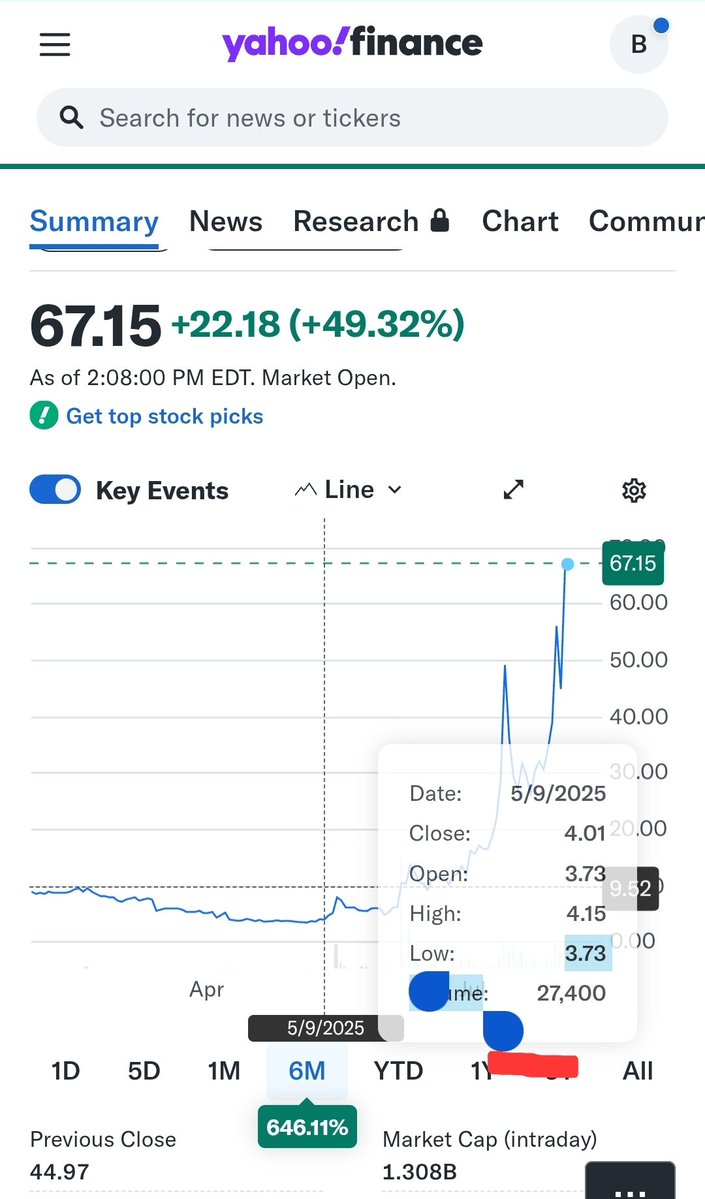

I hope my followers have done well on this one $NEGG

Asymmetric Bet Analysis: @Newegg $NEGG (NEGG) at All-Time Lows + Bitcoin Strategic Reserve Hypothesis

I. Asymmetric Bet Framework

An asymmetric bet means the downside is limited, while the upside is exponential. Newegg, trading near all-time lows after a reverse split, may offer that structure:

1. Downside Case (Limited Risk)

Current Market Cap: Tiny relative to competitors; possibly near liquidation value.

Assets: Physical inventory, brand equity in niche PC/gaming enthusiast community.

Price Action: The reverse split reflects prior dilution and negative sentiment, already priced in.

Floor: With cash on hand and minimal debt, the equity may not have much further to fall in percentage terms.

2. Upside Case (Speculative Alpha)

Crypto-Native Retailer: Already accepts crypto including BTC, ETH, DOGE, LTC, and SHIB.

Unique Market Position: One of the few e-commerce firms with native crypto infrastructure and brand awareness in the Bitcoin-friendly tech crowd.

Turnaround or M&A Target: With its infrastructure and e-commerce footprint, Newegg could be attractive to crypto-aligned acquirers or for AI-hardware partnerships.

II. Bitcoin Strategic Reserve Thesis

A Bitcoin Strategic Reserve (BSR) is when a company converts crypto revenue into BTC and holds it on the balance sheet, as a long-term inflation hedge and treasury strategy (à la MicroStrategy). Newegg is an unusually fitting candidate:

1. Operational Precedent

Already accepts crypto — unlike other firms who must first onboard the tech and culture.

Conversion infrastructure already exists. The leap from accepting BTC to holding BTC is much smaller than for traditional retailers.

2. Brand Synergy

Serves a tech-savvy customer base (gamers, miners, hardware builders) with high Bitcoin overlap.

A strategic BTC reserve could attract free attention from Bitcoin Twitter and mainstream financial media.

Could enhance Newegg’s appeal to Bitcoiners, who often reward pro-BTC companies with loyalty.

3. Strategic Playbook

Newegg could adopt a staged model:

Stage 1: Announce conversion of all crypto received into BTC (vs converting to fiat).

Stage 2: Retain a small BTC balance as part of treasury diversification.

Stage 3: Publicly commit to a BTC reserve policy — à la “Bitcoin Standard for e-commerce.”

This would position Newegg as:

"The first publicly listed e-commerce company operating on a Bitcoin-native treasury model."

III. Optionality and Narrative Risk

The investment thesis rests on:

Optionality: Newegg doesn't need to succeed in massive BTC accumulation for upside — a mere announcement could spark outsized sentiment-driven gains.

Narrative Alpha: In a bull market, a “Newegg goes Bitcoin Standard” headline could ignite momentum trading.

Low Cost of Bet: If you assume the company is at or near distressed valuation, your entry cost is low relative to potential breakout.

IV. Conclusion

Newegg is a speculative, asymmetric bet on two fronts:

A distressed turnaround story with tech/e-comm infrastructure in place.

A sleeper Bitcoin adoption play—with actual rails already laid, and massive untapped Bitcoin branding potential.

Should Newegg embrace even a small BTC reserve strategy, it could:

Change the company’s public narrative.

Expand its shareholder base to include Bitcoin-aligned investors.

Potentially ride the same attention wave that once sent MicroStrategy stock up over 1000%.

This is not a fundamentals-based value play — it's a narrative+optionality bet with skewed upside in a macro environment ripe for Bitcoin-aligned corporate adoption.

394

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.