In the past few days, I've revisited the community operations of @TheoriqAI and increasingly feel that this is not just a project that shouts slogans, but a rare team that truly treats the community as partners.

1. Theoriq's community approach is a long-term partnership.

From the early testnet incentives to the later Yapper behavior scoring mechanism, and now to the community sales round on @KaitoAI, Theoriq has maintained a clear rhythm. It’s not the short-term style of quickly pulling in new users and then withdrawing, but rather a step-by-step approach to create a closed loop of "participation → construction → profit."

Especially the Aura mechanism of Yapper, I find it very interesting. It doesn’t simply look at whether you have posted content or if your account is large, but rather whether you are genuinely participating, interacting, and providing quality. Ultimately, it aims to filter out those who can "stick around to do the work" rather than the speculative accounts that come and go quickly.

Currently, Theoriq's data is also impressive:

- 440,000 followers on X

- Total community size close to 500,000

- No "pump and dump culture," the atmosphere is not competitive, more like a serious work environment.

2. The data from Arbitrum indicates that it is no longer just a scaling chain.

Many businesses choosing to operate on @arbitrum is not a coincidence. Recently, I looked at some DeFi data from Arbitrum and found that this ecosystem now has a very solid infrastructure capability:

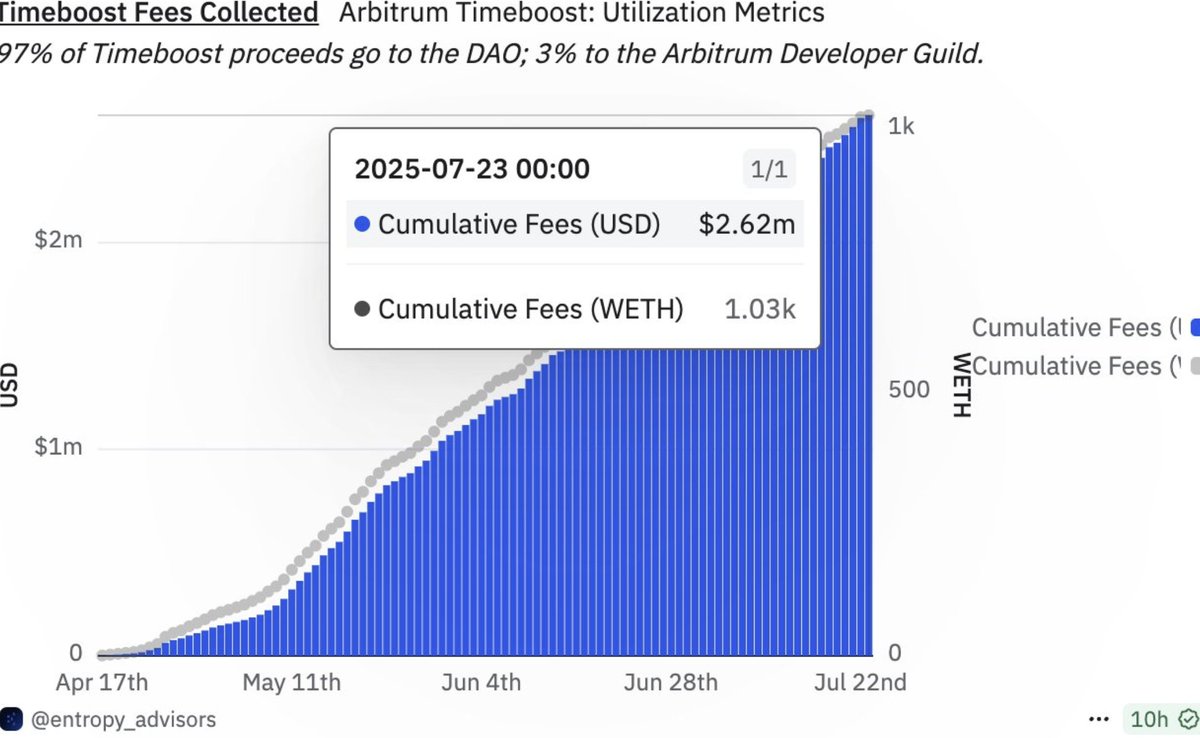

- Timeboost has been online for three months, generating a total of $2.62 million in revenue

→ This indicates that the ecosystem already has real users and real use cases.

- The total trading volume of perpetual contracts exceeds $837 billion

→ It is currently one of the most active and liquid perpetual markets across all chains.

- The EU government bond token assets launched by Spiko are growing rapidly, with total custody exceeding $150 million

→ This marks the real-world assets (RWA) beginning to land in Web3, no longer just a concept existing in white papers.

These data points indicate that Arbitrum has evolved from a "technical scaling tool" to a "real business hosting platform."

3. The combination of Theoriq + Arbitrum is worth long-term attention.

Currently, many people are just chasing airdrops and XP, only looking for immediate profits, but projects like Theoriq, which take a slower pace, actually have greater potential. It’s more like building an on-chain production system centered around AI agents, rather than just doing a round of traffic and then leaving.

Moreover, it has chosen Arbitrum, which is currently the most practical chain in Web3 DeFi, making the collaboration between the two quite natural.

If you are currently:

- Looking to participate in a long-term project where you can engage in content/community/strategy

- Hoping for more opportunities beyond airdrops, such as identity, dividends, and governance

- Also recognizing the main line of AI + Onchain

Then Theoriq is worth keeping an eye on.

4. Summary of participation methods:

- Go to @KaitoAI to participate in Theoriq's community sales round (Base chain USDC deposit)

- Join the Yapper content leaderboard, write posts, comment, participate in the community, and increase your Aura score.

- Collaborate on the @shoutdotfun platform to boost influence (you can follow tokens like $ENERGY, $SHOUT, $BOOM, $FAN, $MGANG, etc.)

- Also keep an eye on other emerging projects on @arbitrum, such as @spiko_xyz, @factor_fi, @sommelierxyz, which are all potential interaction or content opportunities.

Conclusion | Just chasing airdrops is only the beginning; being able to stick around and work is the real opportunity.

Some projects are suitable for making a quick profit and leaving, while others are suitable for staying and building a system together. From what I see, Theoriq is the latter.

#Theoriq #Yapper #KaitoAI #Arbitrum #RWA #DeFi #InfoFi #TheoriqAI

@TheoriqAI @KaitoAI You really know how to have fun!

35.38K

153

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.