Most stablecoins suck at generating yield relying on slow DAOs or fund managers.

@capmoney_ flips the script with a decentralized marketplace for yield.

Everything you need to know about cap in under 2 minutes 👇

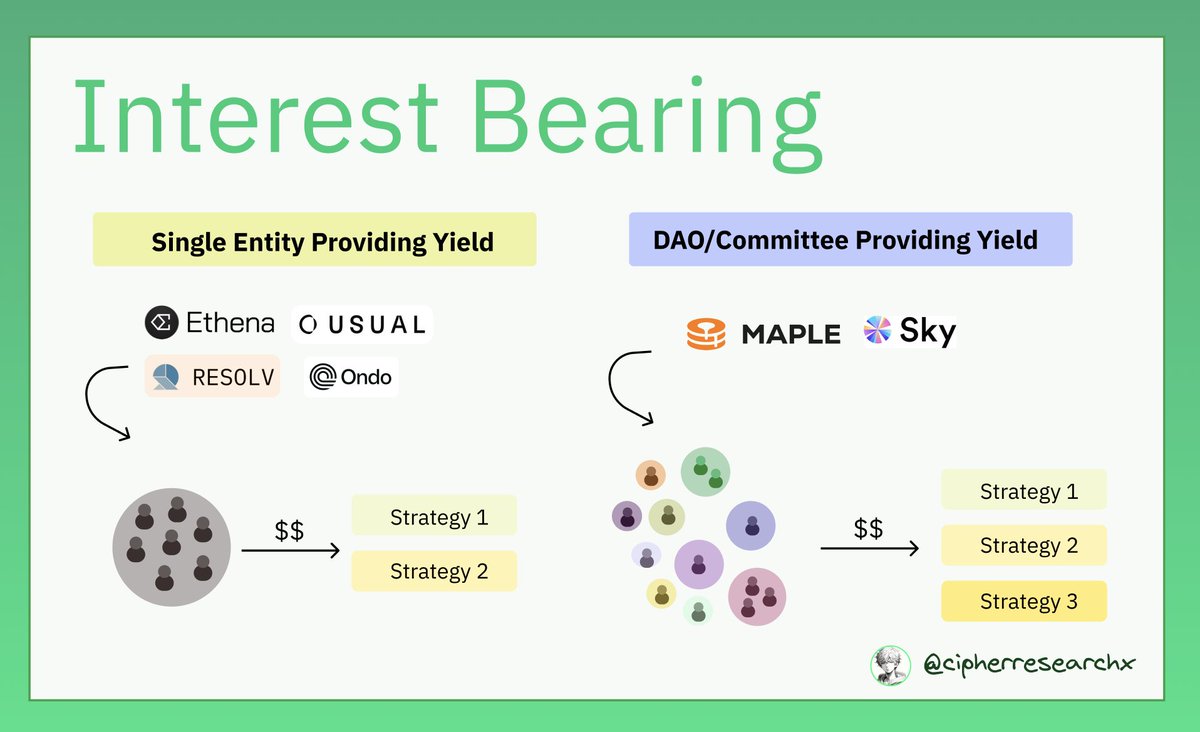

The Current Landscape

Most yield-bearing stablecoins today follow one of two models:

