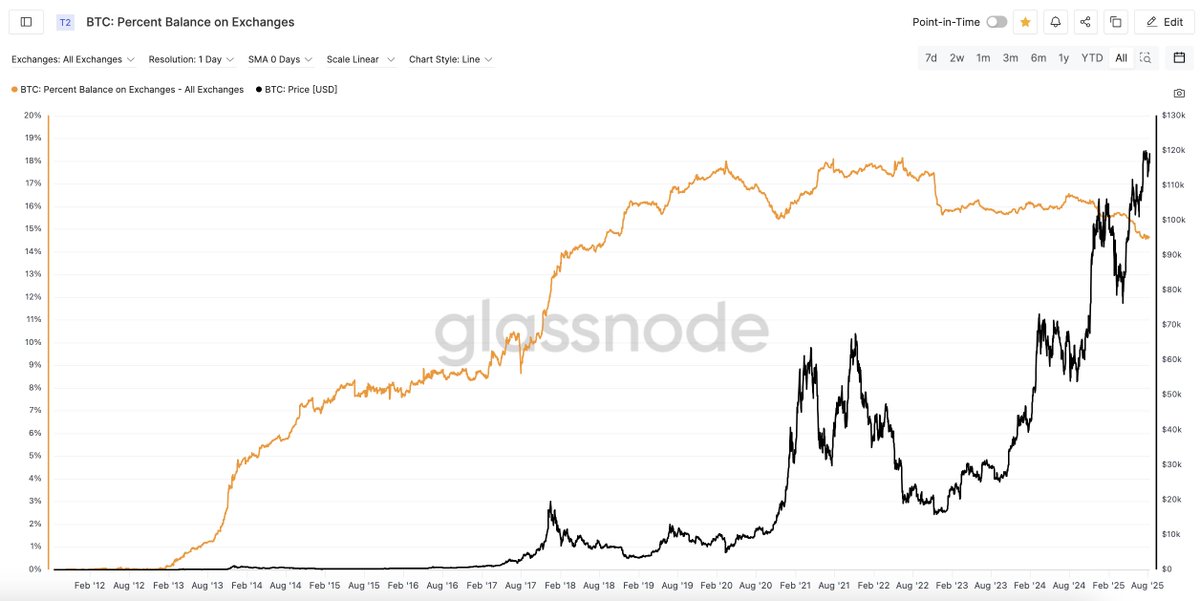

10/ ETH supply on exchanges drops to the lowest level since July 2016

🔵 $ETH has 12% of supply on exchanges. It hasnt been this low since July 2016

🪙 $BTC has 14.5% of supply on exchanges. It hasnt been this low since Aug 2018

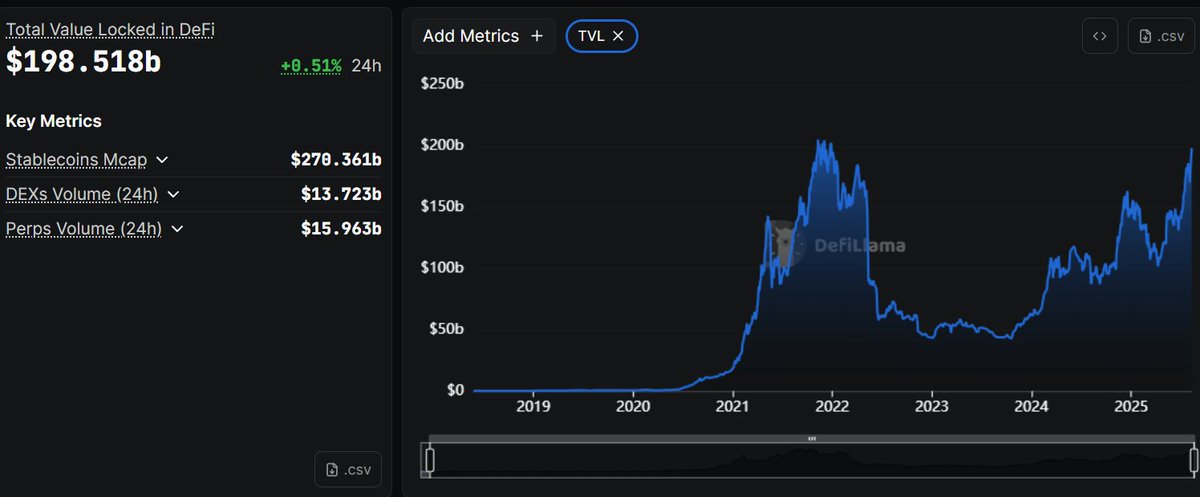

11/ DeFi TVL is almost back at ATH

DeFi TVL is almost back at ATH.

