Hard pegging vs. soft pegging 🧵👇

We just had our first redemption of ebUSD!

So wanted to share how @ebisu_finance ensures ebUSD's $1 peg

- What are redemptions?

- How redemptions affect borrowers & interest rates?

- How to prevent being redeemed?

- Hard vs soft pegging forces.

Redemptions get a bad rap, but they're super important in ensuring system stability.

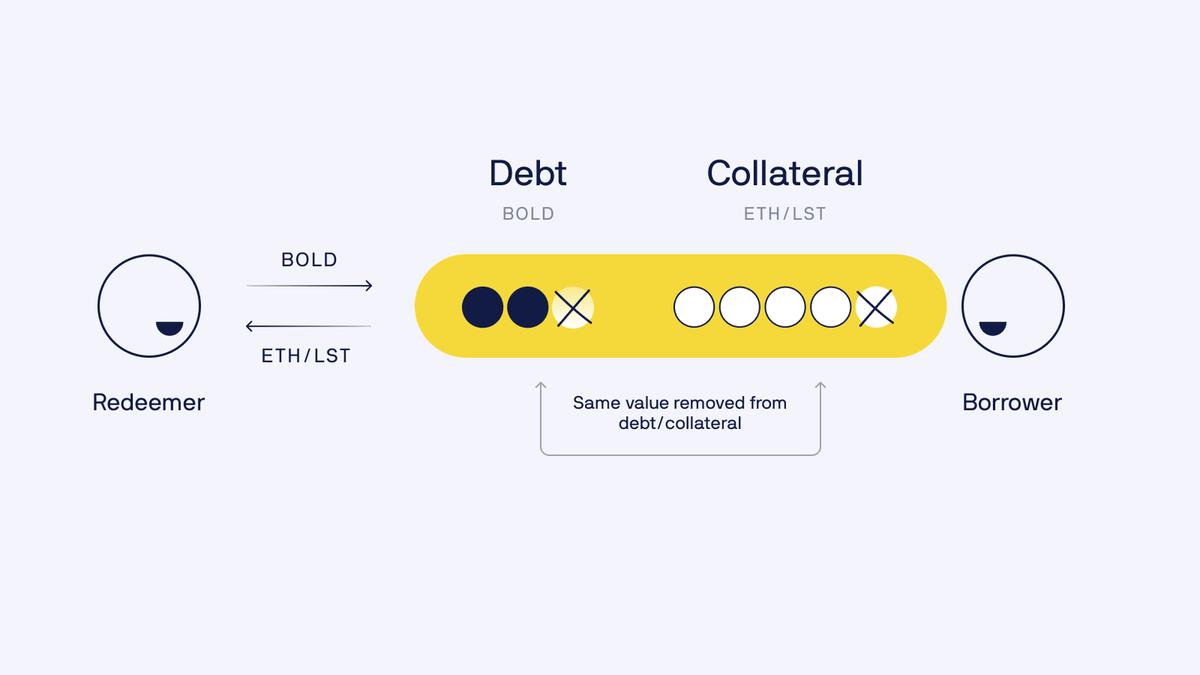

If ebUSD depegs, redemption bot can buy ebUSD at a discount & redeem it for $1 of collateral.

This arbitrage opp creates buy pressure + reduces ebUSD supply during depegs -> ebUSD back to $1.