1. Centralized Teams that assess and deploy capital into strategies.

2. DAOs that vote on which strategies to allocate funds to.

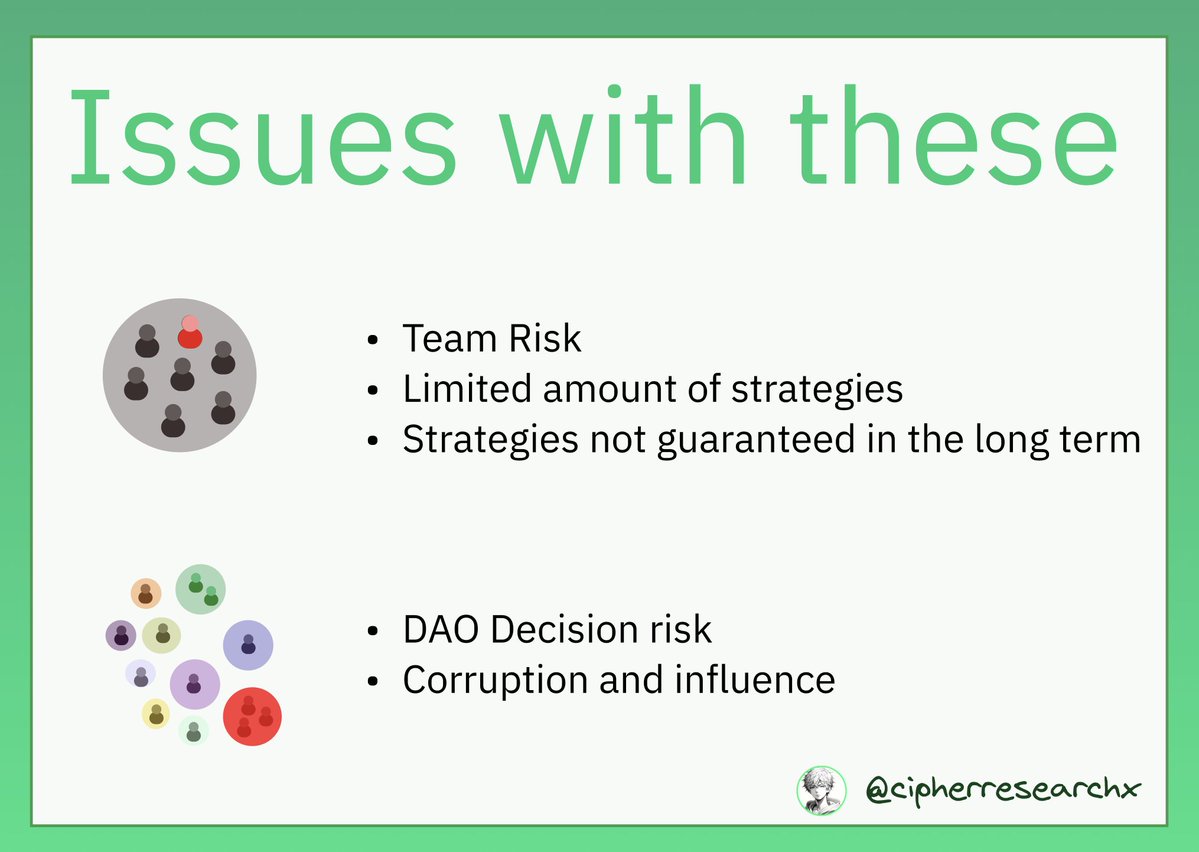

Both have fundamental flaws:

Teams may deploy into unproductive strategies or have no real edge in the long term.

DAOs can be slow, political, or captured - leading to misaligned incentives or poor capital allocation.

