Treehouse (TREE) Overview

In the rapidly expanding decentralized finance (DeFi) landscape, there's a growing demand for fixed-income products, mirroring the role of bonds in traditional financial markets.

However, establishing a transparent, decentralized, and secure interest rate system on the blockchain remains a significant challenge. This is precisely why Treehouse was created: to unify the on-chain ETH interest rate market and lay the foundation for a fixed-income product ecosystem.

So, what makes this project special enough to be listed on Binance?

This Article ⤵️

1. What is Treehouse?

2. How Treehouse Operates?

3. Treehouse Products

4. Key Features of Treehouse

5. Tokenomics

6. Roadmap Q3/2025

7. Development Team, Investors, and Partners

🟡 Sign up on Binance today and get ready for Chainbase:

🌐 Follow Binance Vietnam for more updates:

• Telegram:

• Twitter: @binance_vietnam

• Facebook:

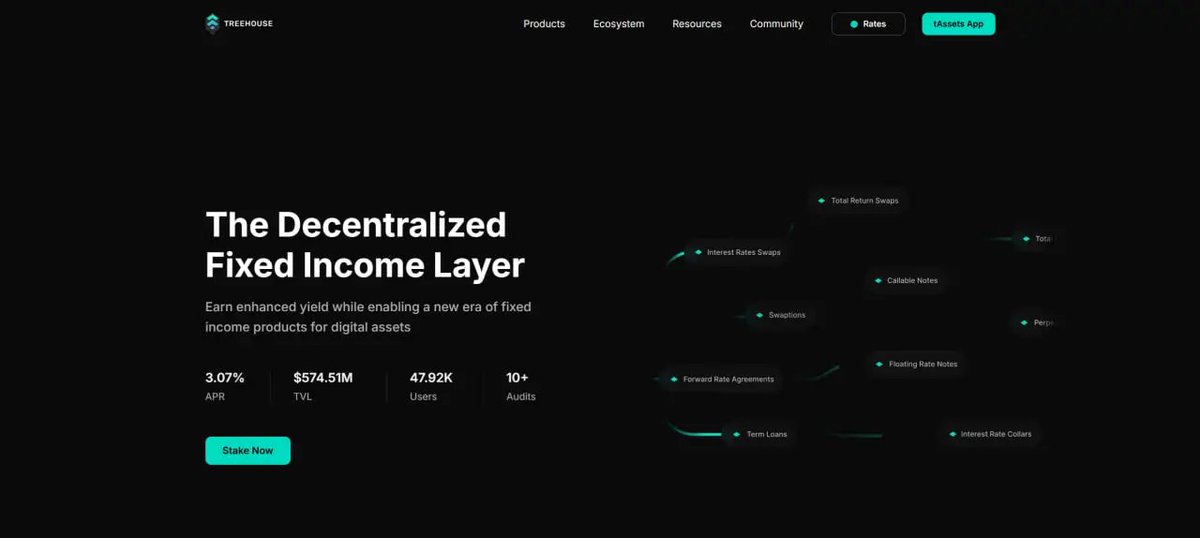

1. What is Treehouse (TREE)?

@TreehouseFi is a pioneering DeFi protocol focused on building a Decentralized Fixed Income Layer for digital assets. The project introduces two core infrastructure components:

• tAssets (e.g., tETH): These are liquid staking tokens that enable users to earn superior real yield compared to Ethereum's PoS rewards.

• DOR (Decentralized Offered Rates): This is a mechanism for establishing decentralized reference interest rates, analogous to LIBOR or SOFR in traditional finance, but implemented on-chain.

Treehouse's objective is to converge fragmented ETH interest rates into a unified standard, creating a foundation for long-term, stable, and accessible lending, borrowing, staking, and hedging products.

