【Igniting Wall Street: Opportunities and Challenges of "Crypto-Stock Linkage"】

In recent years, "Crypto-Stock Linkage" has become one of the hottest trends between the capital markets and the crypto world.

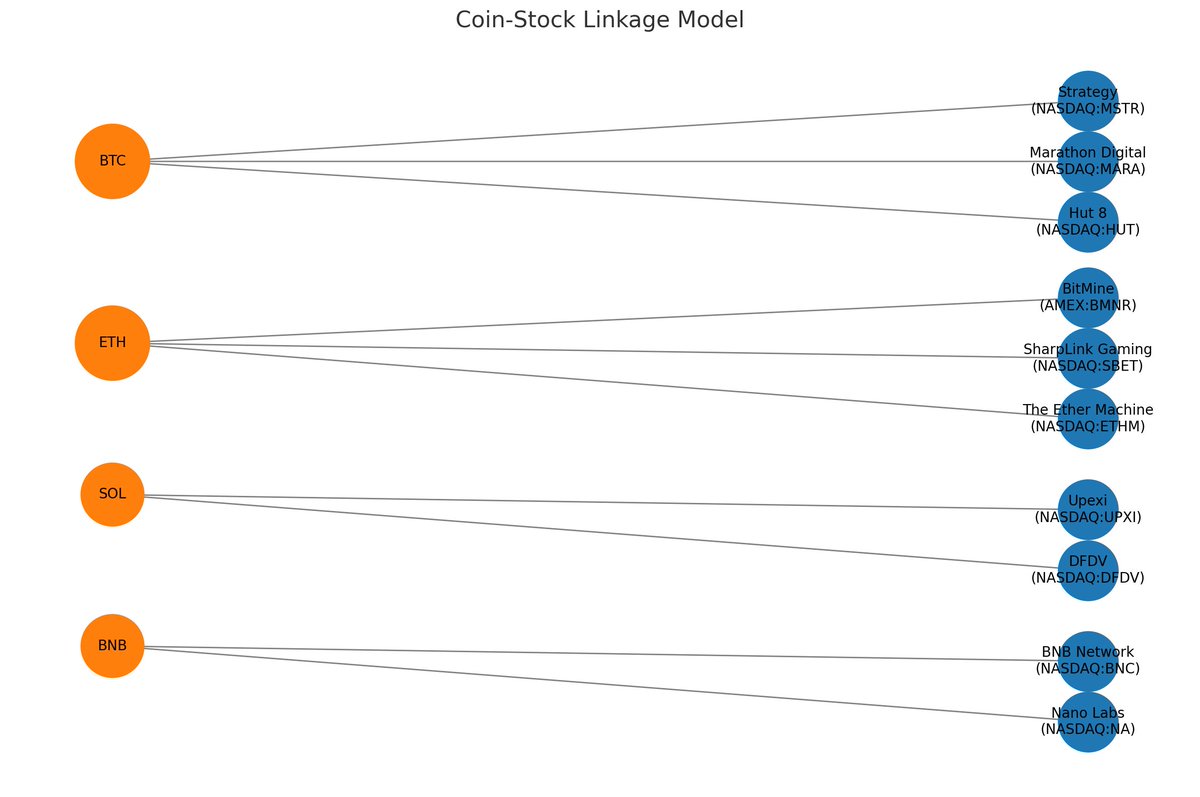

From the Bitcoin leader MicroStrategy $MSTR, to Ethereum strategic reserves like BitMine $BMNR and SharpLink Gaming $SBET, and the entry of multi-chain assets like SOL, BNB, and XRP, "Crypto-Stock Linkage" is gradually evolving from a few cases into a trend.

This article combines observations from the internet industry, private equity funds, and experiences since entering the Bitcoin industry in 2014 to systematically outline the models, motivations, risks, and trends of crypto-stock linkage.

1. What is "Crypto-Stock Linkage"?

"Crypto" refers to cryptocurrencies, and "stock" refers to shares; "Crypto-Stock Linkage" means the linkage operations between the crypto and stock markets.

The earliest representative is MicroStrategy (now renamed Strategy, stock code MSTR), which has continuously bought Bitcoin and currently holds 649,800 BTC, with a market value exceeding $76 billion, accounting for 3.09% of the total Bitcoin supply.

In the peak period of November 2024, MSTR's daily trading volume reached $40-50 billion, surpassing Nvidia and Tesla, even though its market value is just a fraction of the latter.