It's up over 70% in the last 4 months and it's only 3% off all-time highs.

DeFi Summer is not a meme.

12/ The All Core Devs - Testing (ACDT) #48 was today

All Core Devs - Testing (ACDT) #48 is Live!

🗓️ Aug 11, 2025 at 14:00 UTC

Agenda:

- Fusaka updates

- Gas limit testing updates

Livestream:

X:

YT:

#Ethereum #ACDT #Testing #DevCall #gas #Fusaka #Glamsterdam

13/ The Ethereum Foundation is hiring a DeFi Protocol Specialist. Apply below

The Ethereum Foundation is hiring a DeFi Protocol Specialist!

They're looking for someone hungry and ambitious, not just a community OG that gets by on their reputation. This role will be hugely impactful so make sure you apply (link in next tweet)!

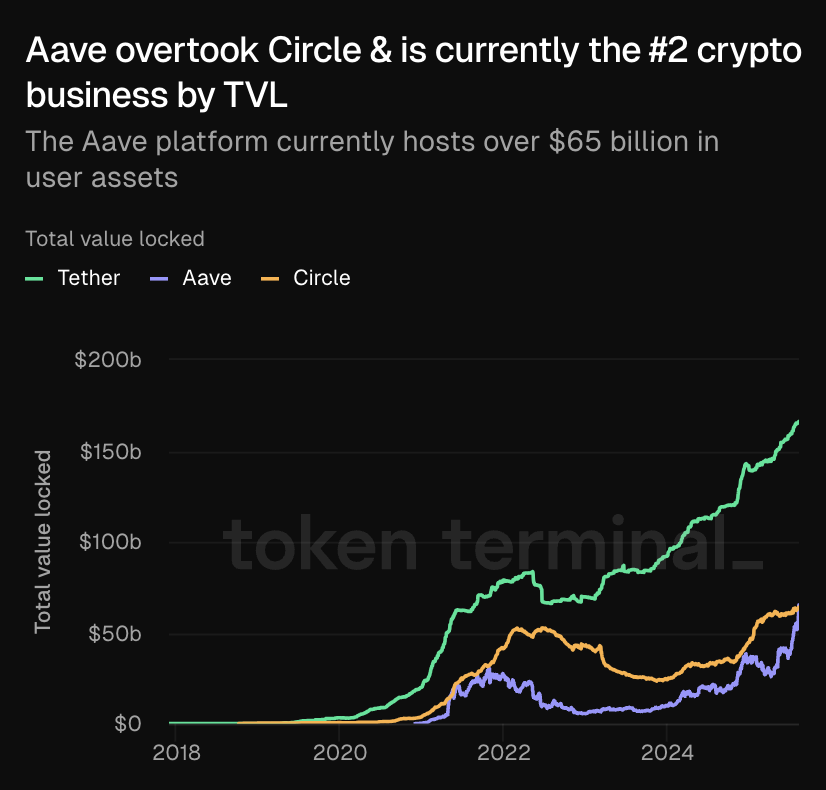

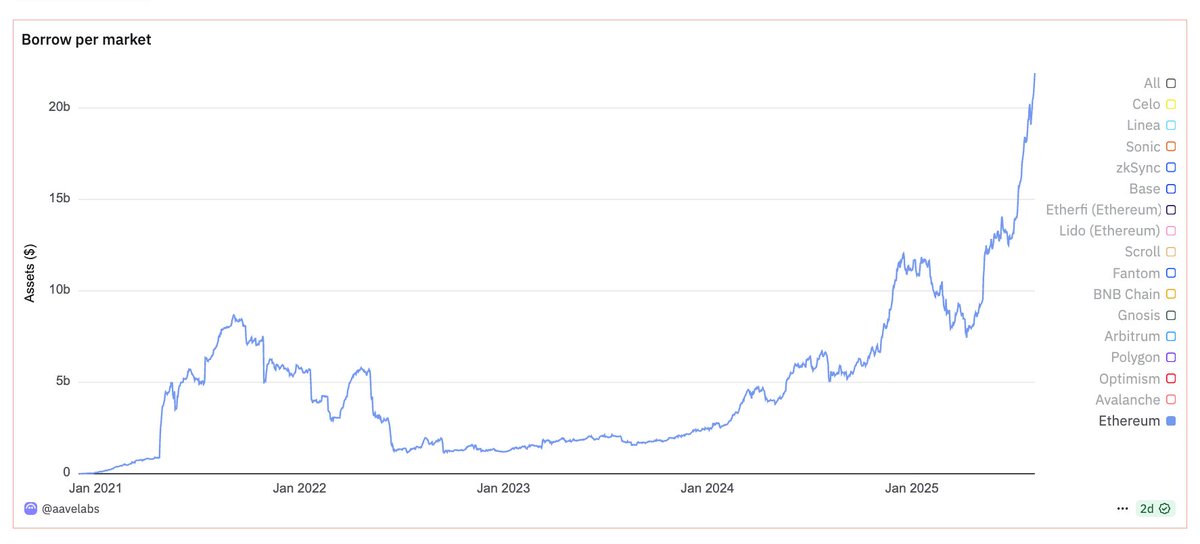

14/ @aave overtook Circle and is the #2 crypto business by TVL

ICYMI: @aave overtook Circle & is currently the #2 crypto business by TVL.

The Aave platform currently hosts over $65 billion in user assets.