2. How Treehouse Operates?

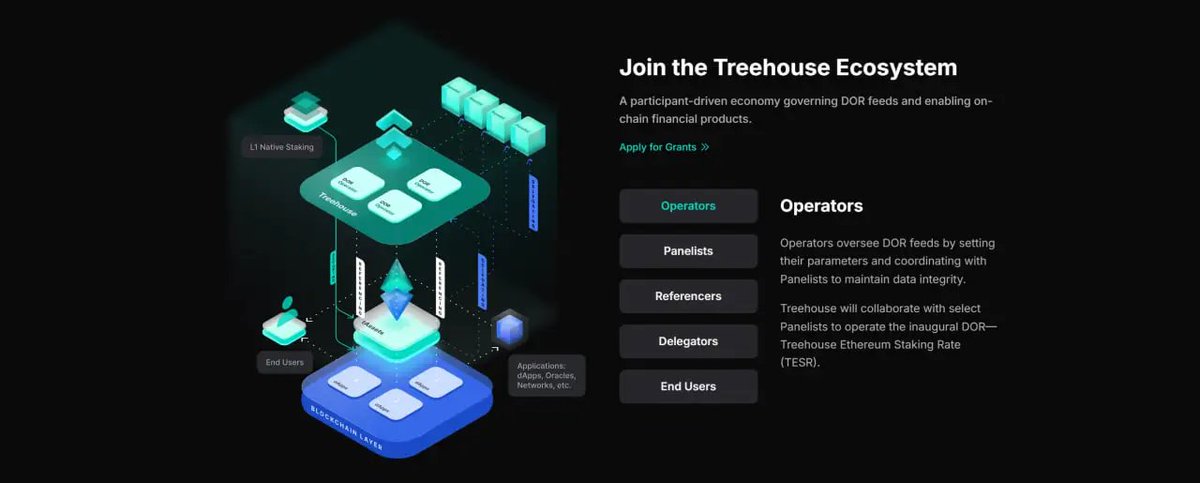

Treehouse operates based on a collaborative model involving various ecosystem participants:

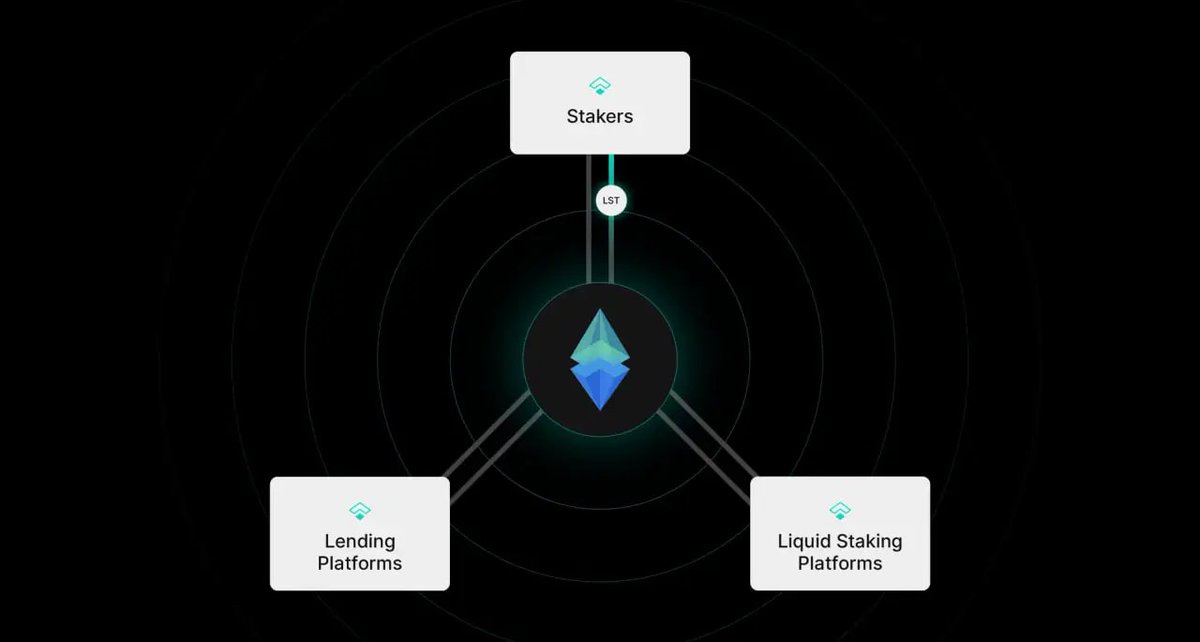

• Users deposit ETH or Liquid Staking Tokens (LSTs) into the protocol to receive tETH, thereby earning real yield and utilizing tETH within DeFi platforms.

