📽 It’s time for another weekly crypto roundup!

@mattzahab and @Rachelwolf00 are back with Episode 54, hosting a solo episode and breaking down the latest crypto headlines.

Don’t miss out — tune in now!👇

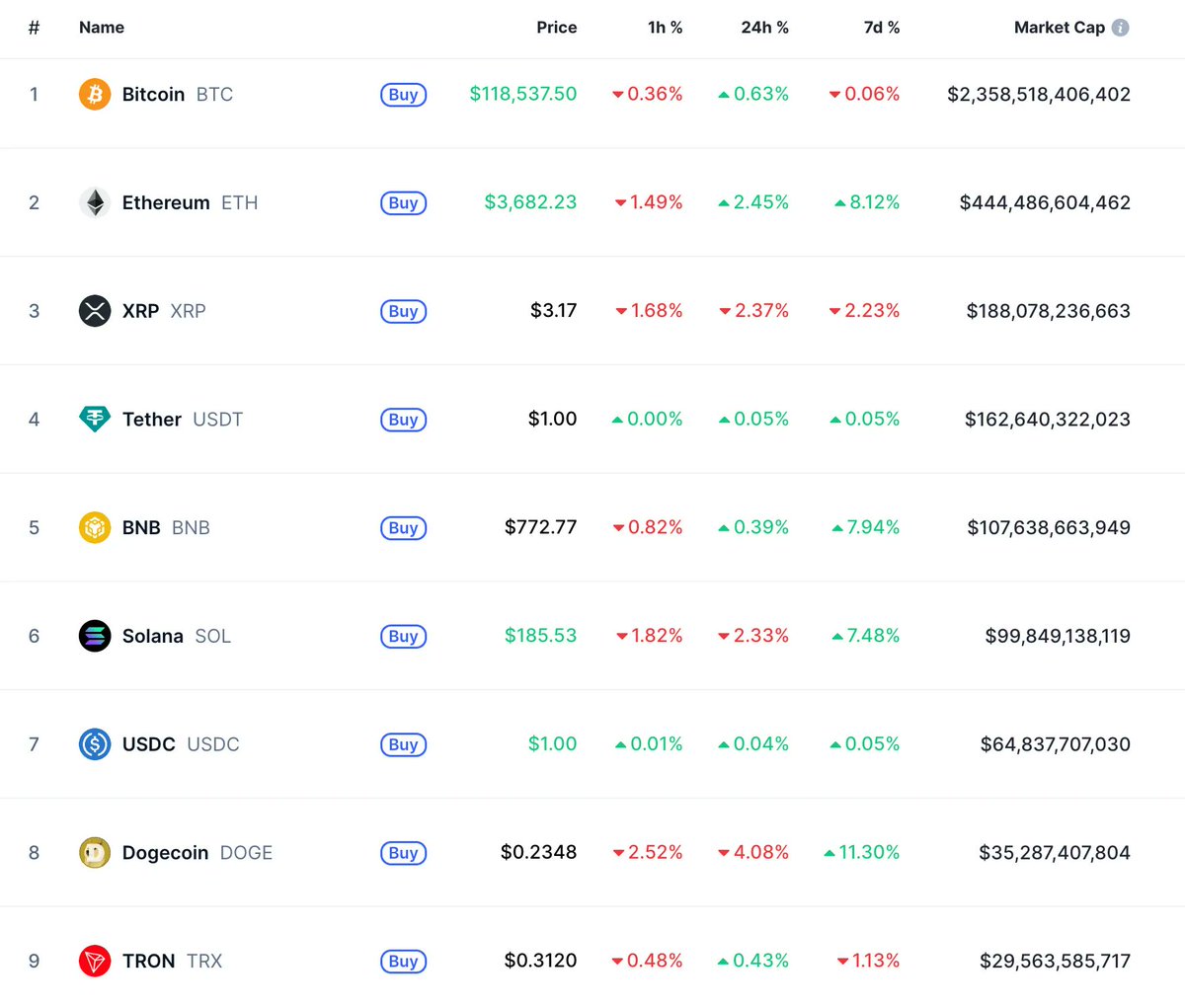

📌 Price Action

📌 Crypto Funds Hit Record $4.39B Weekly Inflows

Digital asset investment products recorded an all-time high in weekly inflows of $4.39 billion, surpassing the previous record of $4.27 billion set after the U.S. election in December 2024 and pushing total assets under management to a historic $220 billion, according to CoinShares.

The surge marks the 14th consecutive week of inflows, bringing year-to-date totals to $27 billion as institutional appetite intensifies across Bitcoin and Ethereum products.

📌 Ancient Bitcoin Whale Completes $9.53B Selloff After 14 Years, Turns $132K Into Billions

An ancient Bitcoin whale has successfully liquidated their entire stash of 80,202 BTC after holding for 14 years, generating approximately $9.53 billion at an average selling price of $118,834.

Over the last three days, the whale operating from a Bitcoin address ending in “f4au0” has been systematically disposing of its cryptocurrency reserves.