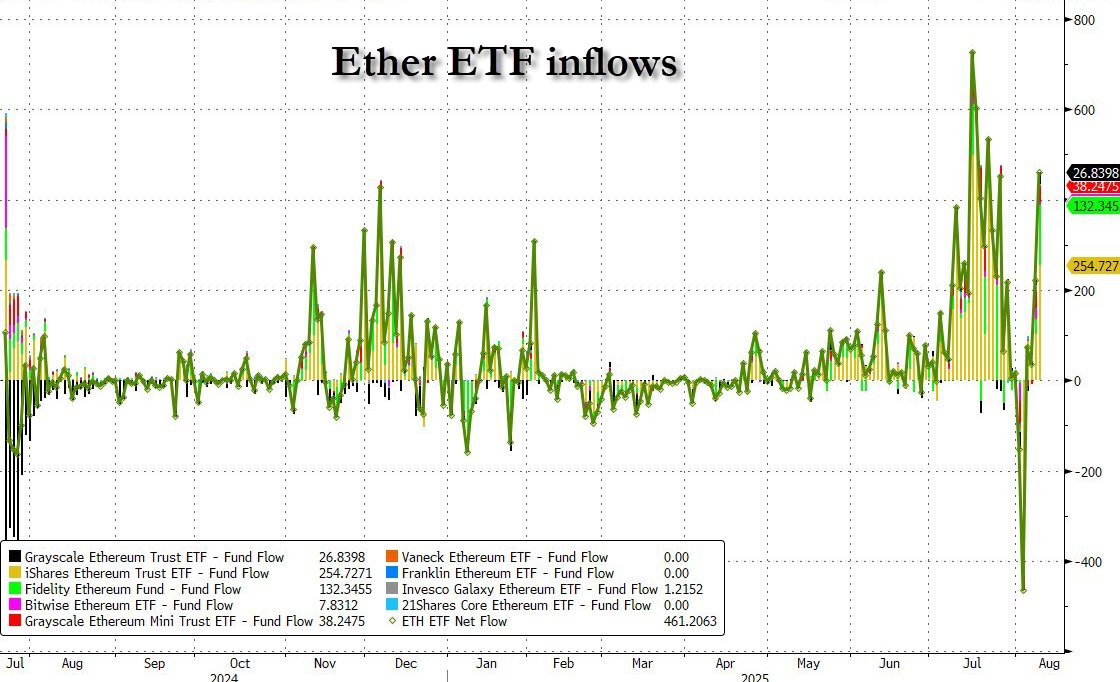

15/ ETH inflows are starting to soar again

It's not just the mystery whale buyer: ether ETF inflows are soaring again

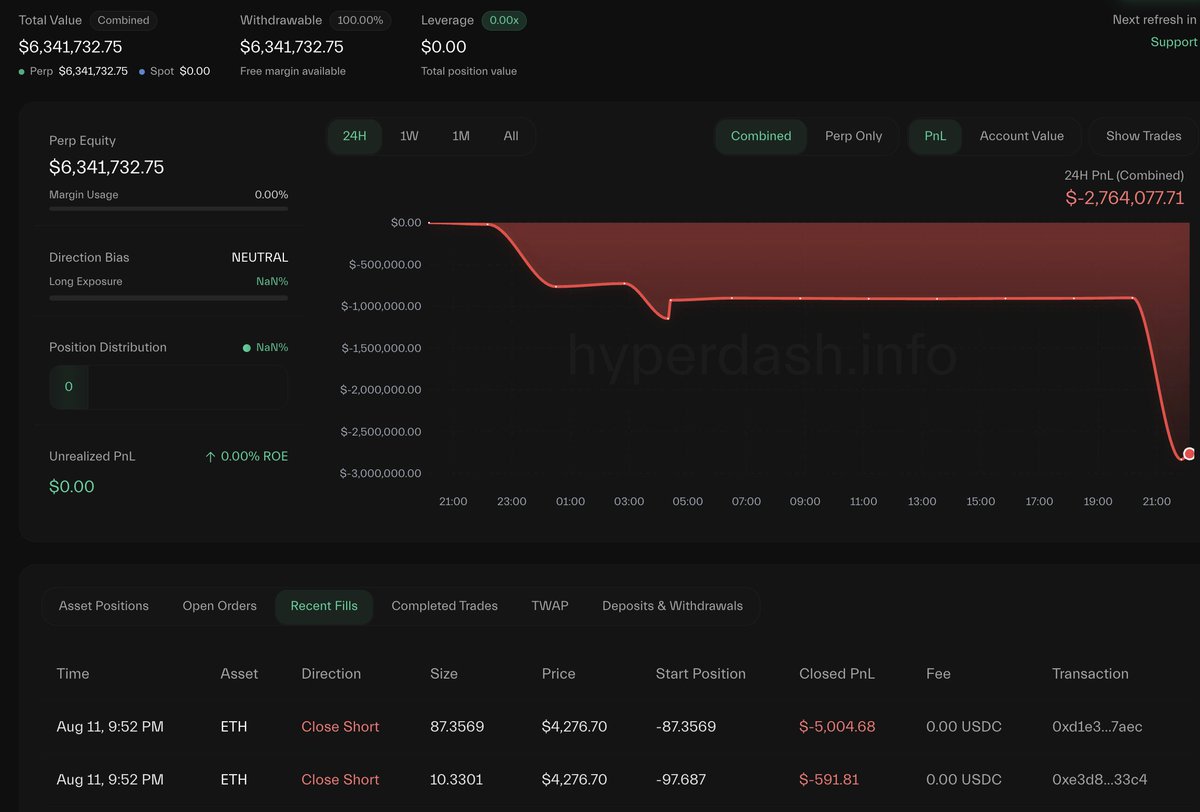

16/ AguilaTrades closes $112M ETH short, losing $1.86M is 10 minutes

AguilaTrades(@AguilaTrades) quickly closed its short position of 26,187 $ETH($112.35M), losing$1.86M in just 10 minutes.

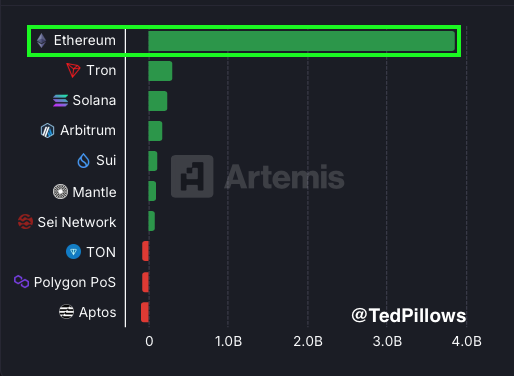

17/ The ETH stablecoin supply was +3,900,000,000 last week

$ETH stablecoin supply + $3,900,000,000 last week.

Ethereum is going to $10,000.