• Operators initiate DOR Feeds. Treehouse will operate the first DOR called TESR (Treehouse Ethereum Staking Rate).

• Panelists (who are vetted) provide interest rate data or forecasts and stake TREE/tAssets to commit to accuracy.

• Delegators own tETH and delegate it to Panelists to fulfill DOR establishment obligations, while retaining token ownership.

• Referencers integrate DOR Feeds into financial products like lending, swaps, or derivative pricing.

• Clients are end-users who benefit from fixed-income products, arbitrage, or tETH staking.

Through a forecast-stake-reward/penalty-DOR establishment loop, Treehouse ensures a transparent, objective, and manipulation-resistant interest rate mechanism.

3. Treehouse Products

Treehouse develops core products aimed at building the fixed-income infrastructure layer for digital assets, encompassing staking, interest rate determination, and reward distribution.

3.1. tETH

tETH is Treehouse's first liquid staking asset, minted when users deposit ETH or LSTs (such as stETH, rETH, cbETH) into the protocol.

Utilities:

• Accumulate real yield through interest rate arbitrage strategies.

• Can be used as collateral on DeFi platforms like Aave, Compound, Pendle, and others.

• Supports economic security for DOR by staking or delegating to a Panelist. Goal: To converge on-chain ETH interest rates and provide a fixed-income solution for users.

3.2. DOR – Decentralized Offered Rates

DOR is a decentralized reference interest rate system, akin to LIBOR/SOFR but on the blockchain.

• First DOR: TESR (Treehouse Ethereum Staking Rate) – representing Ethereum's "risk-free" interest rate.

• Operation: Determined by Panelists who stake TREE or tETH and submit interest rate forecasts. The results are aggregated and recorded on-chain.

• Application: Integrated by platforms (Referencers) to price financial products such as lending, fixed yield, and derivatives.

3.3. GoNuts Point System

The GoNuts Point System is a reward system designed to incentivize early participation in Treehouse. How to earn points:

• Deposit ETH or LSTs to receive tETH.

• Provide liquidity on integrated platforms.

• Participate in staking, delegation, or contribute to the DOR establishment process.

Utility: Nuts points will be used for ranking, distributing TREE airdrops, or exchanging for benefits within the Treehouse ecosystem.

4. Key Features of Treehouse

Treehouse possesses several notable characteristics:

• Unification of ETH Interest Rates: Helps converge fragmented yields into a risk-free interest rate standard, similar to government bonds in TradFi.

• Upgraded Liquid Staking: tETH allows users to participate in yield arbitrage while maintaining liquidity and usability within DeFi.

• Enhanced Economic Security: Holding tETH helps ensure the integrity of the DOR system.

• Multi-protocol Integration: tETH can be used as collateral on platforms like Aave, Compound, Euler, Pendle, Gearbox, and others.

• Multi-layered Incentives: Users can simultaneously earn yield, accumulate Nuts points, and potentially receive airdrops from multiple sources.

5. Tokenomics

5.1. Token Metrics:

• Token Name: Treehouse

• Ticker: TREE

• Contract: 0x77146784315Ba81904d654466968e3a7c196d1f3

• Blockchain: Ethereum (ERC)