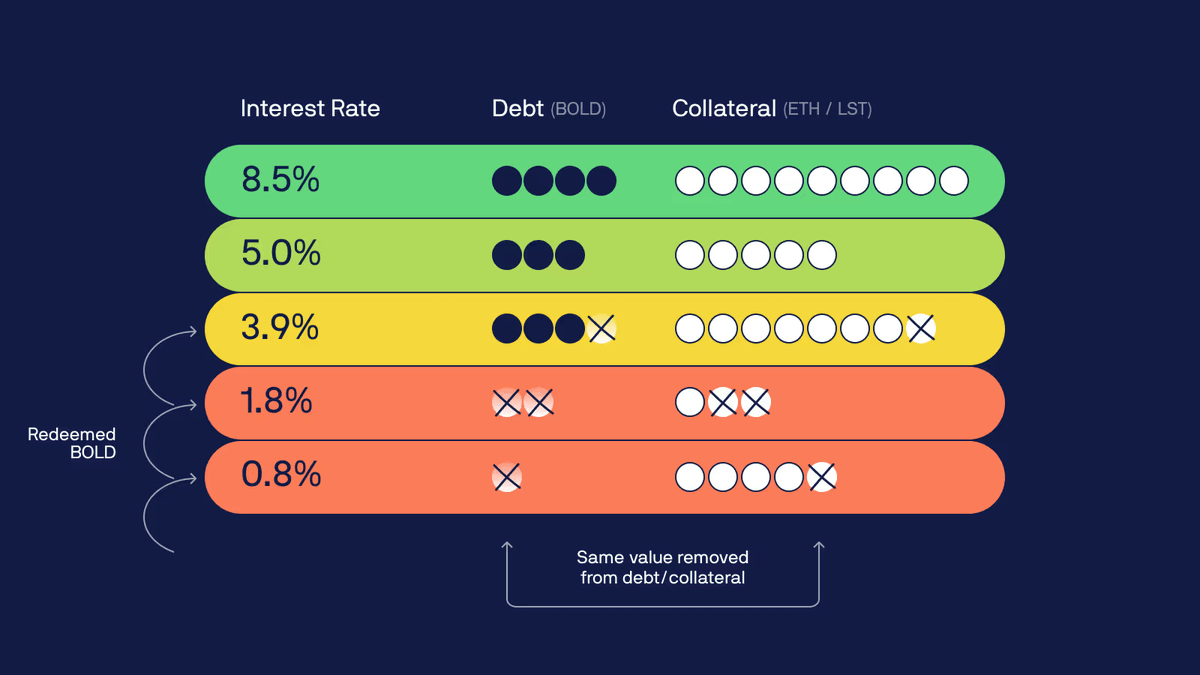

The collateral given to Redeemer comes from loans paying the lowest interest rate relative to other loans against the SAME collateral.

(Remember borrowers set their own rate on Ebisu)

This DOES NOT incur losses for borrowers, as the loan debt is reduced proportionally to the redeemed amount.

But they do lose collateral exposure. For yield-bearing stablecoin collateral it's chill, but for BTC/ETH borrowers it can be sad.

How to avoid redemptions?

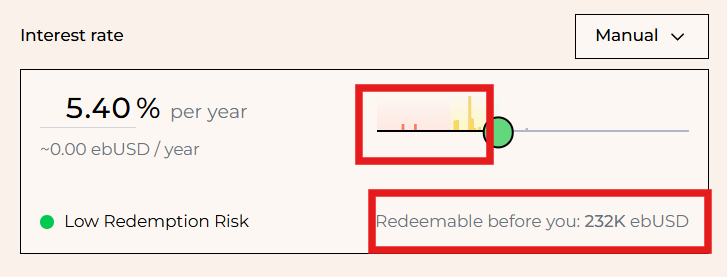

1. Manually set your rate above other borrowers: Observe how much ebUSD is redeemable before you. Monitor your position & ebUSD peg, and adjust your rate accordingly

2. Delegate the management of your interest rate to a third party for a small fee

Why are redemptions & user-set rates related?

Redemptions have the effect of raising system-wide borrowing rates, tightening ebUSD issuance.

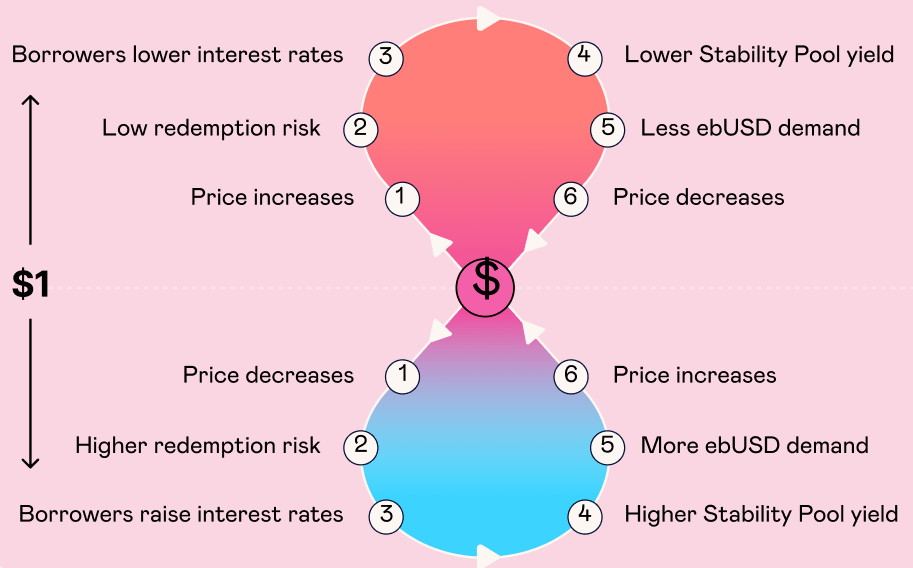

Depeg:

1. Borrowers set rates too low

2. Excess ebUSD supply

3. Sell pressure from carry trades/rate arbitrate

4. Low Stability Pool yields* -> low ebUSD demand

Re-peg:

1. Arbitrageurs buy discounted ebUSD and redeem

2. Supply contracts, peg returns to $1

3. Low-rate borrowers collateral redeemed, debt canceled

4. Borrowers raise rates to avoid redemption

5. Higher rates -> higher Stability Pool yields boosting ebUSD demand

*SP depositors get 75% of interest paid by borrowers

The diagram shows a soft peg for ebUSD is created ~$1 where borrowers compete by setting rates that balance cost with redemption risk, while ebUSD earners assess whether the offered rates justify risk.

Ebisu is a market for rates where a dynamic equilibrium emerges at $1 peg 🤌

TLDR

Hard peg: Redemptions prevent downwards depegs via 1:1 redemptions.

Soft pegging refers to the economic/normative forces that support ebUSD's peg.

Great read on hard & soft peg of @LiquityProtocol LUSD by @TokenBrice

More on how @TelosConsilium manages rates

1.9K

21

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.