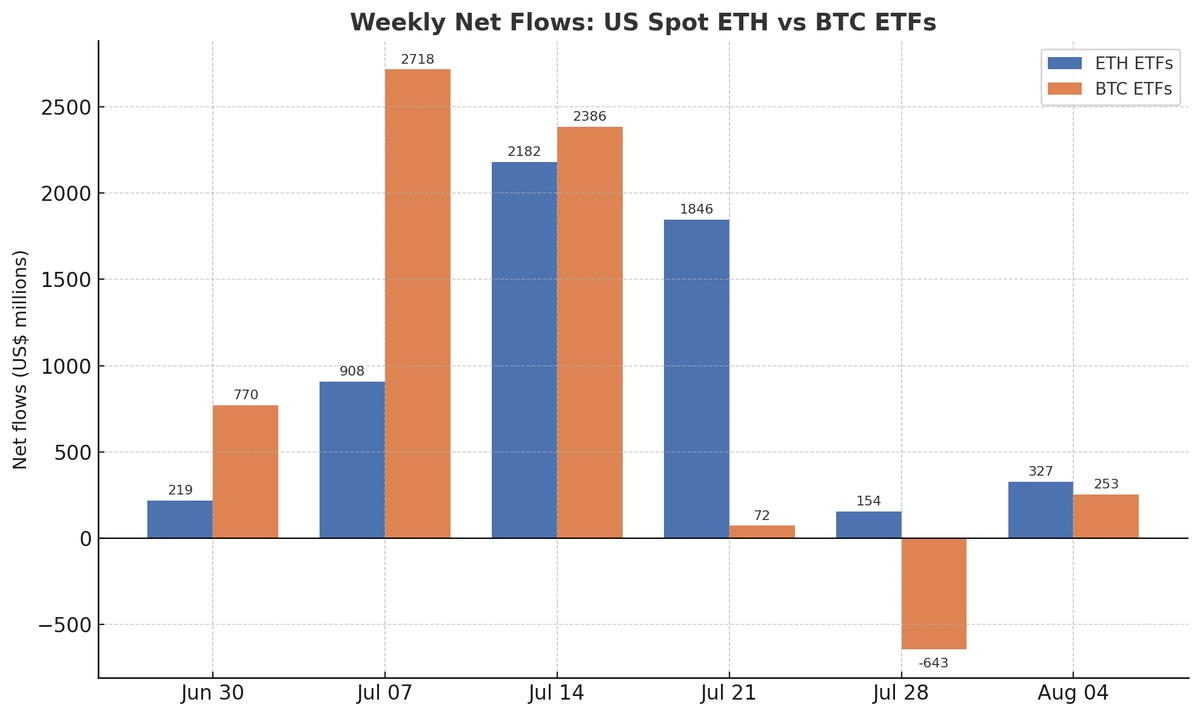

18/ ETH ETF inflows outpaced BTC for the 3rd consecutive week

For the third consecutive week, $ETH ETF inflows outpaced $BTC ETFs: $327M compared to $253M.

Over the same period, ETH strategic reserves accumulated another 1,281,000 ETH ($5.38B), boosting aggregate holdings by 73% in just 3 weeks.

Meanwhile, ETH:BTC is up 23% this month and just reached its highest level (0.037) since January.

Monday could be the start of a very good week 😈

20/ Joe Lubin says Ethereum could flip BTC within a year

Could $ETH actually flip $BTC?

@ethereumJoseph says Ethereum’s monetary base size could "eclipse" Bitcoin’s within a year.

So far @SharpLinkGaming has purchased 521k+ ETH worth $2.2B.

They are one of the leading entities within the new wave of treasury companies stacking ETH at scale.

With real staking yield, a dominant onchain economy, and corporate adoption accelerating.

Is the flippening still a meme or about to become a reality?

21/ IVD Medical Holdings acquires $19M worth of ETH to establish its new treasury

🟢 SΞR NEWS: IVD Medical Holdings () has acquired $19M worth of ETH to establish its new ETH treasury.

IVD plans to deploy their stablecoins on Ethereum and will allocate its ETH reserve into staking, restaking and and onchain derivates to boost returns.

Chief Strategist Officer:

"Ethereum is the world's most mature smart contract platform with extreme high liquidity and growing institutional recognition"

24/ fabda adds an ETH accumulation chart to the Strategic ETH Reserve site

Added an ETH accumulation chart per entities so you can witness how insane $BMNR's accumulation has been.

From 0 -> 833,137 ETH ($3.5B) in just 1 month 🤯

25/ Jeff Bezos Blue Origin now accepts ETH for crypto trips to space

🚨 BREAKING: Jeff Bezos Blue Origin now accepts $ETH and other crypto for trips to space 🚀

26/ Vivek showcases an awesome new Ethereum marketing tactic

They yelled “Ethereum” 10x loudly across the restaurant before I picked up my food

Marketing engine never stops 😎

28/ Borrows on Ethereum are going parabolic on Aave

Borrows on @ethereum are parabolic on @aave.

32/ binji showcases Ethereum is for you vid

twelve strangers made a love letter for ethereum in twenty four hours from idea to production.

six nationalities, one studio and a simple message;

ethereum is for you.