• Total Supply: 1,000,000,000 TREE

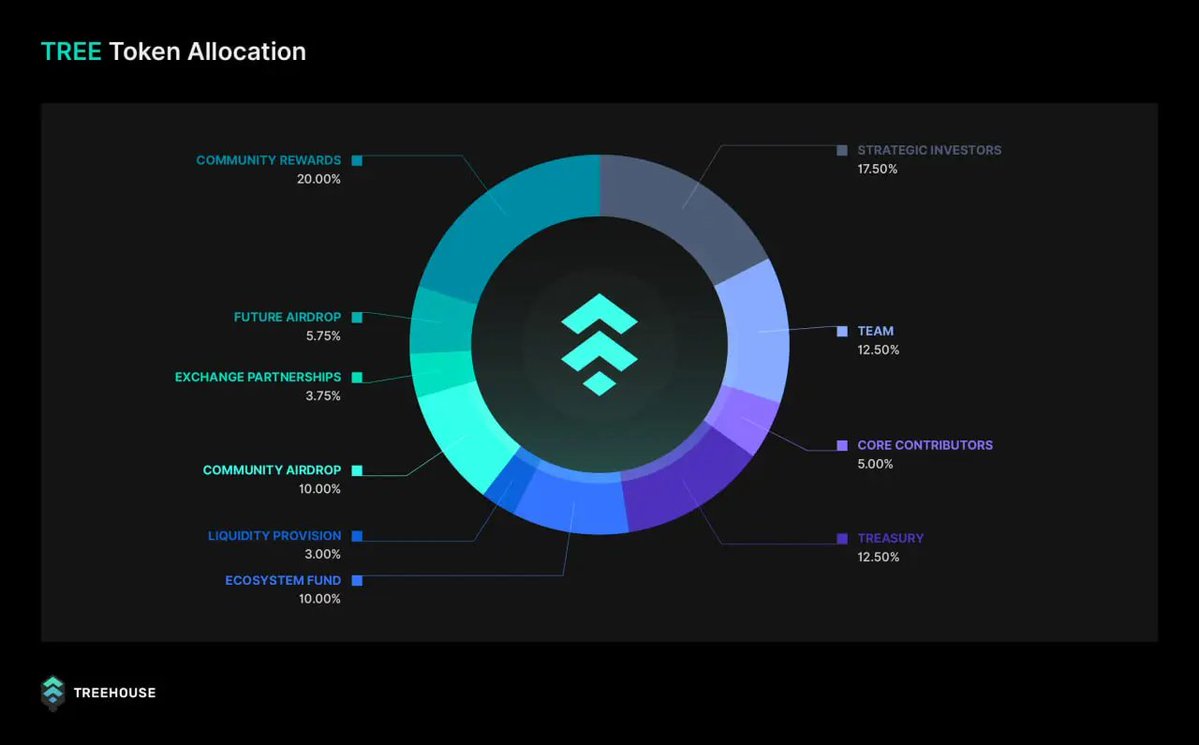

5.2. TREE Allocation:

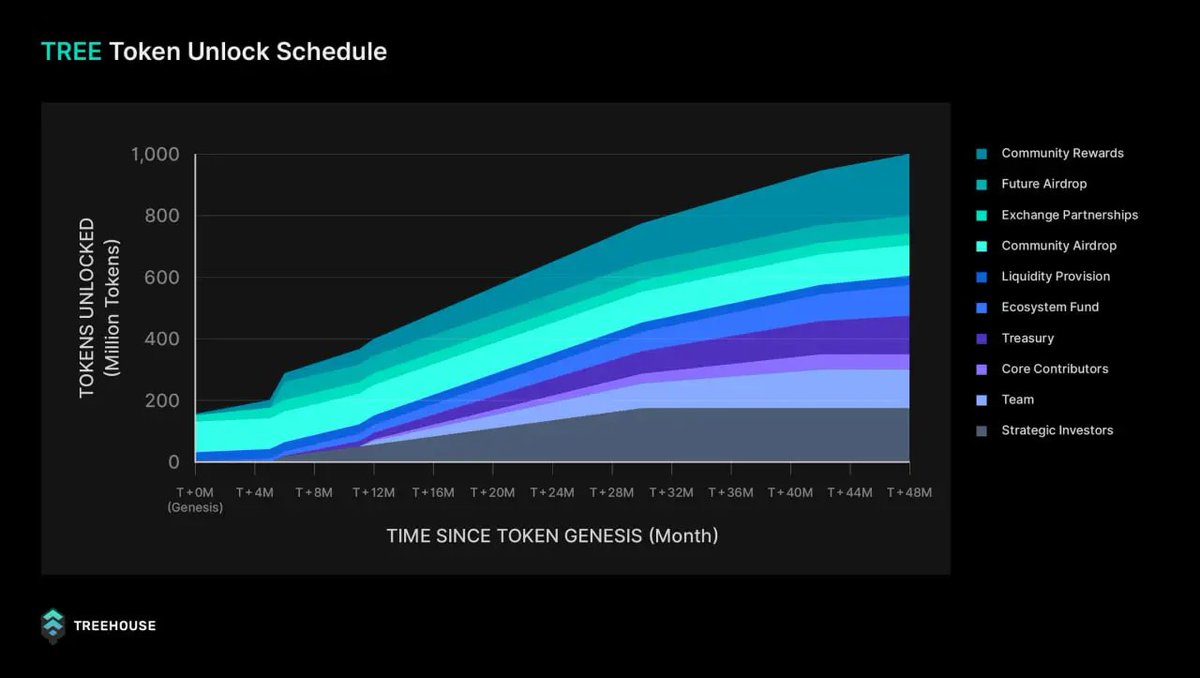

5.3. Token Vesting Schedule:

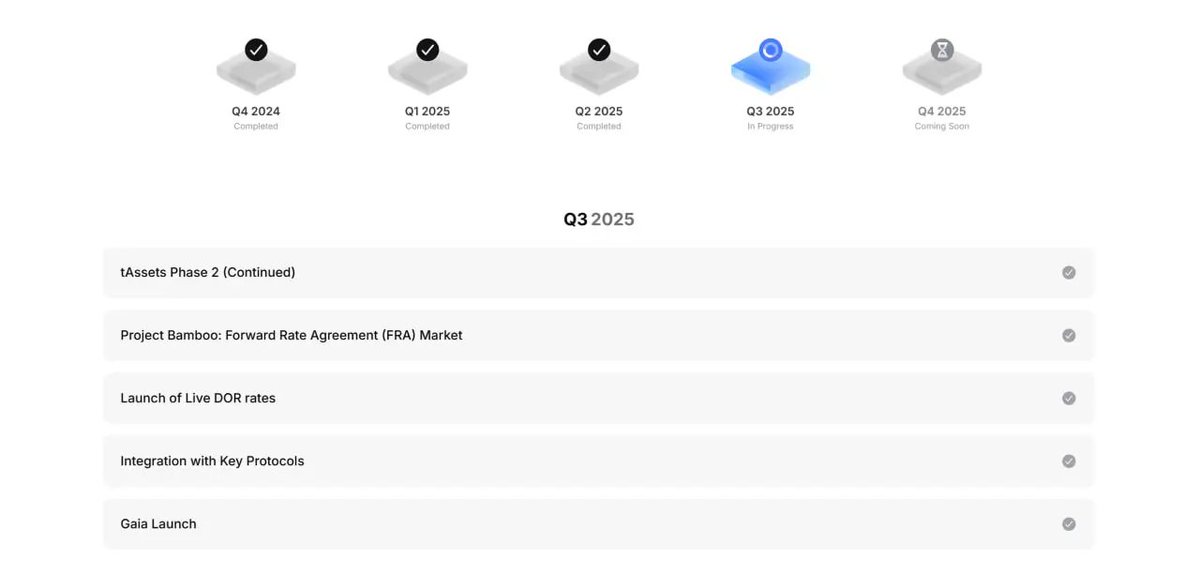

6. Roadmap

Treehouse's roadmap for Q3 2025 includes:

• Phase 2 of tAssets: Expanding and upgrading the tAssets product line, including support for new LSTs and enhanced DeFi integration.

• Project Bamboo – Forward Rate Agreement (FRA) Market: Developing and launching an FRA market to support interest rate hedging and trading based on future interest rate forecasts.

• Deployment of Live DOR Rates: Launching live on-chain DOR feeds, starting with TESR and potentially expanding to other asset types.

• Integration with Key DeFi Protocols: Connecting tETH and DOR with platforms like Compound, Aave, Euler, Gearbox, etc., to broaden practical applications.

• Launch of Gaia: Introducing Gaia – a new product or platform within the Treehouse ecosystem (details to be further clarified).