Most notably, on July 15, intelligence data from Arkham, spotted by EmberCN, showed that a whale from the Satoshi era executed a transfer of 40,000 BTC, with 18,343 BTC valued at $2.172 billion being directed to Galaxy Digital, a platform that provides over-the-counter (OTC) Bitcoin trading services.

📌 Trump’s World Liberty Financial Snags 562 ETH with $2M as Buying Spree Intensifies

Ethereum (ETH) buying spree with another multimillion-dollar purchase. The platform spent $2 million in USDC to acquire 561 ETH at a price of $3,567, according to on-chain data from Arkham Intelligence reported by Lookonchain.

This latest transaction brings World Liberty Financial’s total Ethereum holdings to 76,849 ETH, valued at approximately $281 million at current prices. The group’s average entry price now stands at around $3,291, putting its unrealized gains at over $28 million.

📌 SEC Hits Pause on Bitwise ETF Offering Broad Crypto Exposure

The US Securities and Exchange Commission approved and then immediately paused the conversion of Bitwise’s crypto index fund into an exchange-traded fund, leaving it in limbo pending a review.

The SEC's Division of Trading and Markets granted an “accelerated approval” of the Bitwise 10 Crypto Index conversion into an ETF on Tuesday, which means Bitwise could request that the SEC declare the registration effective earlier than the regular timeline.

However, in a letter the same day, SEC assistant secretary Sherry Haywood said the “order is stayed until the Commission orders otherwise,” and the “Commission will review the delegated action.”

📌 PNC Bank to Offer Crypto Services Through Coinbase Partnership

Pittsburgh-based financial services corporation PNC Bank has announced adding Coinbase’s Crypto-as-a-Service platform, enabling customers to buy, hold and sell crypto.

The crypto move announced on Tuesday said that PNC will also offer “best-in-class” banking services to Coinbase. The PNC-Coinbase deal comes amid growing demand for regulated crypto offerings.

“This collaboration enables us to meet growing demand for secure and streamlined access to digital assets on PNC’s trusted platform,” said William S. Demchak, CEO of PNC Bank.

📌 Crypto Firms Raise Billions for Treasuries, But Aren’t Really Buying Crypto

Talking to Forbes, crypto analyst Ran Neuner claimed that crypto treasury firms are acting less like buyers and more like exit vehicles for crypto insiders.

Instead of purchasing assets directly from exchanges, these companies often receive crypto contributions from existing holders, in exchange for shares that later trade at massive premiums on public markets.

For example, SharpLink’s $425 million Ethereum treasury wasn’t funded by institutions. According to Neuner, crypto holders contributed ETH in return for shares at net asset value.

Once the company publicly declared itself an Ethereum treasury firm, the stock surged, giving early contributors a chance to cash out with significant upside.

📌 Ledger Launches Recovery Key, a Physical ‘Spare Key’

Major crypto wallet maker Ledger has released Ledger Recovery Key, a spare key for users to access digital assets.

The company announced this product in late June 2025. It allows Ledger Flex and Ledger Stax users to create a spare key alongside the 24 words.

According to the press release, Ledger Recovery Key is supposed to make accessing digital assets simple. The team claims it’s “as easy as tapping a card and entering a PIN.”

The spare key connects directly to the wallet via NFC wireless channels. There are no intermediaries, it says.

📌 Stablecoin Giant Tether Rekindles Plans to Break Into US Market

Tether is laying the groundwork for a fresh push into the US, spurred by a major shift in the country’s regulatory climate.

CEO Paolo Ardoino told Bloomberg in an interview Wednesday that the company is moving ahead with its domestic strategy, following last week’s signing of landmark stablecoin legislation by US President Donald Trump.

The so-called GENIUS Act is expected to expand the role of stablecoins in global finance, potentially allowing banks, card networks and tech firms to issue their own digital tokens.

“We are well in progress of establishing our US domestic strategy,” Ardoino told Bloomberg. “It’s going to be focused on the US institutional markets, providing an efficient stablecoin for payments but also for interbank settlements and trading.”

📌 Michael Saylor’s Strategy Rolls Out $100 Bitcoin ‘Stretch’ Preferred Stock With 9% Yield

Michael Saylor’s Strategy is offering yield to bring investors into Bitcoin, but critics say STRC’s 9% returns depend on constant new inflows—making it feel like a system where new investors fund old ones.

Strategy, the digital asset-focused firm led by Michael Saylor and known as the largest corporate holder of Bitcoin, is launching a new financial product designed to raise $500 million for further BTC accumulation.

📌 Polymarket Acquires Derivatives Exchange QCEX for $112M to Expand US Footprint

Polymarket acquired QCEX for $112M to gain a regulated foothold in the US market. The deal follows the closure of a federal investigation that had hindered Polymarket’s US expansion. Polymarket is poised to re-enter the country legally.

Watch the full video on YouTube now:

17.05K

6

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.