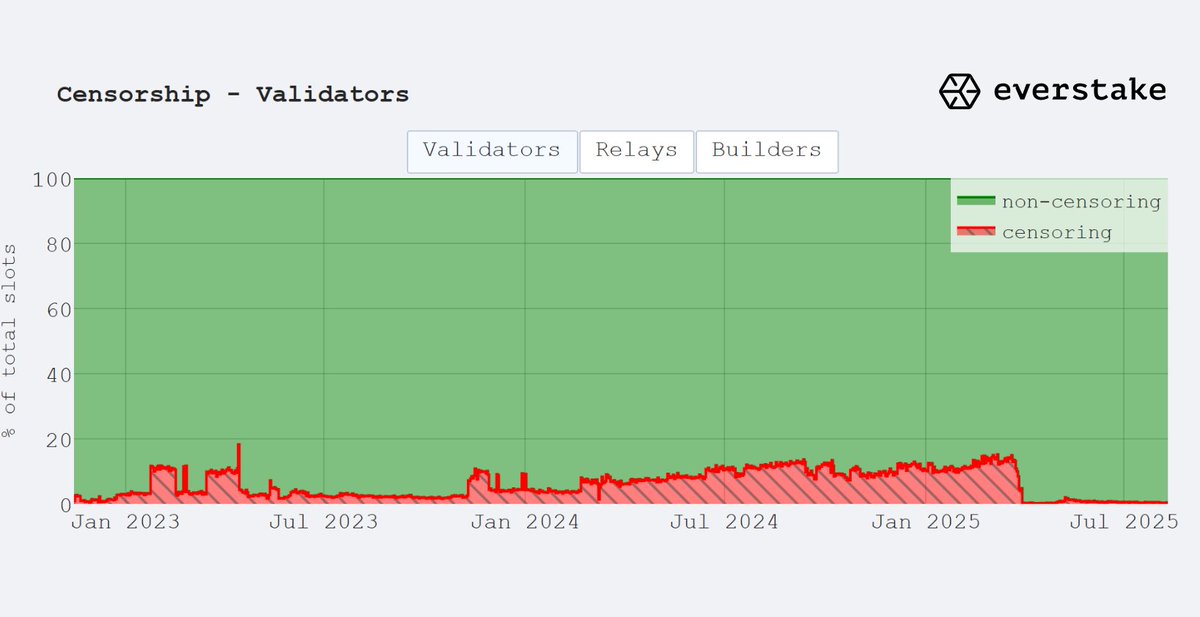

33/ Everstake breaks down why Ethereum censorship by validators has dropped to near zero

Ethereum censorship by validators has dropped to near-zero - the healthiest state the network has seen in years.

Breaking it down: 👇

34/ Charles Allen, CEO of BTCS, says BTCS owns 3 Pudgy Penguins

🐢🦄 Turtlecorn + 3 @pudgypenguins = unstoppable 🚀Proudly owned by @NasdaqBTCS ($btcs.eth), secured by Ethereum, and riding the ETH rocketship to the 🌕!

35/ Zora hits news ATH and a 1400% increase in mindshare over the past month

New ATH for Zora and a 1,400% increase in mindshare over the past month

36/ @DeclanFox14 goes on @fomohour w/ @farokh @rektmando & @Tyler_Did_It

Full interview: Head of Linea @DeclanFox14 on @fomohour

01:40 - Declan & Linea’s background

04:00 - Why Linea?

07:30 - Tokenomics, grants & ecosystem

12:00 - @Consensys + @MetaMask + @LineaBuild

14:40 - Ethereum

18:50 - How can users get involved with Linea?