7. Development Team, Investors, and Partners

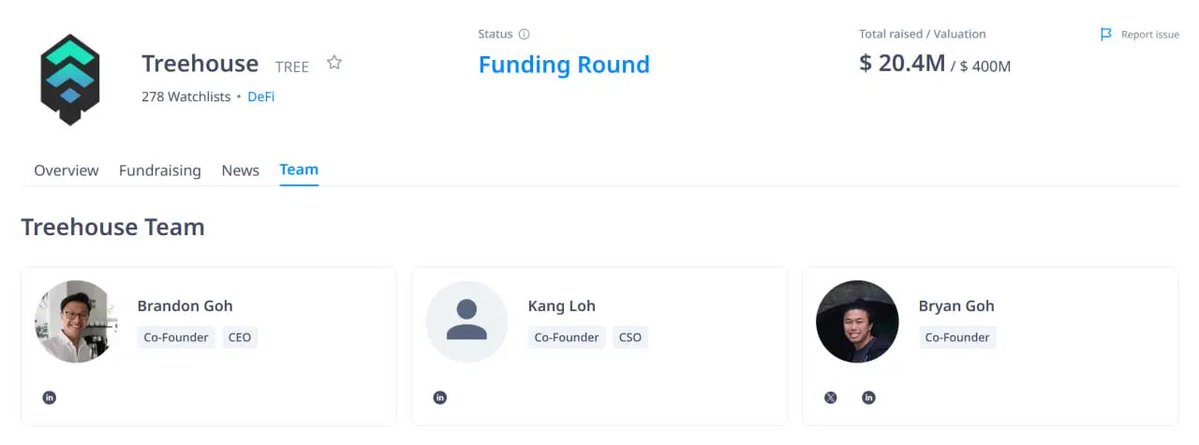

7.1. Treehouse Founding Team

Treehouse is led by individuals with extensive experience in both traditional finance and startup technology:

• Brandon G. – Co-Founder & CEO: Formerly held roles at major financial institutions like Wells Fargo and Morgan Stanley. He co-founded Treehouse in 2021, overseeing the project's development and operations, and representing Treehouse at events like MooFest 2025 and DeFi Fixed Income podcasts.

• Bryan Goh – Co-Founder: Has a strong background in travel-tech, having founded Host Bully, Dibly, Native, and Travelr (acquired by Hotels(.)com(.)sg). At Treehouse, he leads product and design, focusing on intuitive user experiences for products like tETH and TESR.

• Ben Loh – Co-Founder: Prior to Treehouse, Ben participated in the Venture Fellow program at AV/Blue Ivy Ventures, gaining experience in venture capital and startup analysis. At Treehouse, he connects technology, on-chain data, and long-term product strategy.

