After seeing this post been thinking of its lately, the Era of One-Size-Fits-All Blockchains Is Ending

As the blockchain space matures, we’re witnessing the rise of consumer-focused chains built for specific purposes: finance, everyday transactions, and other specialized verticals.

Think of it like your daily productivity app or a heart & step tracker but entirely on-chain, operating within its own tailored environment, optimized for scalability and efficiency.

One of the most exciting sectors is finance-specific base chain blockchains designed from the ground up to serve financial applications with speed, security, and composability.

@neutron_org is one of them, a purpose-built blockchain for finance within the Cosmos ecosystem. It enables smart contracts, cross-chain interoperability, and robust DeFi infrastructure, all while maintaining a secure, capital-efficient environment for builders and users.

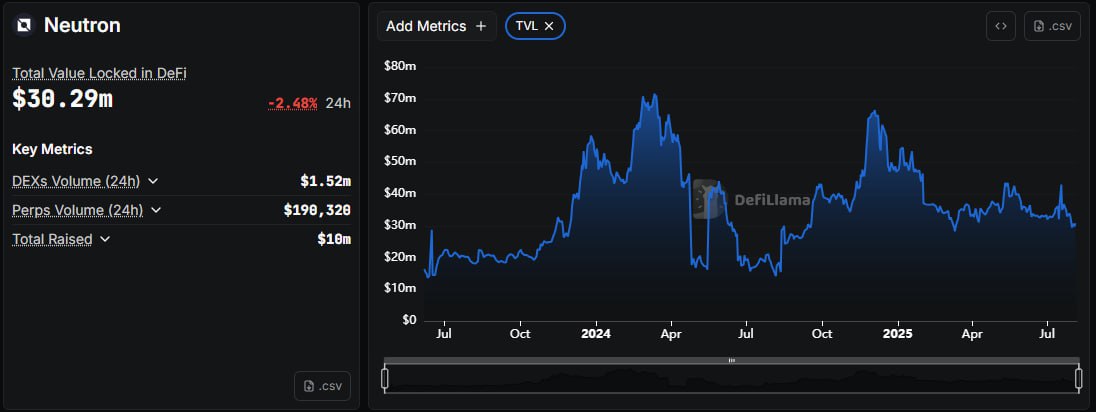

Despite flying under the radar, Neutron has been quietly stacking impressive metrics:

- $1M+ in daily volume processed in the last 24 hours

- 100%+ liquidity inflows over the past year

Outpacing hype-driven, capital-heavy projects in real growth metrics

In case you're wondering why am so hyped, the Neutron DeFi Stack each protocol on Neutron plays a specialized role in building a self-reinforcing financial ecosystem:

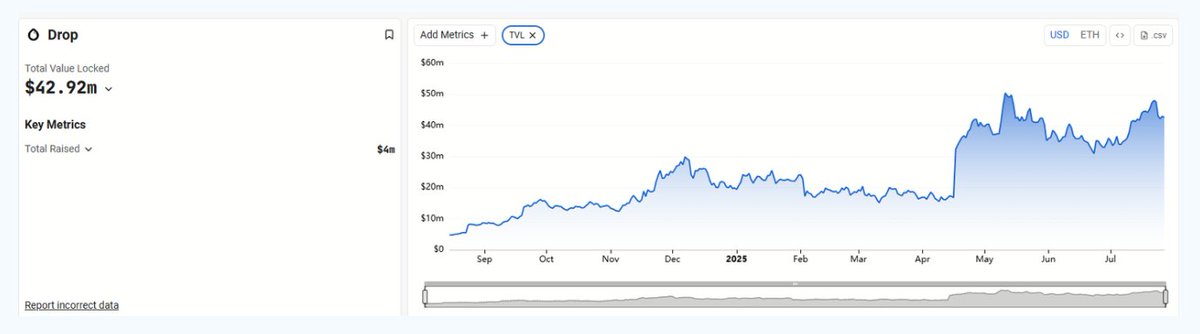

@dropdotmoney been drop utilising every bit of liquidity to finance other projects in the ecosystem a liquid staking protocol on neutron currently the highest THE with $36.77m