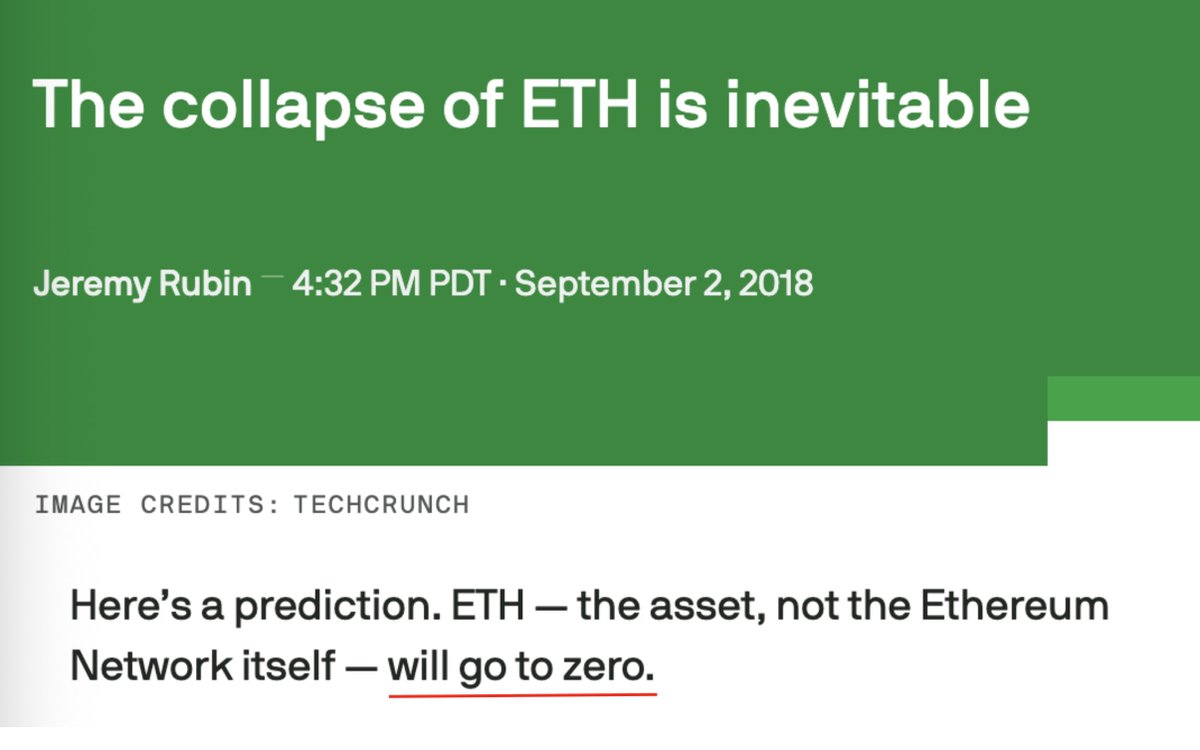

37/ Jrag drops ETH Obituary #33

🪦ETH OBITUARY #33🪦

🗣️"The collapse of ETH is inevitable"

- Jeremy Rubin 2018-09-02 (TechCrunch) | ETH Price: $295/65

A lot of words to say that "Economic abstraction" of ETH as gas will make ETH go to 0.

38/ ETH on CEXs is down 6.7% in Q3

The ETH supply shock is now playing out in real time.

- ETH on CEXs is down 6.7% so far in Q3.

- Now at the lowest levels since July of '16.

With ETH treasury firms just starting to implement their onchain strategies to boost yield and ETH/share, we should see this number continue to drop.

More capital moving onchain could spark further *reflexivity* with activity (and fundamentals) improving along with price action.

We covered the setup in detail in our recent note to readers of @the_defi_report, as well as how we're playing it.

If you'd like to check out the latest research, see the link below 👇

39/ CoW Protocol passes the 3 million trade mark

New week, new milestone 🎉

CoW Protocol just passed the 3 million trade mark. 🤯

That's a lot of Moooos 🐮 and a lot of sad MEV bots. 😭

Thank you to our amazing coMoooonity for helping us get to this historic number. 🙏

Here's to the next 3 million! 📈

40/ Laura Shin drops new Unchained Daily

In today’s Unchained Daily:

🪙 ETH’s on fire — $4.2K and climbing

🏛️ Bo Hines bounces from the White House

💼 WLFI wants a Nasdaq debut with $1.5B

🔗 LayerZero makes a big move for Stargate

🎯 Read it now… and make sure you never miss one. Subscribe!

41/ Anders Elowsson drops thread on Introducing EIP-7999: Unified multidimensional fee market

🧵Introducing EIP-7999: Unified multidimensional fee market.

Ethereum is like a supermarket with one inventory label. There are 45M eggs, 45M cheese, 45M snacks. etc, but everything scans as "1 food". To avoid empty shelves, it closes once 45M food has been sold during the day.

