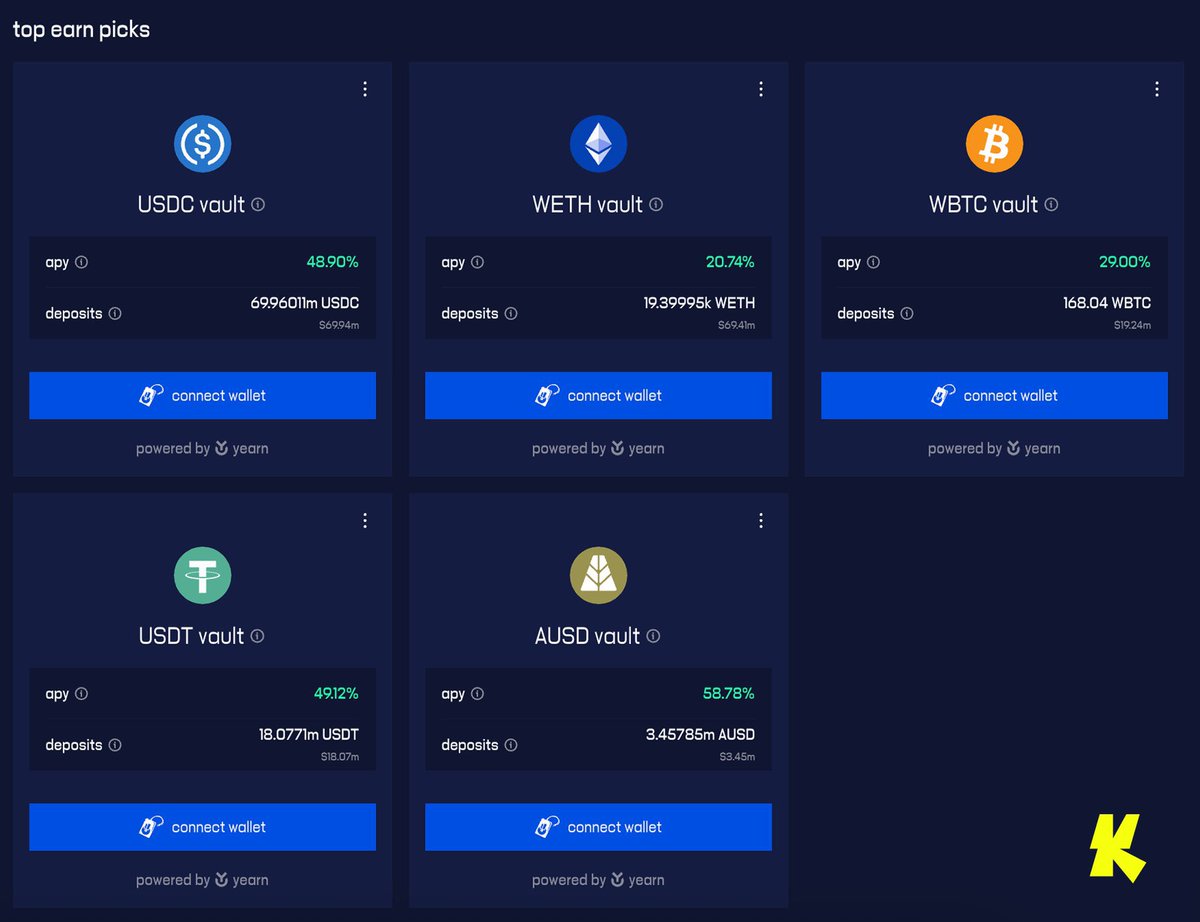

Recently, while browsing Twitter, I came across a foreign DeFi blogger discussing Katana, claiming it’s a project that offers up to 48% annual interest on USDT/USDC even before its TGE, with the condition that funds must be locked until before 2026. Although it sounds a bit crazy, I was indeed intrigued and took a look at some previous content from Lombard, discovering that they have a close relationship with Katana!

In short, this is not just another cross-chain integration for BTC. Lombard has become the sole issuer of BTC on Katana, introducing two new assets:

※ BTCK: Decentralized BTC mapping

※ LBTC: BTC LST with built-in yield

Compared to centralized options like WBTC and BTCB, these two new tokens are thoroughly embedded in the underlying structure of Katana. In the future, when it comes to on-chain scheduling and settlement, the default will be to use them rather than some alternative. This is also why Katana has directly signed Lombard as its sole partner; they want BTC to be a foundational layer that grows together with the ecosystem, not just an add-on!

Interestingly, Katana is not a standalone chain; it is actually the DeFi and liquidity hub of the larger Agglayer network. Agglayer itself connects to many specialized L2s, such as IoTeX (DePIN), Wirex (payments), Sentient (AI), Moonveil (gaming), and more, with a bunch of use cases still in incubation.

So, from this perspective, Lombard is not just launching a new chain but has secured a strategic position: to be the official entry point for BTC liquidity within the entire Agglayer/@0xPolygon ecosystem!

For Lombard, this is actually quite smart: they don’t have to connect to dozens of L2s themselves but can instead focus on a central hub that will distribute BTC to all downstream. As Katana’s liquidity expands, the usage of LBTC and BTCK will also rise!

If you’re like me and considering an early asset allocation (or trying to catch a future Katana airdrop), this could be a relatively rare opportunity. The lock-up period is long, but sometimes, high interest and early dividends require patience!

Show original

14.23K

191

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.