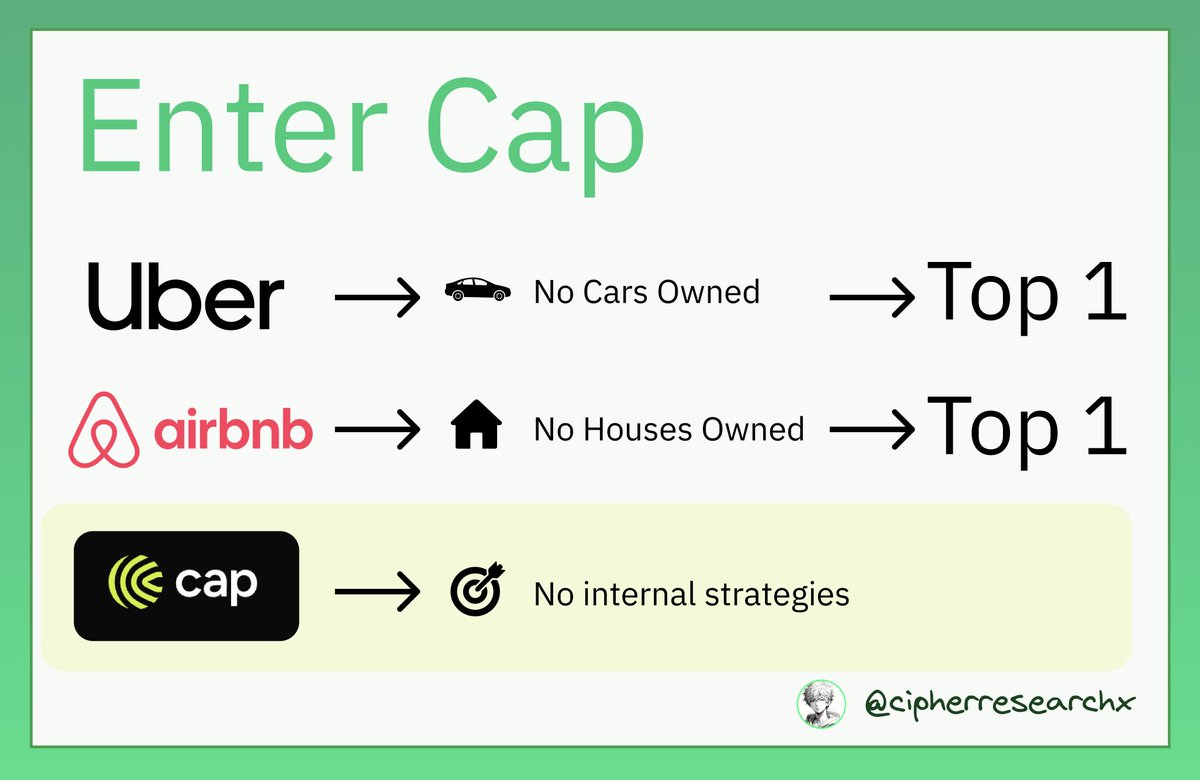

Cap is launching a new type of stablecoin.

The insight is simple: Uber and Airbnb became giants without owning any cars or homes. They just built a marketplace.

Cap is doing the same for yb stablecoins:

A decentralized marketplace that connects capital, strategy, and security

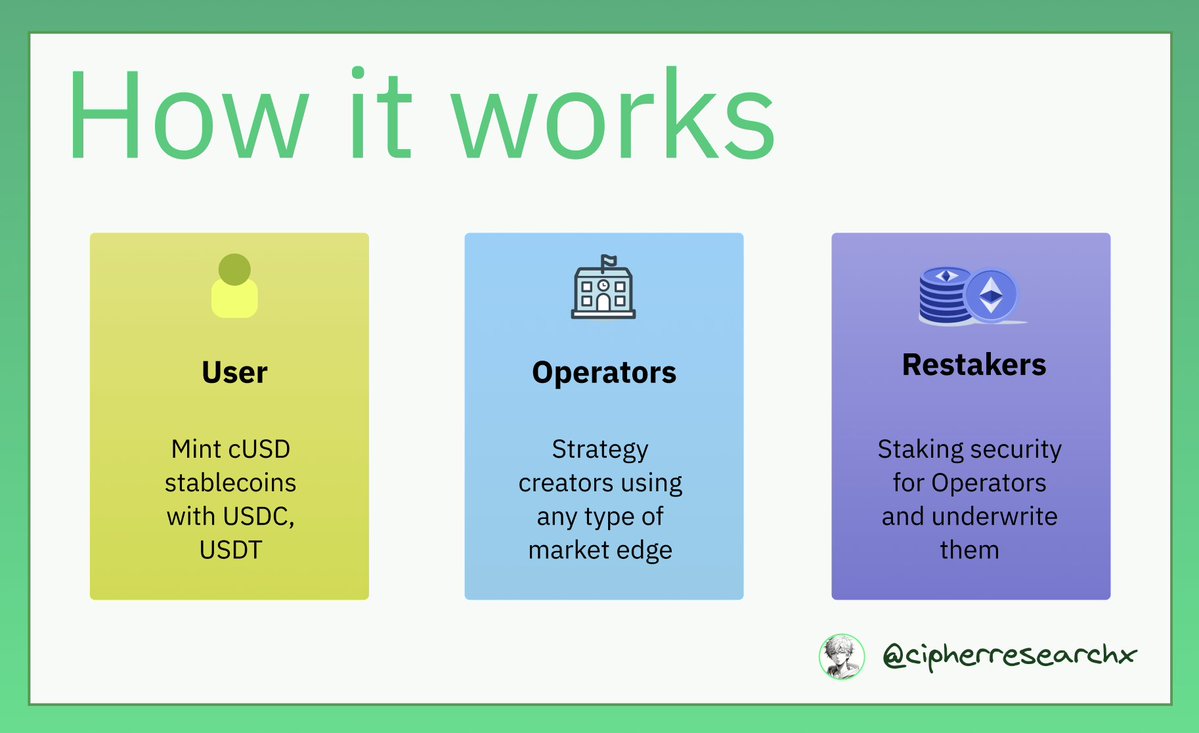

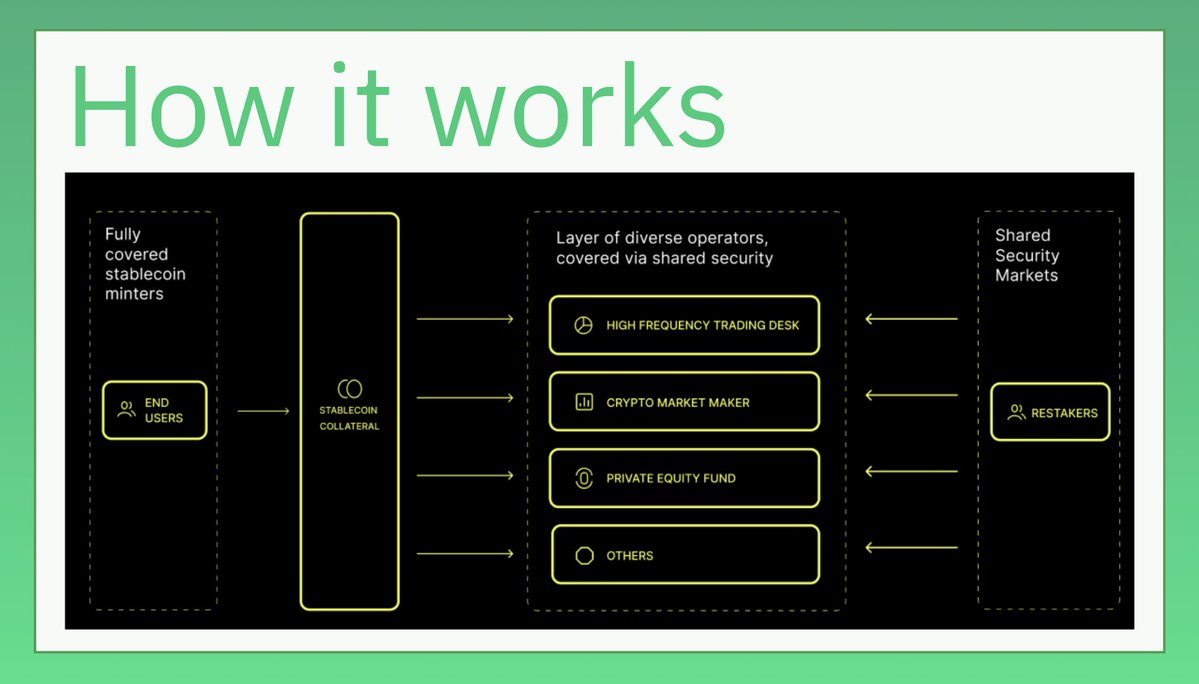

Cap’s system has three core actors:

1. Users deposit stablecoins (like USDC) to mint Cap’s stablecoin: cUSD.

2. Operators borrow that capital to run proprietary yield strategies like arbitrage.

3. Restakers delegate to trusted operators and underwrite their risk

Here’s how it works:

When users deposit stablecoins, that capital is loaned to operators.