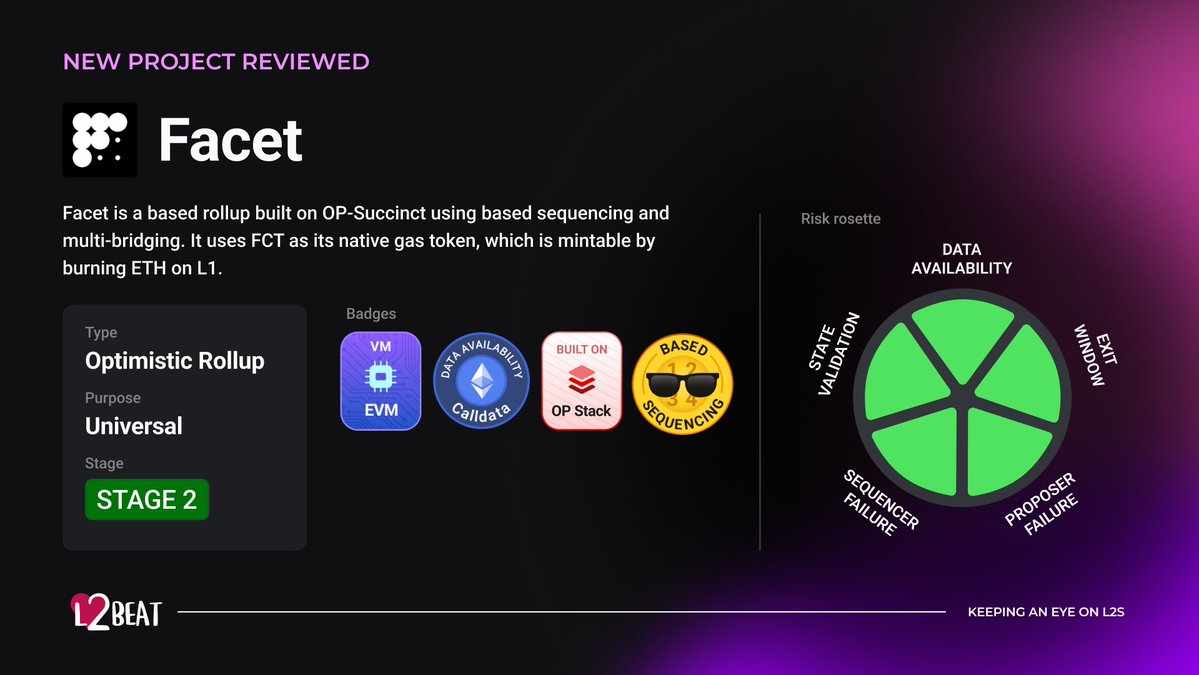

42/ Facet is now on L2BEAT

Another Stage 2 🟢 rollup on L2BEAT! 💗

Introducing @0xFacet - based rollup built on OP-Succinct using based sequencing and multi-bridging.

How does it work? 👇

43/ Meet the Avengers of Ethereum Episode 5 w/ Darius Przydzial is out

“Meet the Avengers of Ethereum” Episode 5: Darius Przydzial, Head of DeFi at The Ether Machine. The DeFi Avenger @0xDariusPR

🦸 Started as an electrical engineer working on advanced radar systems engineering.

🦸 Morphed into hedge fund quant, building and managing risk systems, trading derivatives.

🦸 Hacking mentality, DeFi geek, Solidity dev. AMM & DEX builder, Treasury architect.

🦸 The strategist behind our ETH-denominated on-chain yield engine.

The superpower behind any company is the team. Ours is a lean, mean, onchain machine. 🧵⬇️

46/ The RAILGUN privacy set is now over $100M total value shielded & $3.5B in private volume

The RAILGUN privacy set is now over $100 million total value shielded & $3.5 billion in private volume.

Around $2.5 billion of that volume occurred in the last 18 months.

The more value is privatized through RAILGUN, the stronger the privacy set is for all users.

47/ EIPsInsight spotlights Ethereum EIP-7825

Ethereum EIP-7825 (Fusaka Upgrade) Spotlight:

Why EIP-7825?

EIP-7825 hardens Ethereum against major network attacks while boosting throughput. This means the network becomes faster, cheaper and more reliable for everyone.

#Ethereum #EIP7825 #FusakaUpgrade #Layer2 #Rollups #DeFi #NFTs #Web3 #Blockchain #CryptoNews #EthereumUpgrade #OnChain #CryptoCommunity #ETH

48/ @fileverse is on dGEN1

Files, but better.

@fileverse on dGEN1

Thanks for reading The Past 24 Hours In Ethereum!

Don't forget to follow, retweet, and like

Stay gucci fam

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.