After finishing the airdrop from @rhea_finance and the kaito airdrop from @NEARProtocol, I’ve started to feel attached to the ecosystem.

📖 Let’s review Rhea’s data:

- Current TVL is 260M, with a volume of ~120M in the last 24 hours.

- Monthly revenue of the protocol has grown from about 4WU at the beginning of the year to 15WU in July.

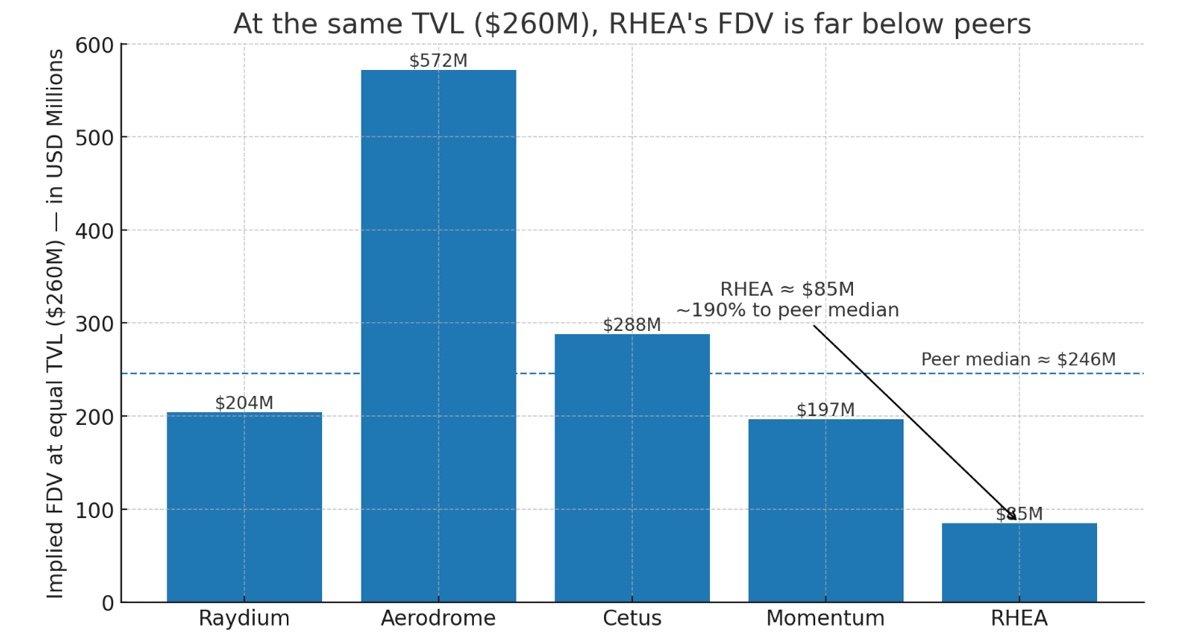

- FDV is 80M, compared to Raydium 1.5B / Aerodrome 1.3B / Cetus 105M / MMT (estimated 100M).

As a super dApp that integrates DEX and lending, Rhea should perform better.

After TGE, Rhea’s announced actions focus on two directions that I’m particularly interested in:

✨ Upcoming rNEAR

Similar to the staking versions of ETH / SOL / SUI, I believe everyone is familiar with this. The core value of LST lies in releasing the liquidity of the native token, enhancing DeFi composability, and it can be mapped to other chains, which will greatly boost the adoption of $NEAR on-chain. This mechanism has already been validated in the ETH ecosystem.

At the same time, for the issuer, it will continuously receive POS subsidies. Just think about how many protocols ETH’s re-staking has supported; if you know, you know.

👛 Chain abstract wallet

Those who frequently use the Near ecosystem know that there aren’t many good wallets available. We are aware of this since we are developing our own wallet. Therefore, if RHEA plans to launch its own chain abstract wallet, it would be excellent.

The adoption of the wallet can further support the adoption of the dApp itself while also facilitating the introduction of liquidity from other chains. We have already seen integration with BNB and look forward to more interoperability with EVM / BTC assets.

🧡 Worth looking forward to

Recently, the rise of ETH in the market seems to indicate that Wall Street is just beginning to realize what Crypto can do. As one of the products of Crypto PMF, DeFi has reason to expect a wave of value discovery in the future. Each DeFi leader in its respective ecosystem may experience this moment. 🚀

Show original

22.3K

42

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.