Restakers choose which operators to back and how much they can borrow.

Operators then use this to run strategies.

If an operator incurs losses, the restakers are slashed, not the users.

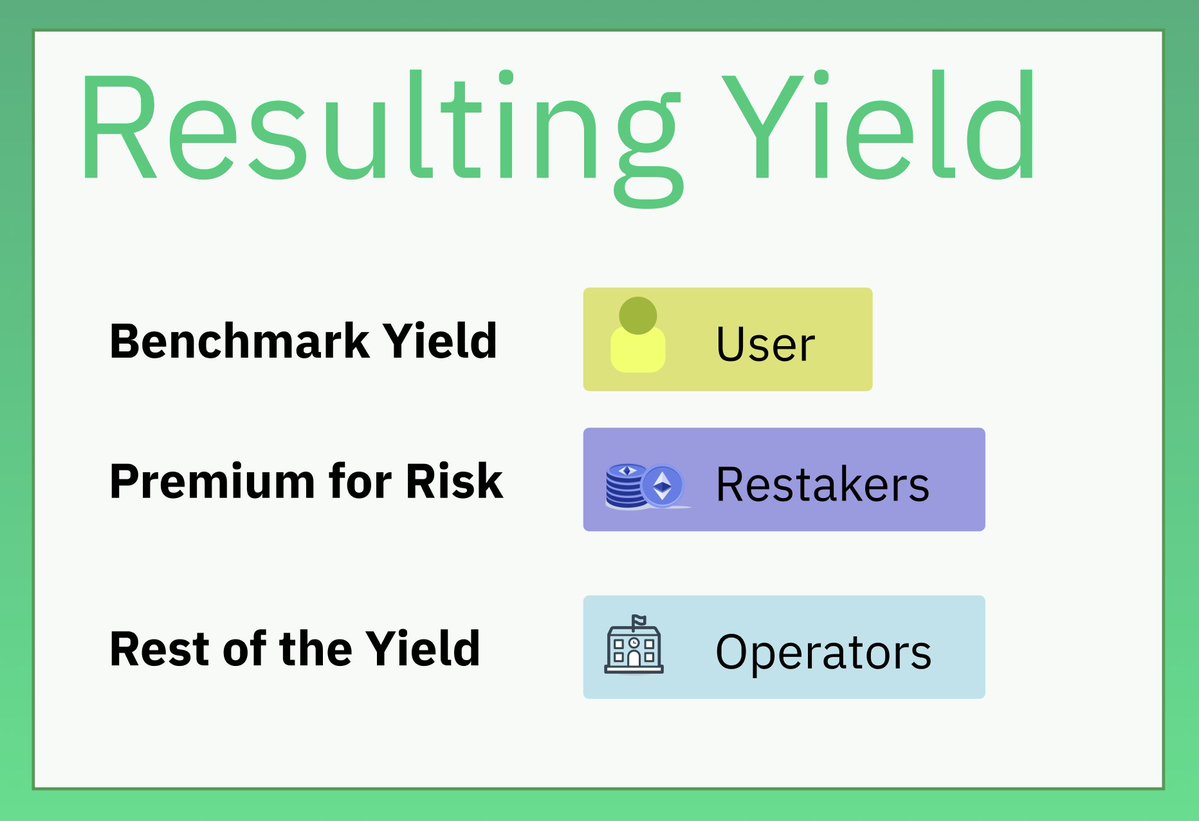

Yield Distribution

- Users receive a benchmark yield.

- Restakers earn a premium for taking on risk.

- Operators keep the upside above the benchmark, creating strong incentives to perform.

All of this is enforced through smart contracts.

That’s it for this quick explainer on @capmoney_ , let us know if you’d like a full deep dive.

Tagging some of the core team and supporters to check this out:

@Benjamin918_

@stablejae

@the_weso

@ClemToune

@DeFiDave22

@0xMegaMafia

1.93K

20

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.