New Morpho Pools On @katana - A Guide ⚔️

So there's a new looping tactic that works between @MorphoLabs and the Katana app's vaults.

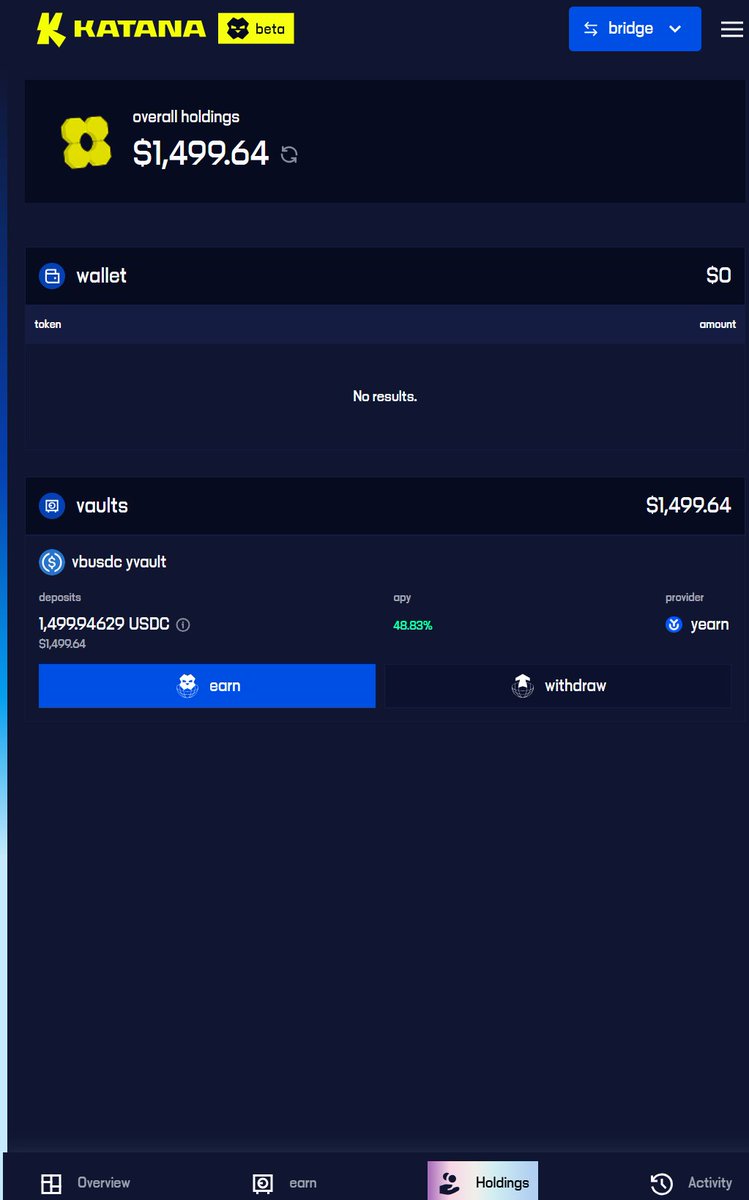

To use this loop, you'll need yvvbUSDC.

Yeah, TF is that. Well, I'm going to explain what yvvbUSDC means, why it's called that, how it earns yield and how to use it. Wish me luck.

Stage 1:

When you bridge USDC to katana, it is converted to a token called vbUSDC - that stands for vault bridge USDC.

The vault bridge works by taking your USDC and putting it to work to earn yield on Ethereum and giving you a representative token on katana so you can deploy it into DeFi. Thus, you receive vbUSDC. The vb before the USDC stands for vault bridge.

Stage 2:

Next, if you deploy your vbUSDC into one of katana's USDC vaults on the katana app, your vbUSDC will be deposited into the vault and you will receive yvvbUSDC. It's called this because when you deposit, you're depositing into a Yearn Vault (they're a project that deploys funds on your behalf to earn yield.)

Therefore, you have:

> yv (yearn vault)

> vb (vault bridge)

> USDC (usdc)

>yvvbUSDC - got it?

This is awesome, because you're earning yield in 2 ways:

1) Yield on Ethereum via vault bridge

2) Yield on Katana via Yearn Vaults

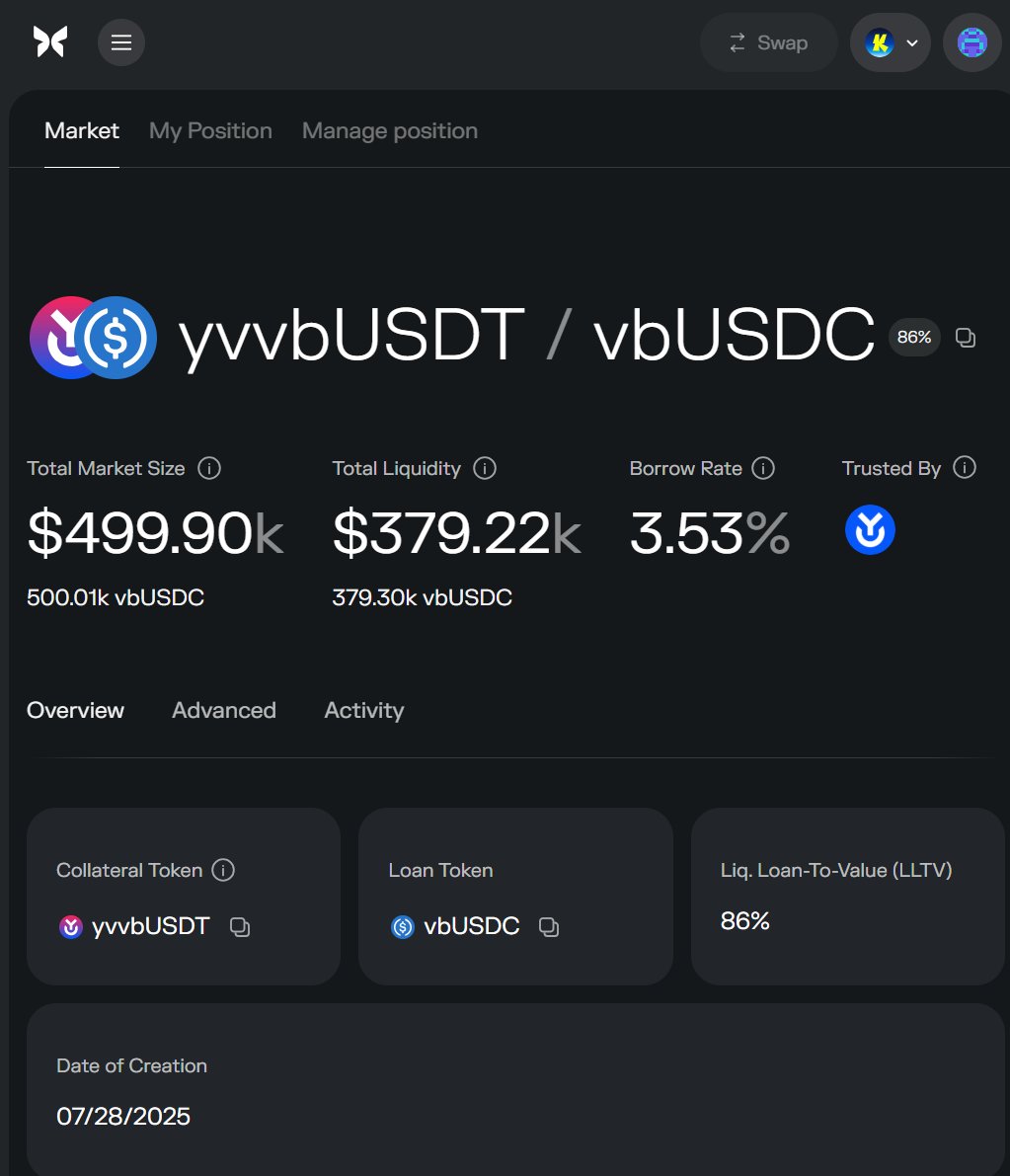

The next part is where @MorphoLabs comes in. They've opened 2 new vaults:

> yvvbUSDT/USDC

> yvvbUSDC/USDT

What this means is you can now lend either USDC or USDT stablecoins and borrow either USDC or USDT stablecoins.

But, why would I deposit a stablecoin to just borrow a stablecoin?

Well if you remember, these aren't just stablecoins, these are stablecoins earning yield - a lot of that yield comes in the form of $KAT incentives.

This means if you're holding yvvbUSDC or yvvbUSDT you're earning $KAT - so if you can borrow it, you can earn yield on the stuff you borrow.

To borrow yvvbUSDC or yvvbUSDT it's going to cost about 3-5% interest, but the amount you can earn from $KAT rewards? 35% minimum.

Looping

Looping in DeFi is when you deposit and borrow and the deposit the stuff you borrowed - which allows you to borrow more; so on and so fourth in a loop.

In this scenario it means you could:

> Deposit yvvbUSDC into yvvbUSDC/yvvbUSDT

> Borrow yvvbUSDT

> Deposit yvvbUSDT into yvvbUSDT/yvvbUSDC

> Borrow yvvbUSDC

> Deposit yvvbUSDC into yvvbUSDC/yvvbUSDT

> etc.

> etc.

By looping, you can take a relatively small initial position and keep looping until you get a much bigger position.

As these are both stablecoins, in theory you can push your LTV really high. But based on experience, don't run the risk.

So there it is, how to understand some of the more complicated terminology within Katana and how looping works.

I'll do this when I get home from travelling - but I've probably ruined the alpha by telling you rabble now.

Any questions 👇

4.93K

110

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.