In June 2025, Ethereum strategic reserve companies emerged, forming a "dual leader" pattern:

Leader One: BitMine (BMNR) holds 833,133 ETH, and its chairman Tom Lee has a strong influence on Wall Street.

Leader Two: SharpLink Gaming (SBET) holds 521,939 ETH, with its core figure being Ethereum co-founder and MetaMask parent company founder Joseph Lubin.

Since then, publicly listed companies holding $SOL, $BNB, $XRP, and other crypto assets have continued to emerge, and collaborations between shell companies and strong project parties have become increasingly common.

For shell companies, binding with crypto is a means to boost stock prices, sell shares, and offload shells;

For crypto project parties, this is an opportunity for "turnaround, redemption, and monetization," with some even profiting directly through the stocks of listed companies.

The capital market has always attracted the most funds with the most enticing stories: issuing announcements, raising funds to buy coins, stock price increases, and then raising funds again... forming a flywheel effect, until the market no longer buys in, the tide recedes, and deleveraging begins—at that point, it becomes clear who is swimming naked.

2. Main Models of Crypto-Stock Linkage

Using own funds/fundraising to buy coins. Publicly listed companies directly use their own funds or raised funds to purchase mainstream crypto assets like BTC and ETH.

Project parties reverse merge. Crypto projects acquire shell companies to effectively "reverse merge" and become the controlling party or chairman of the listed company.

Entering crypto-related businesses. From mining to stablecoins, RWA, asset tokenization, etc., publicly listed companies are involved in various tracks of the crypto ecosystem.

Pure concept speculation. No substantial business, only pushing stock prices up through announcements, news, and market sentiment; such cases exist in US stocks, Hong Kong stocks, and even A-shares.

3. Why do crypto project parties want to bind with listed companies?

Identity redemption and compliance. Transitioning from a gray industry identity to the chairman of a listed company is often the only opportunity for many project parties to "get ashore" and is the first step towards compliance.

Best liquidity and capital operation platform. The financing and capital operation capabilities provided by US stocks, Hong Kong stocks, and other securities markets far exceed those of the native crypto market.

Brand and reputation effect. Ringing the bell on Nasdaq or the New York Stock Exchange is the ultimate dream for many entrepreneurs—Tron founder Justin Sun recently achieved this.

4. Risks and Challenges of "Crypto-Stock Linkage"

Market value trap. Many investors do not understand how stock market value is calculated. Companies involved in crypto-stock linkage often frequently issue new shares, leading to severe underestimation of market value. Many people rush in upon seeing a market value of $50 million or $10 million, unaware that the real market value after issuance is already $1 billion.

Lack of performance support. The vast majority of crypto-stock concept companies do not have stable main income, and stock prices are highly dependent on sentiment and speculation.

High leverage volatility. The crypto-stock concept is akin to leveraged crypto, with both price increases and decreases magnified; once sentiment recedes, it is easy to experience a "double kill"—both crypto prices and stock prices fall.

Death spiral risk. Ethereum founder Vitalik Buterin once described the worst chain reaction: ETH falls → forced liquidation → further sell-off → trust collapse.

5. Future Trends of "Crypto-Stock Linkage"

More publicly listed companies holding coins are currently concentrated in BTC, ETH, SOL, BNB, and will continue to expand to XRP, DOGE, TRX, TON, SUI, LTC, FET, etc.

The US stock market is the main battlefield, with Hong Kong stocks being partially active; the US stock market remains the core stage, while Hong Kong stocks have certain appeal among Asian project parties.

Regulation will eventually catch up; innovation always runs ahead of regulation, and only after systemic risks appear will regulation intervene.

Investment must be cautious. Whether it is the inscriptions of 2023, the memes of 2024, or the crypto-stock windfall of 2025, ultimately only a few leading companies can navigate through bull and bear markets, while most concept stocks will eventually go to zero.

Conclusion

Crypto-Stock Linkage is a product of the deep integration of the crypto market and traditional capital markets, containing huge opportunities but also hidden high risks.

For investors, it is essential to understand both crypto and stocks, and more importantly, to understand the rules of the capital market.

Flying on the wind requires not only courage but also a parachute.

@1783DAO @BroadChain_info

#1783DAO #BroadChain #Crypto #Web3 #RWA #Stablecoin #Stock

Show original

54.57K

7

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.