@astroport_fi the biggest dex on neutron a multigrain though capitalising on other liquidity from different market

@mars_protocol lending protocol on neutron currently accepting $wBTCl which is now capped and more positioning as the go to Bitfi this summer '25 sitting as $18m TVL

@Levana_protocol Perps trading protocol with $1.47M TVL, expanding DeFi derivatives access recently launched $Rune and $XRP with a 4x leverage

Duality the Native DEX on Neutron holding $1.21M TVL just has Hyperliquid persp is to Hyperliquid some pattern here

@axvdez DEX integrating unique liquidity models, $862K TVL.

Overall Neutron is proving that tailored financial base chains can outperform generalized blockchains by focusing on one thing and doing it extremely well in this case, powering an interconnected DeFi economy.

Perps volume on @neutron_org did +14% in the last 7D.

There's a couple of interesting things in this eco, and I wonder why I'm not seeing too many CT chads talk about it yet.

So, let me share this one really quick.

@neutron_org has nearly doubled its TVL since the last notable dip in August 2024 ($14.12m > $34.2m)

There haven't been a major airdrop in this ecosystem since the one done by @neutron_org in 2023, where 70M $NTRN (7% of the total supply), was distributed to $ATOM stakers & voters.

Now, @dropdotmoney is the biggest LSD on @neutron_org, but no native token yet. However, they raised $4M led by @coinfund_io last year (2024).

10% $DROP tokens is allocated for phase 1 participants in the "droplet" event which ended a few months ago. Phase 2 is live and 5% DROP tokens is allocated to participants, then TGE follows next.

My strategy? It's simple: earn droplets via $NTRN in a delta-neutral style.

Follow my guide here:

[Capital ≈ $1k. This will buy you ≈ 9,569 $NTRN at current price of $0.104]

1/ Buy spot $NTRN via @mars_protocol

2/ Visit @dropdotmoney, and stake $NTRN to receive dNTRN which tracks $NTRN 1:1.

Fyi, dNTRN is a 1:1 LSD of $NTRN. You'll use this to LP and trade.

3/ LP dNTRN/NTRN on @astroport_fi

To LP, you need equal value of both assets (dNTRN & NTRN), So, withdraw $200 dNTRN, swap $200 dNTRN to $NTRN, then LP them in the dNTRN/NTRN pool.

- This earns you 10x droplets

- You’re now long $NTRN twice through LP & the rest of your dNTRN

4/ LP dNTRN/USDC on Astroport

Withdraw $300 worth of dNTRN from Drop, swap half of it ($150) to USDC to form a balanced LP position, and LP in dNTRN/USDC pool via @astroport_fi

Note: we're leaving $300 so we can use it as collateral later on.

Result:

- earn 50x droplets

- still long $NTRN here via dNTRN

- but introduces IL risk due to pairing with USDC. So we need to hedge.

5/ Hedge $NTRN exposure via perps on @mars_protocol

The idea is to be delta-neutral, since you're exposed to price fluctuations via $NTRN, you'd need to offset your long exposures which are:

- $400 LP in dNTRN/NTRN pool @astroport_fi

- $150 LP in dNTRN/USDC pool @astroport_fi

So, short $550 worth of $NTRN perps at 1.83x leverage via @mars_protocol, using the remaining dNTRN minted from @dropdotmoney as collateral, but if you're monitoring closely, you may stay around 1.1x–1.3x for safety.

I think it's a dynamic move since you can use the remaining $300 worth of dNTRN as collateral. Also, this move earns you 5x droplet multiplier per $ worth of your asset.

Overall results:

- earning 10x droplets on dNTRN/NTRN LP

- earning 50x droplets on dNTRN/USDC LP

- earning 5x droplets via Mars collateral

- fully hedged against price volatility via perps

- Delta-neutral & yield-maximized.

Enjoy your LSD farming.

/ Marve's out :)

24.74K

48

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.