7.2. Investors

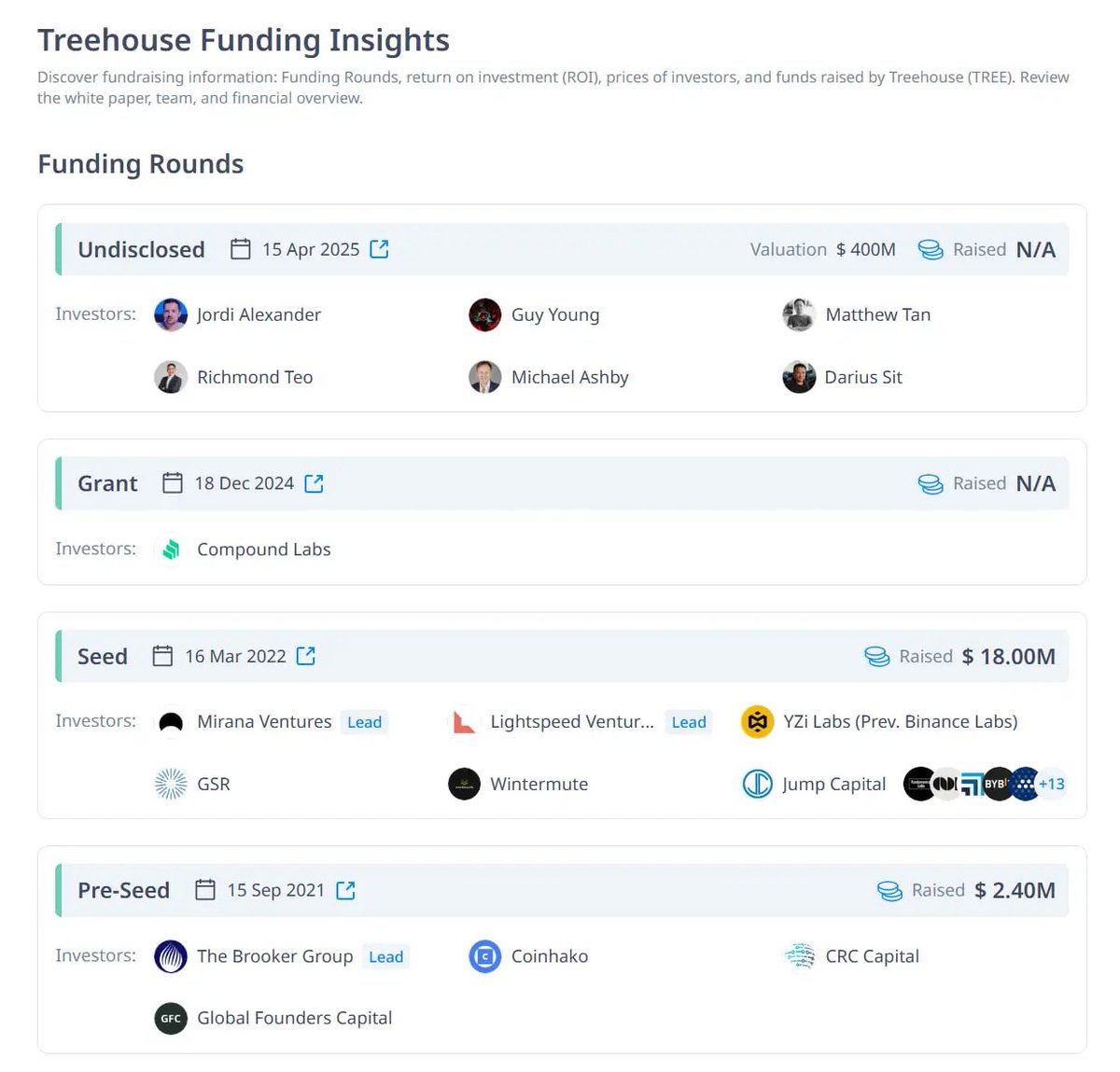

Treehouse has successfully completed several funding rounds:

• Strategic Round – April 15, 2025: Treehouse completed a strategic funding round at a valuation of up to $400 million (amount raised not disclosed). This round attracted notable individual investors such as Jordi Alexander (Selini Capital), Guy Young (Ethena), Matthew Tan (Etherscan), Richmond Teo (Paxos APAC), Michael Ashby, and Darius Sit (QCP Capital), indicating strong confidence in the project's long-term vision for establishing a fixed-income layer for DeFi.

• Grant – December 18, 2024: Treehouse received a grant from Compound Labs, a leading lending protocol on Ethereum. This grant supports Treehouse in developing decentralized interest rate infrastructure and deeper integration within the existing DeFi ecosystem. The specific amount was not disclosed but marks a significant strategic partnership milestone.

• Seed Round – March 16, 2022: Treehouse successfully raised $18 million in its Seed round. This round was led by Mirana Ventures and Lightspeed Venture Partners, with participation from YZi Labs (formerly Binance Labs), GSR, Wintermute, Jump Capital, and over 13 other investors. These funds were used to build initial products like tETH and the DOR platform.

• Pre-Seed – September 15, 2021: In its very early stage, Treehouse raised $2.4 million from strategic investors including The Brooker Group (lead), Coinhako, CRC Capital, and Global Founders Capital. This Pre-Seed round laid the groundwork for market research, economic model development, and founding team recruitment.

7.3. Partners

Treehouse is actively collaborating with leading DeFi protocols to enhance the application of its products, such as integrating tETH into various Lending & Derivatives protocols like Aave, Compound, Euler, Gearbox, and Pendle.

11.7K

24

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.